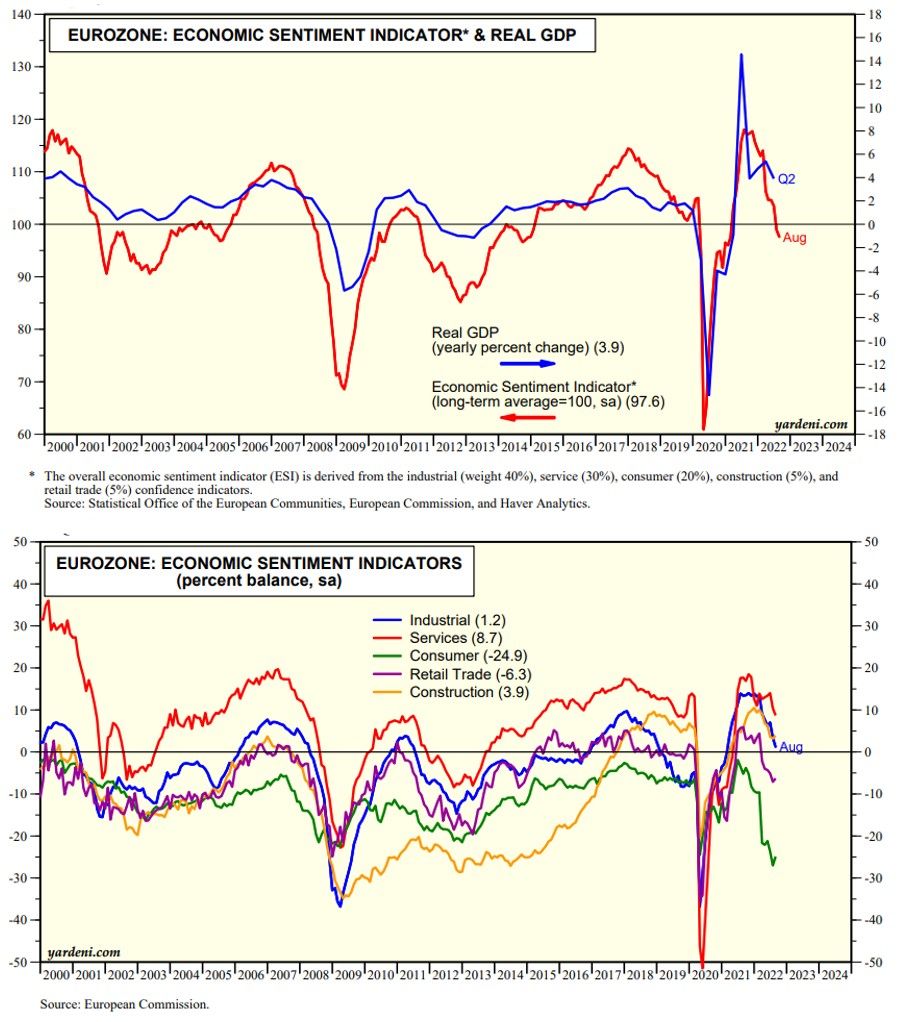

The Eurozone's Economic Sentiment Indicator (ESI) slipped further below 100.0 to 97.6 during August (chart below). This indicates that the growth rate of the region's real GDP could turn negative during the second half of this year, or early next year. European are scrambling to store natural gas for the winter because they fear that Putin will cut off Russian exports of the fuel to them in retaliation for sanctions imposed on Russia in response to his invasion of Ukraine.

Of the five components of the Eurozone's ESI, the weakest is the one for consumers (-24.9) followed by the one for retail trade (-6.3). Still in positive territory are services (8.7), construction (3.9), and industrial (1.2). The consumer ESI is the lowest on the record since 2000 (chart below).

The euro is just below parity with the dollar this morning. It is likely to remain weak for a while. Let's hope it's a mild winter. For now, the US remains one of the few safe havens for global investors, i.e., there is no alternative country (TINAC).