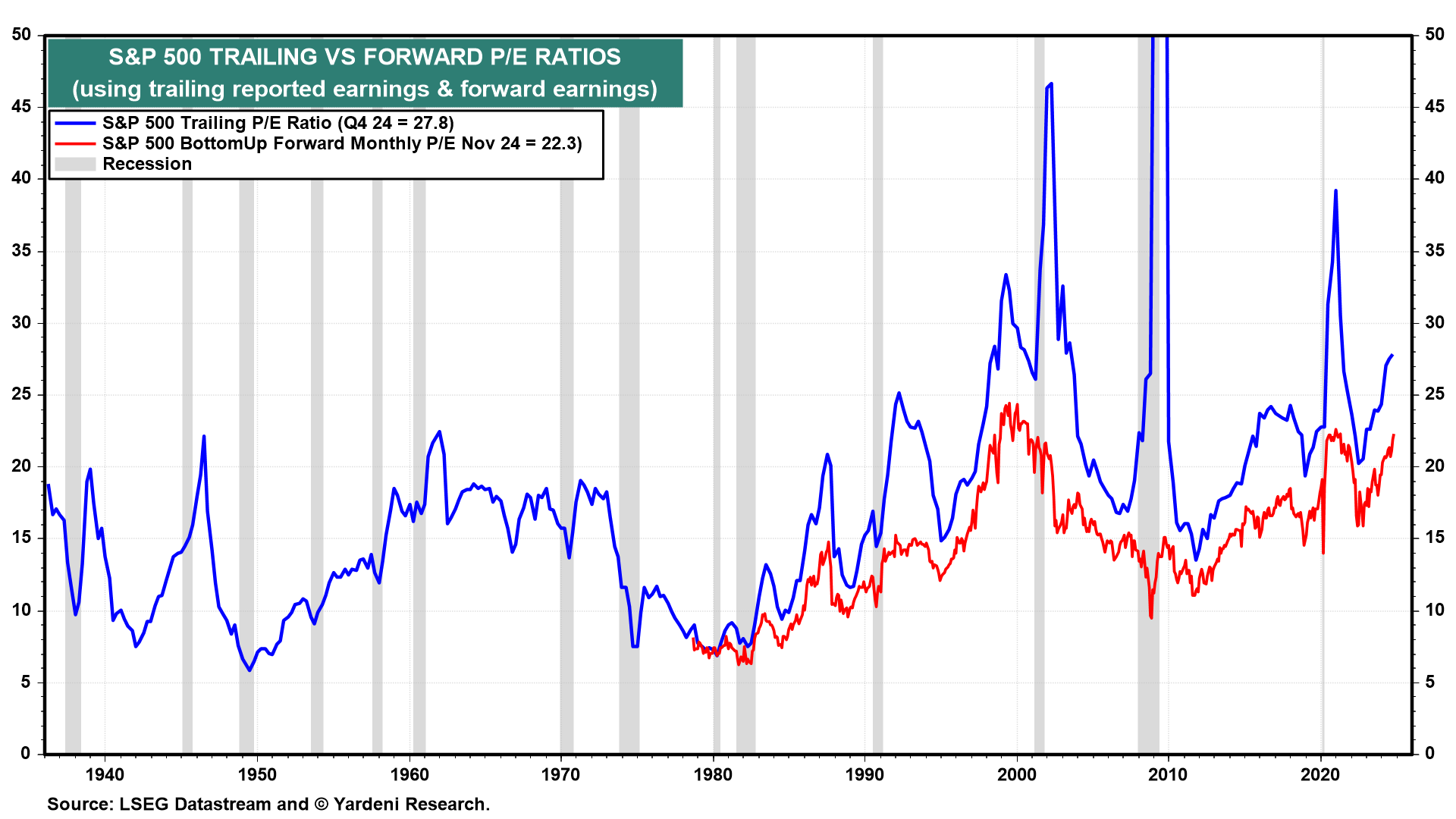

We are often asked if the current bull market in stocks has turned into a meltup that could soon be followed by a meltdown. That's a risk we currently give a 25% subjective probability. Relatively high stock valuations are the main worry for many investors (chart). However, our bullish outlook for strong productivity-led economic growth means that earnings rather than valuations can lead the market higher. Coupled with Trump 2.0 policies, the Roaring 2020s may very well continue into the Roaring 2030s.

