Earlier last week, crypto exchange FTX had to deny customer withdrawal requests of about $5 billion. FTX lent about $10 billion of customers’ funds to Alameda Research for trading purposes. John Ray III is the new CEO of FTX. He was the man who cleaned up the mess at Enron. He says the situation at FTX is even worse, describing what he calls a “complete failure” of corporate control. (Here is his November 17 bankruptcy petition.)

This is just one of many speculative bubbles that have burst since early last year (e.g., ARK, SPACs, meme stocks) without causing a credit crunch or a recession, which is consistent with our rolling recession scenario.

So far, there are no signs that the recent bursting of any of the speculative bubbles is stressing out the US financial system in general or the banking system. Consider the following:

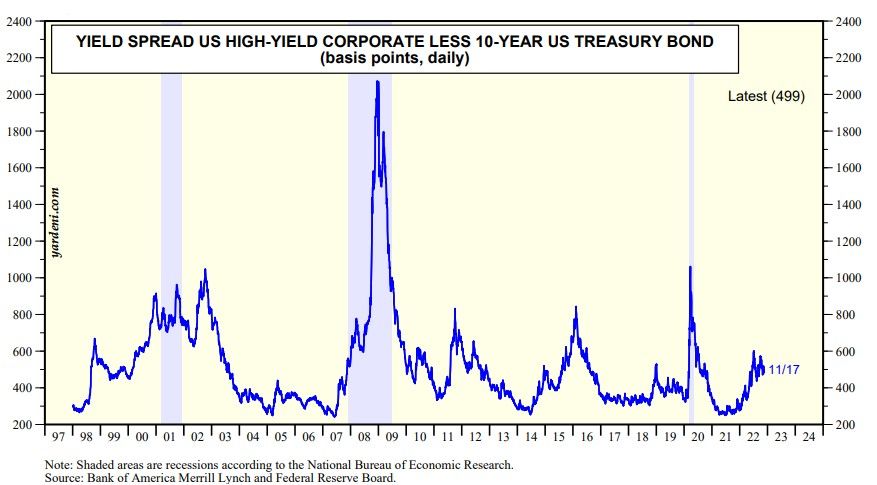

(1) Credit spread. The yield spread between the high-yield corporate bond composite and the 10-year US Treasury has widened from 279bps at the start of this year to 499bps recently (chart). However, it isn’t spiking higher the way it did during previous credit crunches.

(2) Bank loans. Loans on the balance sheets of all commercial banks in the US are up $1.0 trillion so far this year to a record high of $11.8 trillion during the November 9 week.

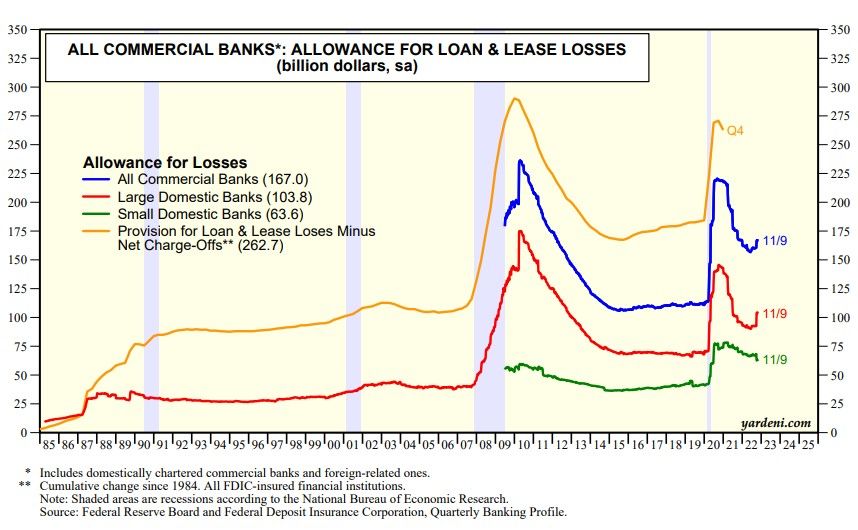

(3) Loan loss provisions. We track the Fed’s weekly data on provisions for loan losses at all commercial banks in the US. This year, they bottomed during the June 8 week and are up just $10.5 billion to $167.0 billion through the week of November 9.