Santa is on his back foot. Fed Chair Powell's presser was hawkish last Wednesday. Thursday's batch of economic indicators seemed to support the hard-landing scenario. Could the Santa Claus rally make a comeback before Christmas despite the Grinch at the Fed? It could, depending on November's personal income report to be released on Friday.

We think that it will confirm that inflation is moderating as measured by the PCED measure of consumer prices. It should also confirm that consumers are still spending, though more on services than goods. It should show that in addition to excess saving, wages are rising faster than prices, boosting consumers' purchasing power. That would all be consistent with a soft landing.

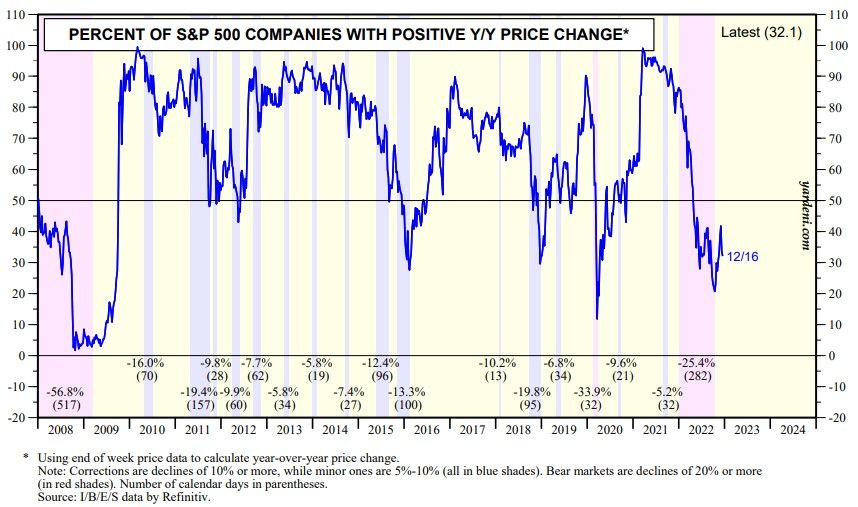

Meanwhile, the S&P 500 is also on its back foot. Only 32.1% of the 500 companies were showing positive y/y stock price comparisons as of Friday (chart).

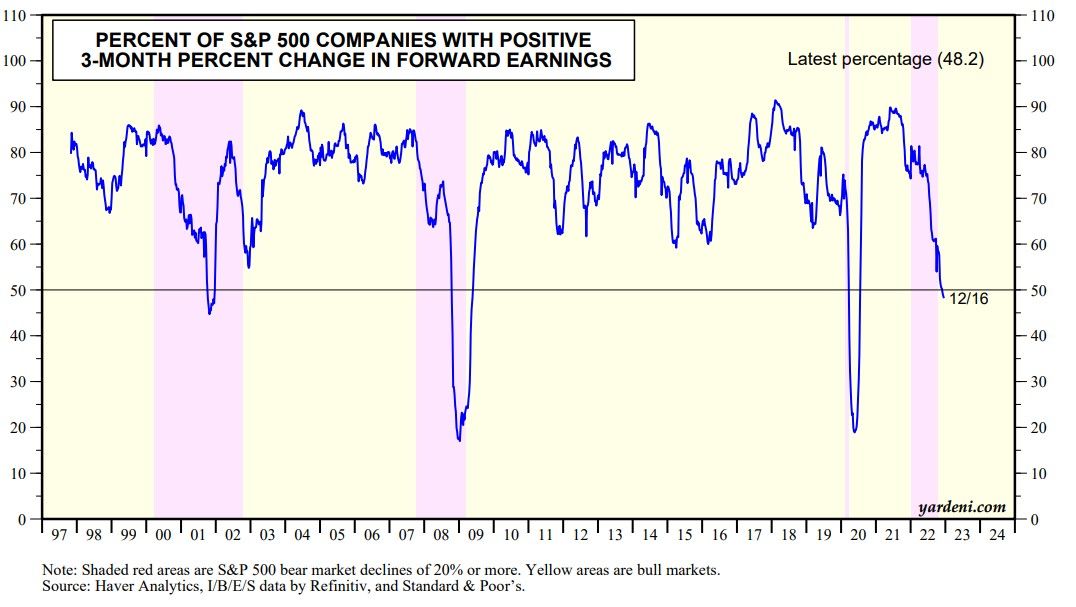

A similar measure of breadth shows that the percent of S&P 500 companies with positive three-month percentage changes in forward earnings was down to 48.2% (chart). That's a low reading, but it would go lower in a recession. The previous three hard landings show that this series tends to peak at the start of bear markets and bottom before the end of bear markets. We think the latest bear market ended on October 12. We would be wrong if a hard landing rather than a soft landing occurs in 2023.

By the way, the stock market held up relatively well today despite the backup in global bond yields caused by the BOJ's surprise announcement that it would allow Japan's 10-year government bond yield to rise as high as 0.5%. The Era of Free Money is over. So far, the transition back to the Old Normal hasn't been as terrible as touted by the permabears.