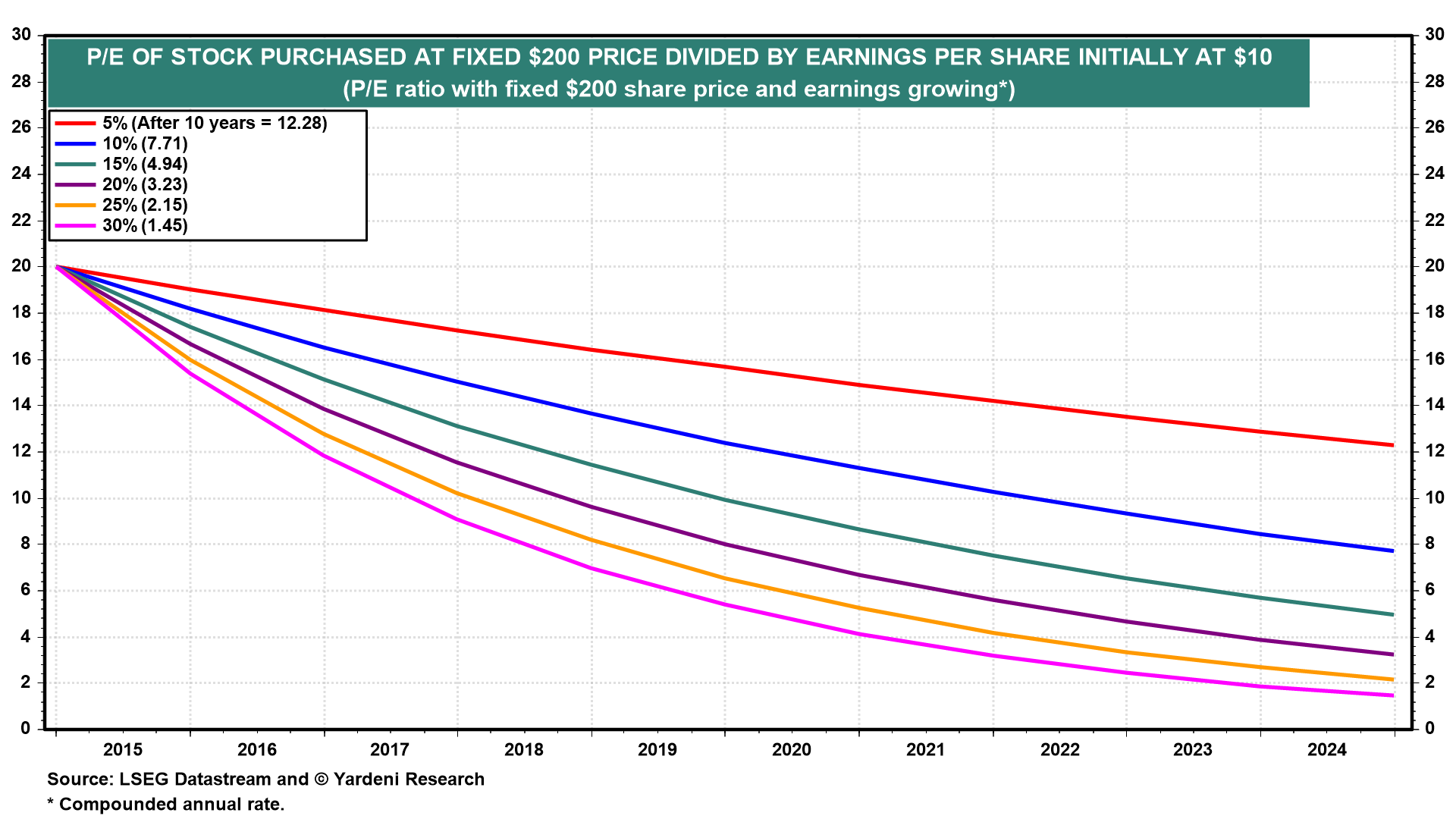

The stock market's P/E ratio tends to fall sharply during recessions. It tends to rise and stay relatively high when investors don't expect a recession to occur any time soon, and their expectations are realized with a long expansion. That's because earnings growth will lower valuations over time (chart). Over the past three years, the most widely anticipated recession of all times didn't happen despite the tightening of monetary policy. Investors must be wondering if the economy can continue to grow without a recession through the end of the decade now that the Fed is easing! No wonder valuation multiples are elevated.

