Federal Reserve Chair Jerome Powell's congressional testimony today confirmed that the Fed remains in a dovish pause mode. The FOMC is in no hurry to lower the federal funds rate (FFR). That's even though many of the committee's participants believe that the FFR remains relatively restrictive. So when they finally move again, it will most likely be to lower rather than to raise the FFR. That's the Fed's current message. Tomorrow's January CPI isn't likely to change it anytime soon.

The possibility that annual price resets might boost monthly consumer inflation is widely known. So a cooler headline CPI—something below 0.3% and closer to 0.2% m/m—could boost stock and bond prices. But that doesn't mean it would change the FOMC's posture, especially with so much uncertainty regarding the eventual impact of tariffs on inflation.

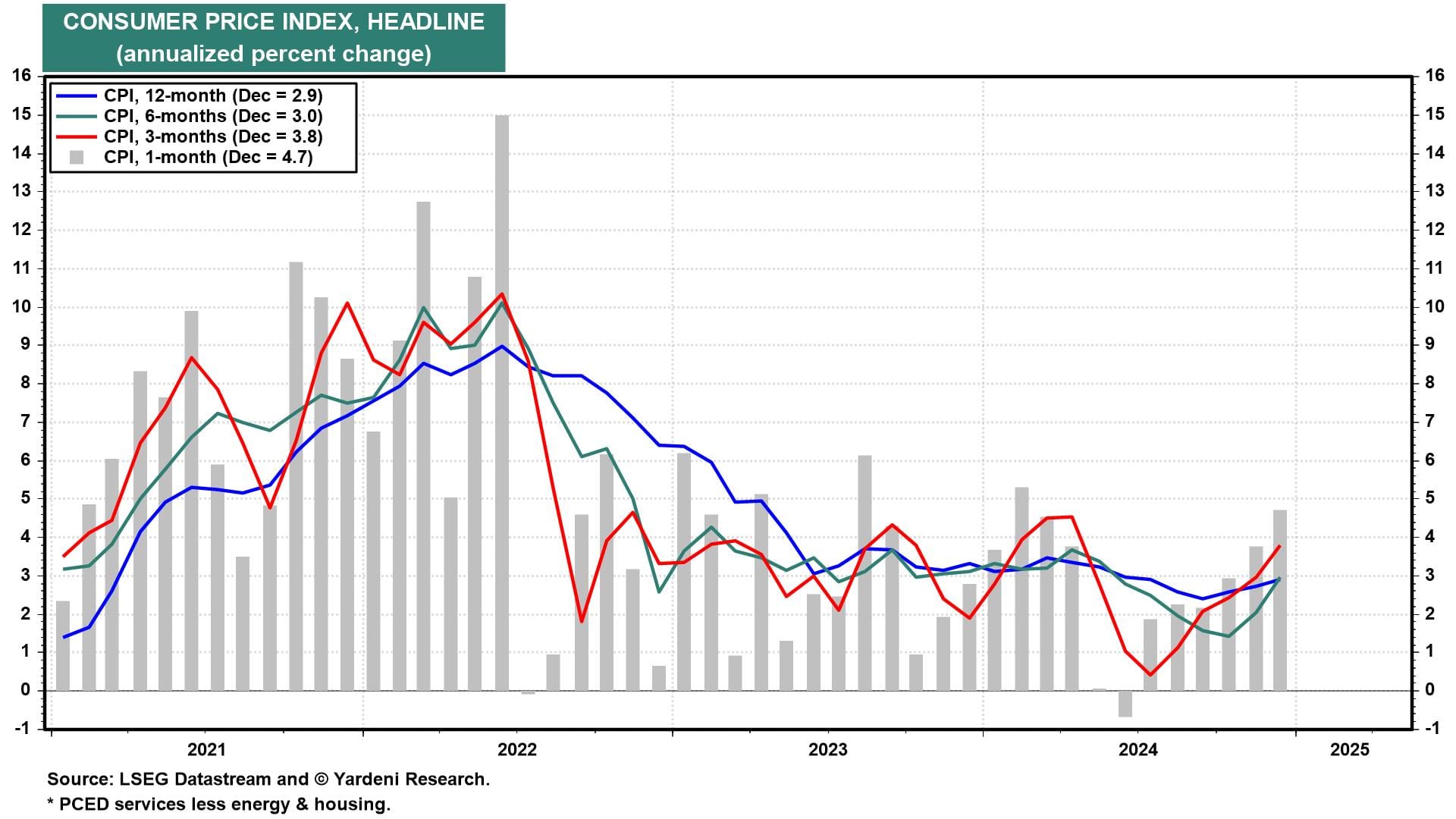

Headline CPI has been warming up since mid-2024 (chart). That's in part due to rising energy prices, which have recently stopped climbing. However, it's also notable that inflation tended to pick up in Q1 of each of the last two years. So even a cooler-than-expected January number does not mean CPI inflation will remain cool in February as well.