"Greed is good" is a catchphrase based on Gordon Gekko's quote "greed, for lack of a better word, is good" from the 1987 film Wall Street. That was the year that Fed Chair Alan Greenspan introduced the "Fed Put" as a way to stop panic selloffs in the stock market.

For stock prices to go up, fear is sometimes better than greed. Greed usually makes market tops, while fear usually makes market bottoms.

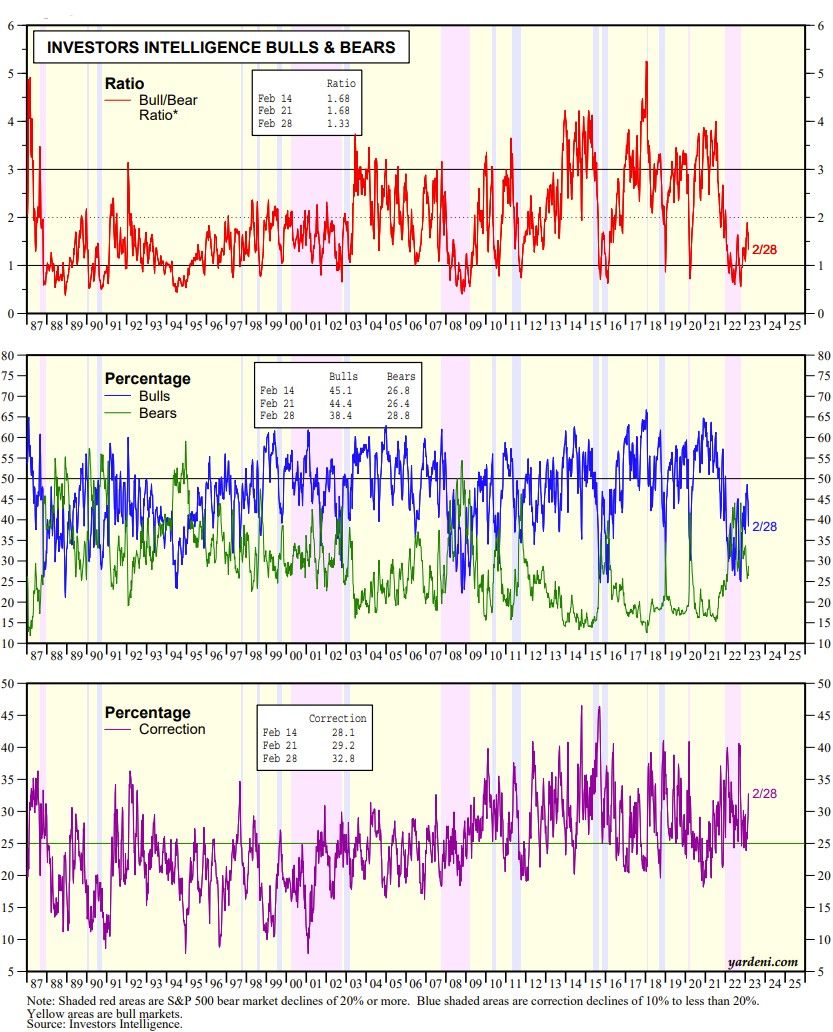

Early in the latest bear market, the Investors Intelligence Bull/Bear Ratio (BBR) fell to 0.60 during the week of June 21, 2022 (chart). It briefly rebounded during the summer but fell to a new bear-market low of 0.57 during the October 11 week . The BBR bottomed at 0.41 during the bear market of the Great Financial Crisis during the week of October 21, 2008.

We often previously observed that BBR readings of 1.00 or less have offered great buying opportunities for long-term investors. That's why we concluded that last year's stock market low on October 12 was probably the end of the latest bear market. The BBR fell to 1.33 this past week from 1.68 the previous week.