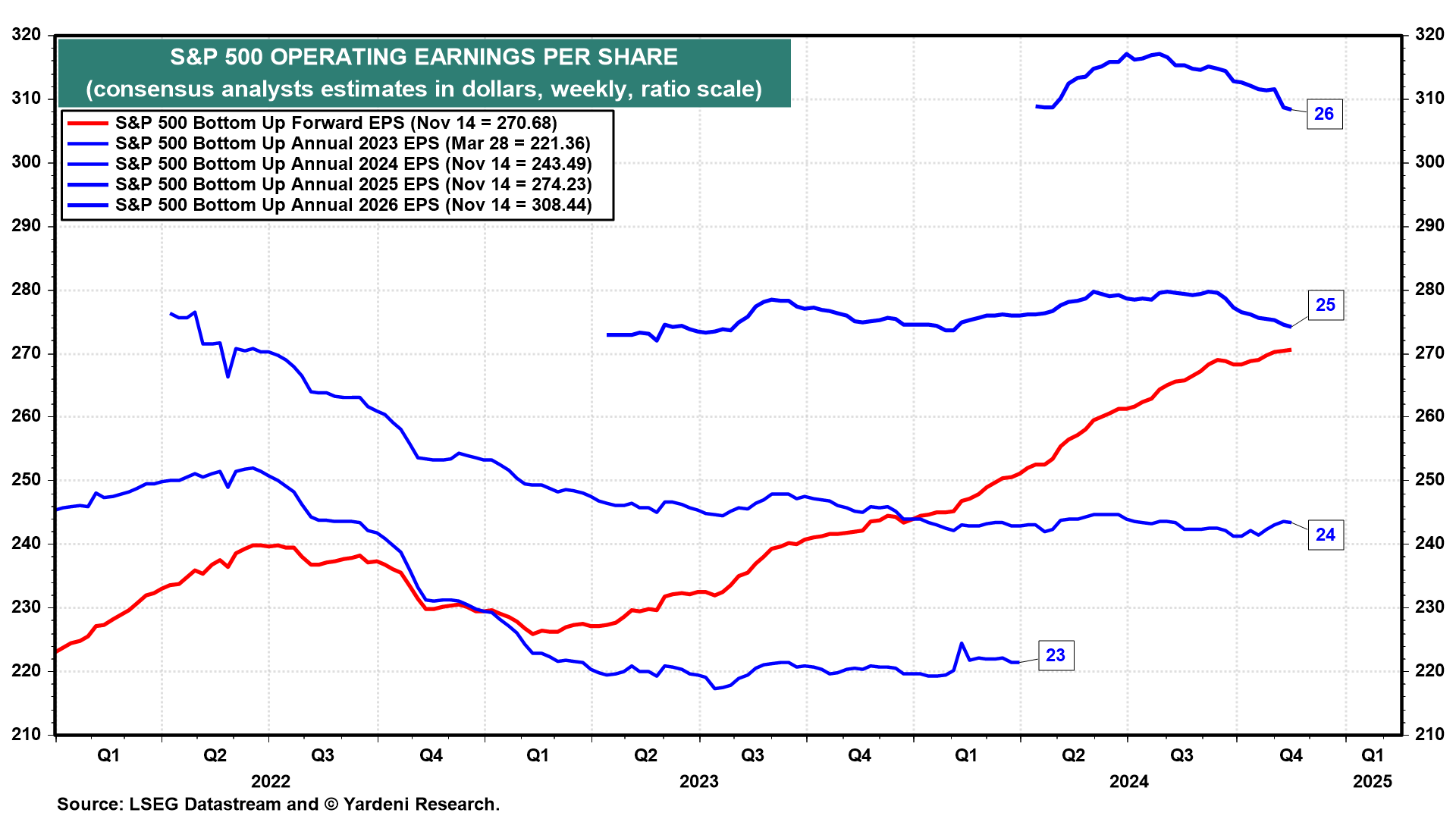

Last week, we raised our S&P 500 operating earnings per share (EPS) targets for 2025 and 2026 from $275 to $285, and $300 to $320, respectively. Both numbers are higher than the current consensus estimates of $274 and $308. We think EPS could rise to $450-$500 by the end of the decade suggesting that the S&P 500 could get to 9000-10,000 by then.

Here's more on the latest earnings data: