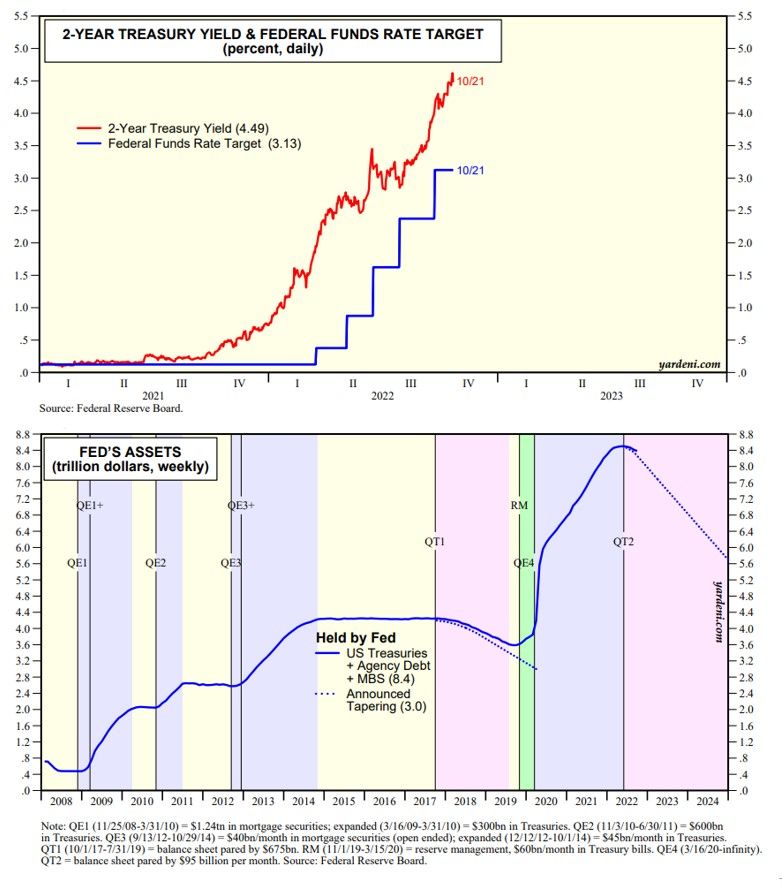

The S&P 500 rallied 2.37% to 3,752.75 on Friday as the 2-year US Treasury note yield fell to 4.50% from 4.61% on Thursday (chart). The happy day's performance was sparked by Friday's WSJ article titled "Fed Set to Raise Rates by 0.75 Point and Debate Size of Future Hikes." It was written by the Journal's ace Fed watcher, Nick Timiraos.

Once the blackout period ended one day after the FOMC's September 20-21 meeting, numerous Fed officials depressed investors by repeating the Fed's latest party line: "We are going to raise interest rates until we see the inflation is clearly coming down."

Nick's article suggested that some Fed officials are realizing that the party line might be excessively hawkish. The markets had been discounting that the FOMC would hike the federal funds rate two more times by 75bps at each of the FOMC’s last two meetings this year with more rate hikes next year. Nick’s article indicated that some Fed officials wanted to discuss a 50bps hike during December, rather than 75bps one, and a pause early next year.

Indeed, on Friday afternoon, San Francisco Federal Reserve President Mary Daly said, "I hear a lot of concern right now that we are just going to go for broke. But that's actually not how we, I, think about policy at all." She said, "We have to make sure we are doing everything in our power not to overtighten." She added, "The time is now to start planning for stepping down."

Meanwhile, the Fed continues to reduce its balance sheet by roughly $95 billion per month (chart).

Now for some really good news: The latest blackout period starts today and lasts through November 3. However, Fed Chair Jerome Powell will start squawking again at his press conference on November 2.