The Federal Open Market Committee (FOMC) cut the federal funds rate (FFR) by 25bps today, as widely expected. That takes the target range for the overnight rate down from 5.25%-5.50% to 4.25%-4.50%, a full percentage point lower since the Fed's rate cutting cycle started on September 18. A cut was all but guaranteed. Yet the S&P 500 fell almost 3%, while the Nasdaq dropped 3.5%. The 10-year yield jumped 13bps to 4.51%, its highest since May.

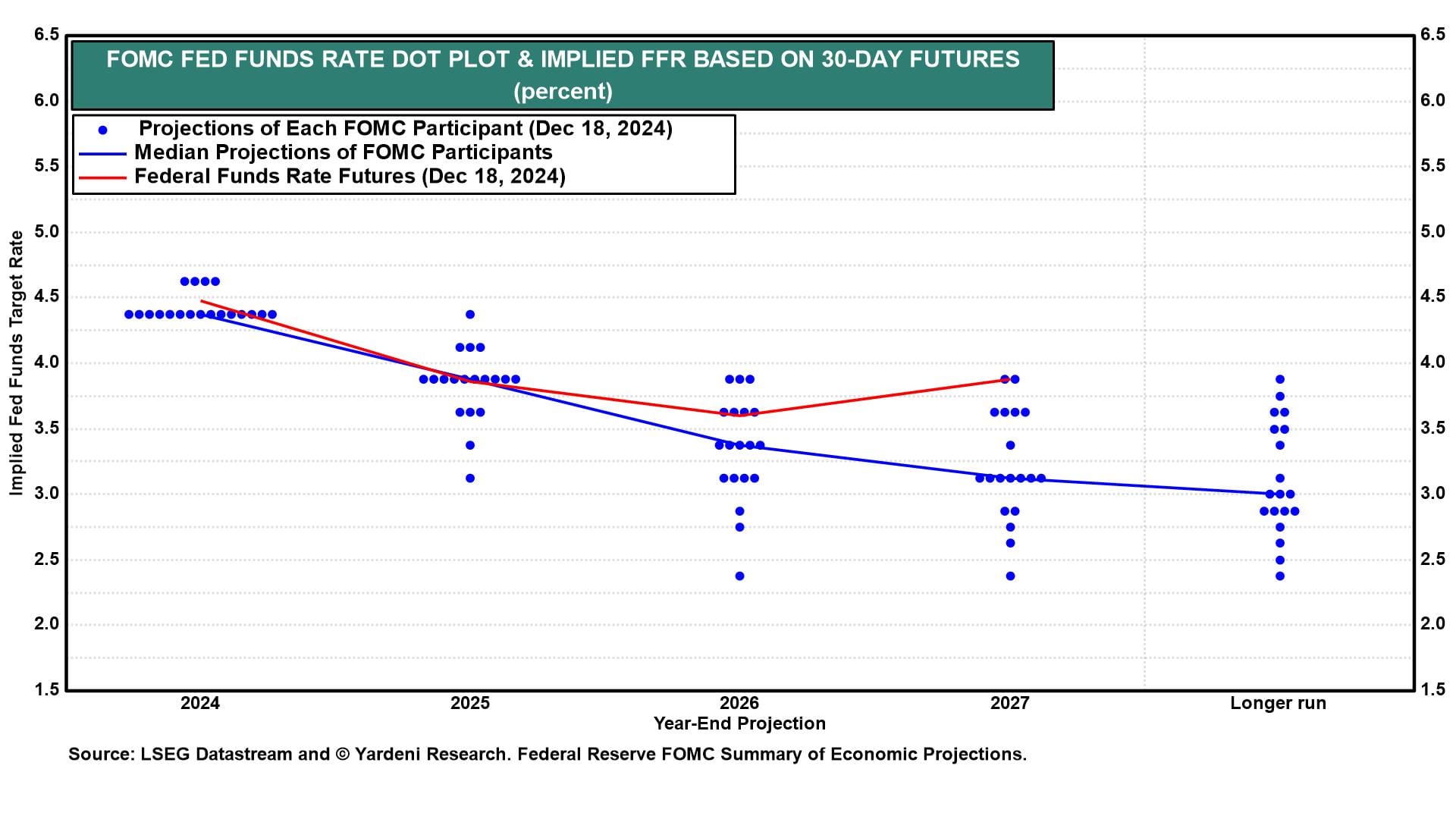

What gives? The Fed's updated Summary of Economic Projections was quite hawkish. When including the nonvoters on the committee, the dot plot shows that four FOMC participants were in favor of not cutting the FFR today (chart). Newly appointed Cleveland Fed President, Beth Hammack, dissented in favor of no cut.

Here are some other interesting aspects of today's FOMC meeting to consider: