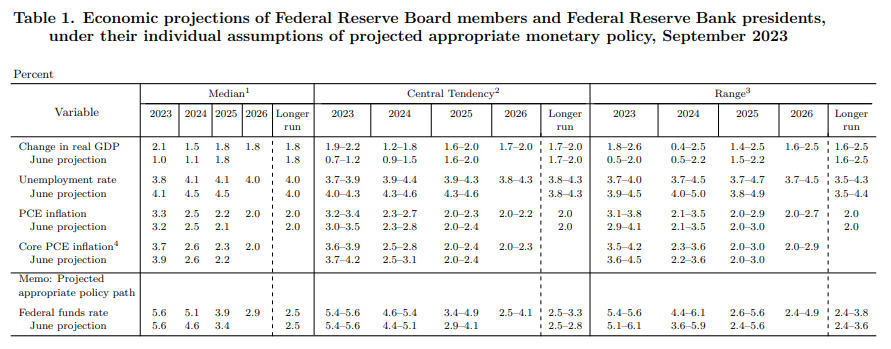

The FOMC’s latest Summary of Economic Projections (SEP) released today shows that the median forecast of the federal funds rate (FFR) for 2023 is 5.6%, unchanged from June’s SEP (table). The 2024 forecast was raised to 5.1% from 4.6%. As we expected, the FOMC’s message is that the FFR might be lowered next year by 50bps rather than 100bps.

The latest SEP shows headline PCED inflation continuing to moderate from 3.3% this year to 2.5% next year, 2.2% in 2025, and 2.0% in 2026. That’s nearly identical to the path projected in June’s SEP.

So why did the committee raise the FFR trajectory to holding-for-longer? The economy has been stronger than expected. The committee boosted this year’s estimated real GDP growth rate from 1.0% to 2.1% and next year’s from 1.1% to 1.5%. As a result, the trajectory of the unemployment rate was lowered to 3.8% this year from 4.1%, and to 4.1% next year from 4.5%.