It was another day of recession jitters in the stock market as the CEOs of Bank of America and Wells Fargo reported that they are seeing slowing consumer spending and borrowing. That may be so, but there wasn't any evidence of a slowdown in October's consumer credit data released by the Fed today.

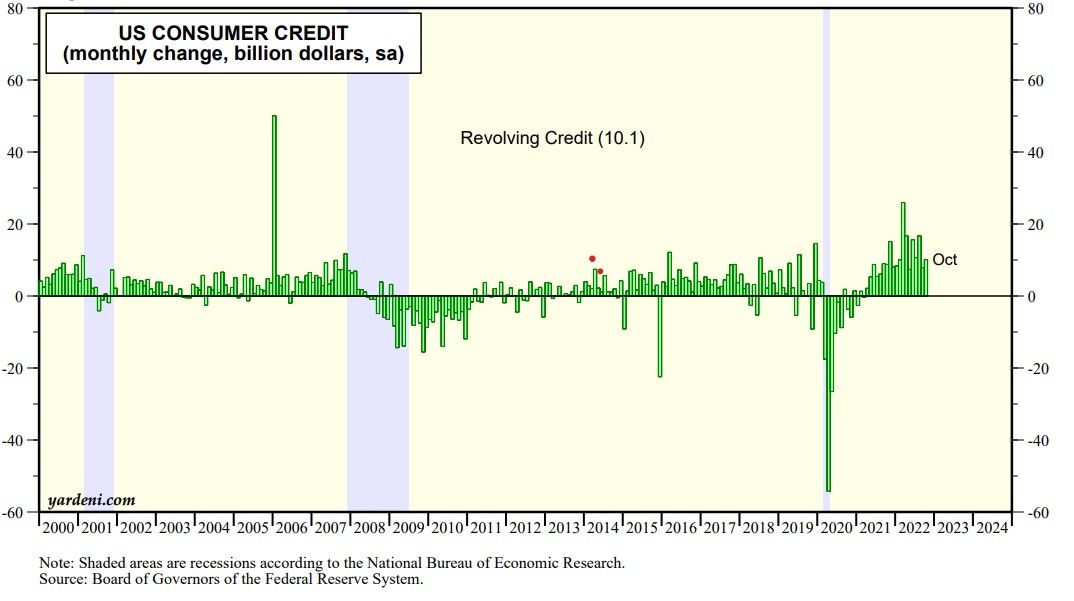

Total consumer credit rose $27.1 billion in October, up from a revised $25.8 billion gain in the prior month. That translates into a 6.9% annual rate, up from a revised 6.6% gain in the prior month. Revolving credit, mainly credit cards, rose 10.4% in October after an 8.2% gain in the prior month (chart). Nonrevolving credit, typically auto and student loans, rose 5.8% down from a 6.1% growth rate in the prior month.

Slower consumer spending could put more downward pressure on prices than on wages, given the chronic shortage of workers. If so, then the purchasing power of consumers would actually increase, thus averting the widely-feared consumer-led recession.