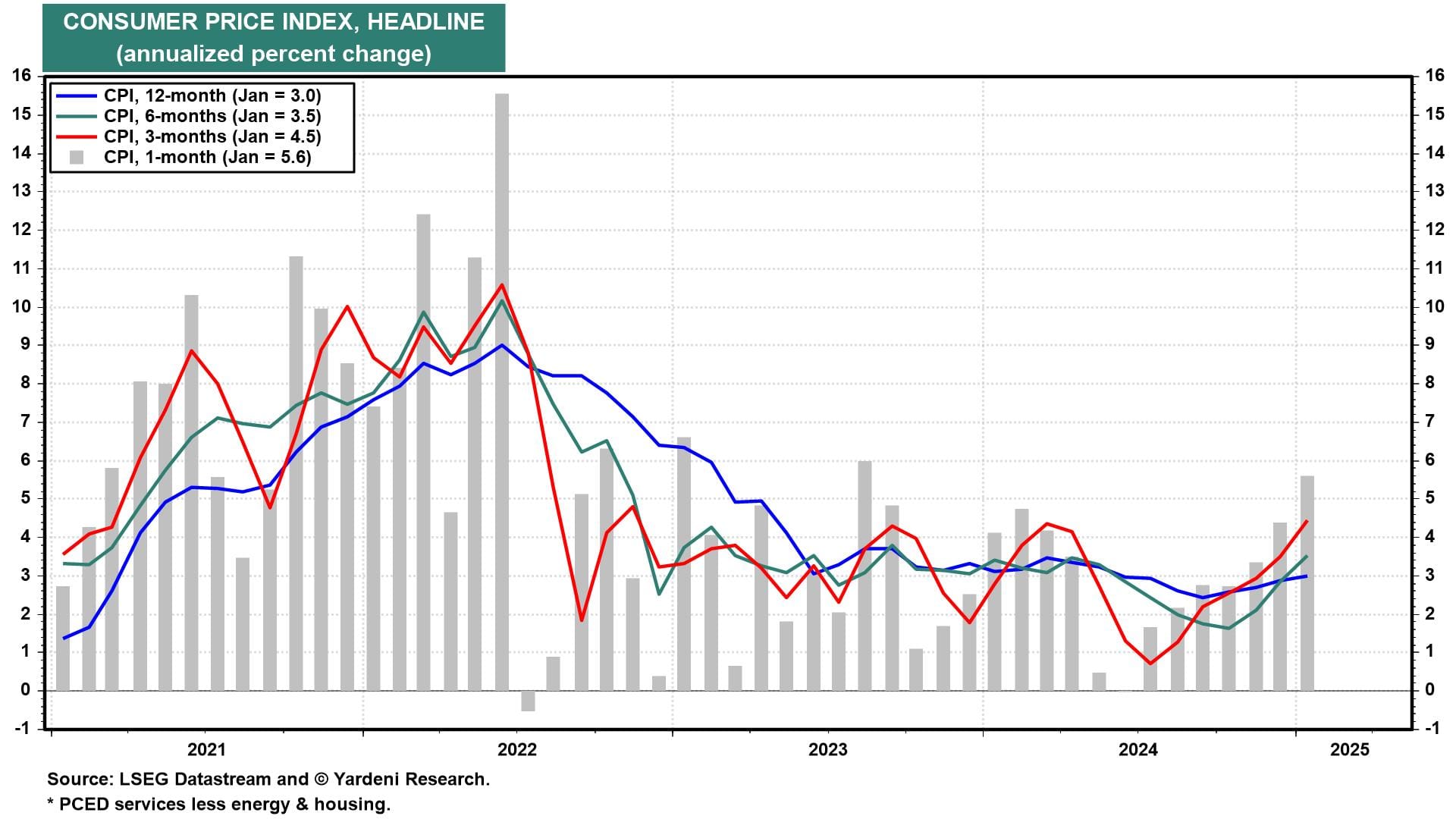

Today's hotter-than-expected January CPI inflation did some damage to bonds, raising long-term Treasury yields roughly 10bps. Headline and core CPI rose 0.5% and 0.4% m/m, respectively, as many companies set their annual price increases. But this wasn't a start-of-the-year blip; inflation has been rising since last summer (chart). So after 100bps of federal funds rate (FFR) cuts from September 18 through December 18 last year, the Fed's easing cycle is on pause for the remainder of the year, as we've been predicting.

But a side effect of Trump 2.0 is that Fed-related economic data, like inflation and labor market news, are not the only headlines which move markets. President Trump said that Russia agreed to begin negotiations "immediately" to end the war in Ukraine, helping give stocks a lift and leaving them mostly unchanged on the day.