When Janet Yellen was Fed chair from 2014 to 2018, we often referred to her as the “Fairy Godmother of the Stock Market.” We noticed that stock prices tended to rally following her speeches and testimonies on monetary policy and the economy. She has been Treasury secretary since 2021. We may start calling her the “Fairy Godmother of the Bond Market.”

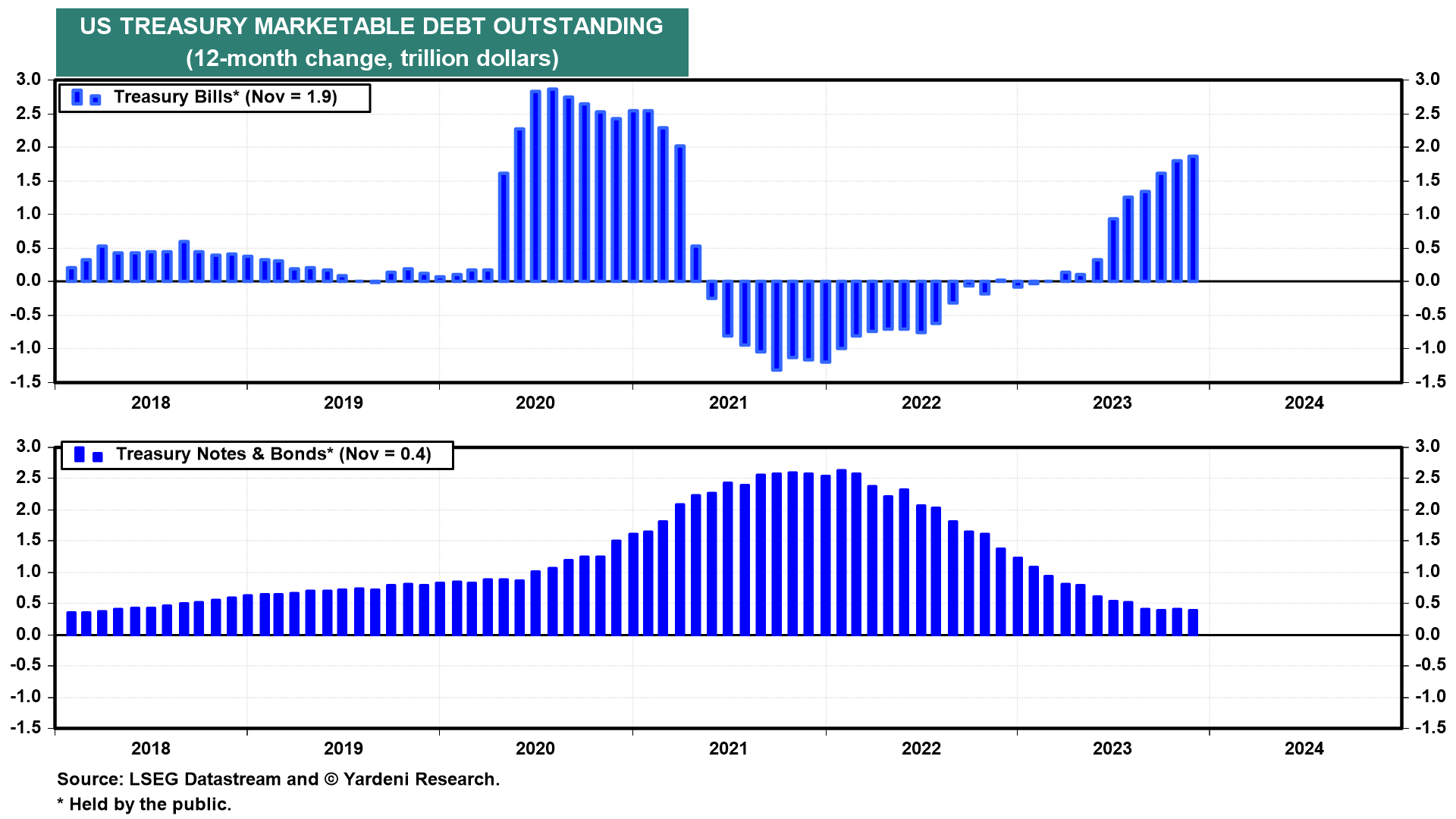

That’s because the rally in the bond market at the end of last year was sparked by the November 1 Treasury announcement that less would be raised in the note and bond markets and more in the bill market to finance the government’s deficits. Indeed, over the past 12 months through November, the net increase in Treasury bills versus notes plus bonds was $1.9 trillion versus $0.4 trillion (chart). Let’s hope Yellen’s magic wand continues to work.

Also helping to push yields down during the last two months of 2023 was a drop in the Citigroup Economic Surprise Index from 63.4 at the end of October to 1.1 today (chart). We don't expect much more downside in the CESI in coming weeks.