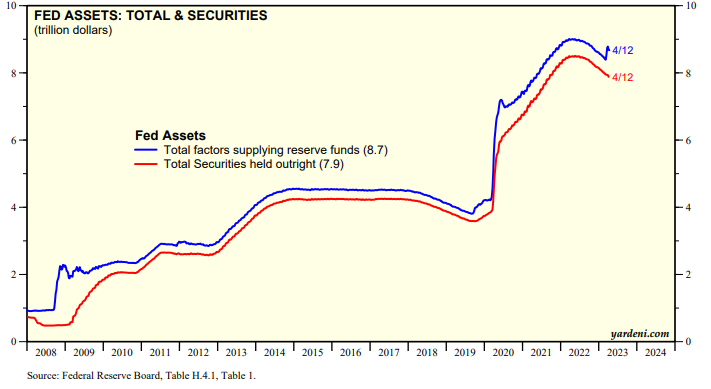

The Fed's H.4.1 report is released every Thursday at 4:15 pm. It shows the Fed's assets and liabilities. Yesterday's report shows that the Fed's total assets edged down to $8.7 trillion after rising since early March when banks scrambled to borrow from the Fed's liquidity facilities to offset deposit outflows during the SVB-induced banking crisis (chart). Meanwhile, the Fed's QT program continues apace as maturing securities roll off the Fed's balance sheet.

The Fed's holdings of total loans to the banking system spiked up dramatically during March as the banks scrambled to borrow at the discount window (a.k.a., "primary credit" in the H.4.1) and the new Bank Term Funding Program (BTFP) (chart). These loans have edged down slightly over the past two weeks as borrowing at the discount window declined sharply while BTFP borrowing has jumped higher. Other credit extensions remain elevated as the FDIC needs the funds to work out the resolution of the SVB and Signature Bank implosions.