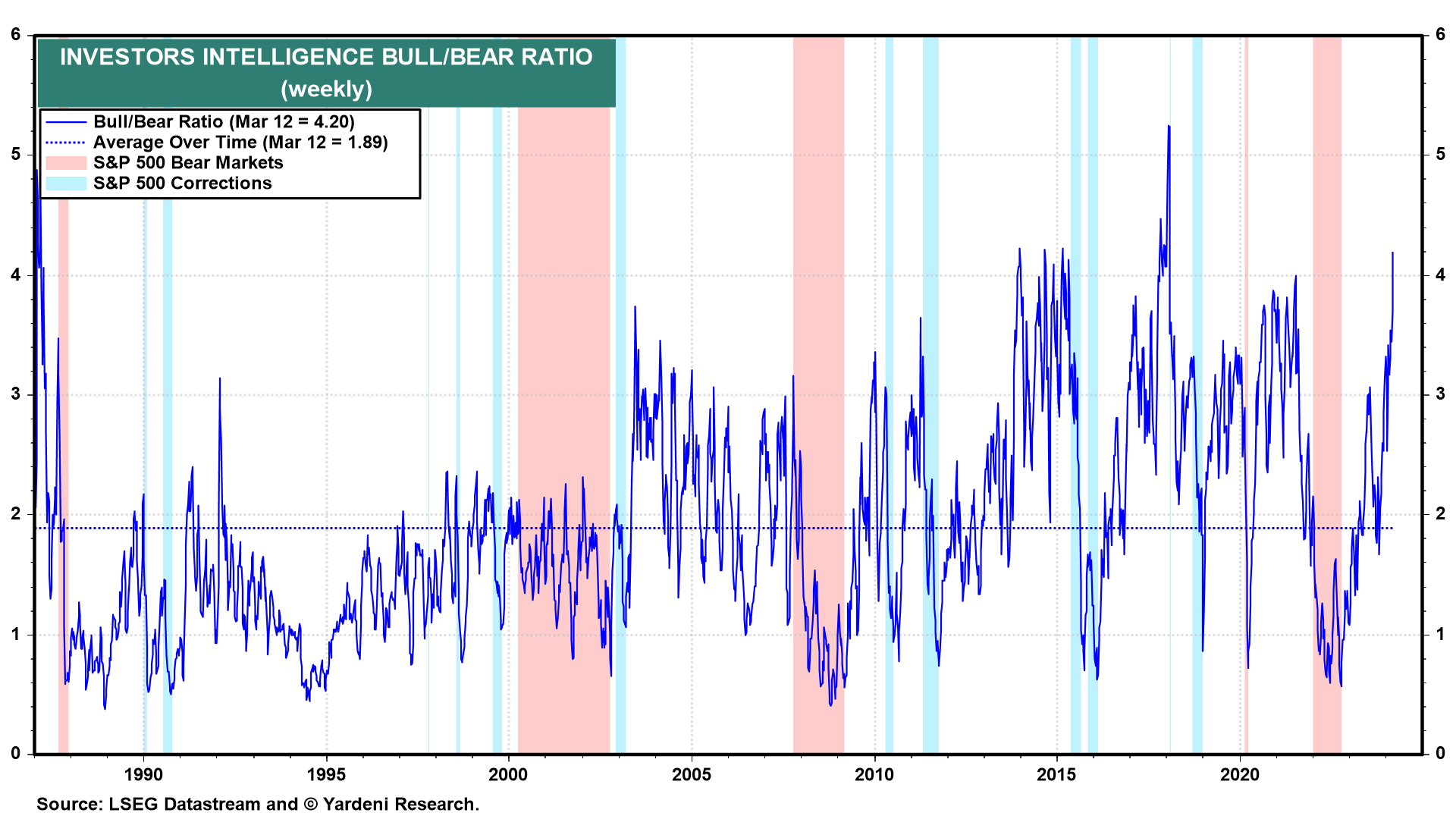

During the week of October 11, 2022, the Investors Intelligence Bull/Bear Ratio (BBR) fell to a cyclical low of 0.57 (chart). The previous bear market bottomed the next day on October 12, 2022. The BBR reading back then was the lowest since the Great Financial Crisis. We turned bullish in early November figuring that sentiment was much too bearish and that the most widely expected recession of all times would continue to be a no-show.

The S&P 500 is now up 44.7% from the bear market low through Tuesday's close. So naturally, almost everybody is bullish. The BBR jumped to 4.20 this past week to the highest reading since the week of December 19, 2017.

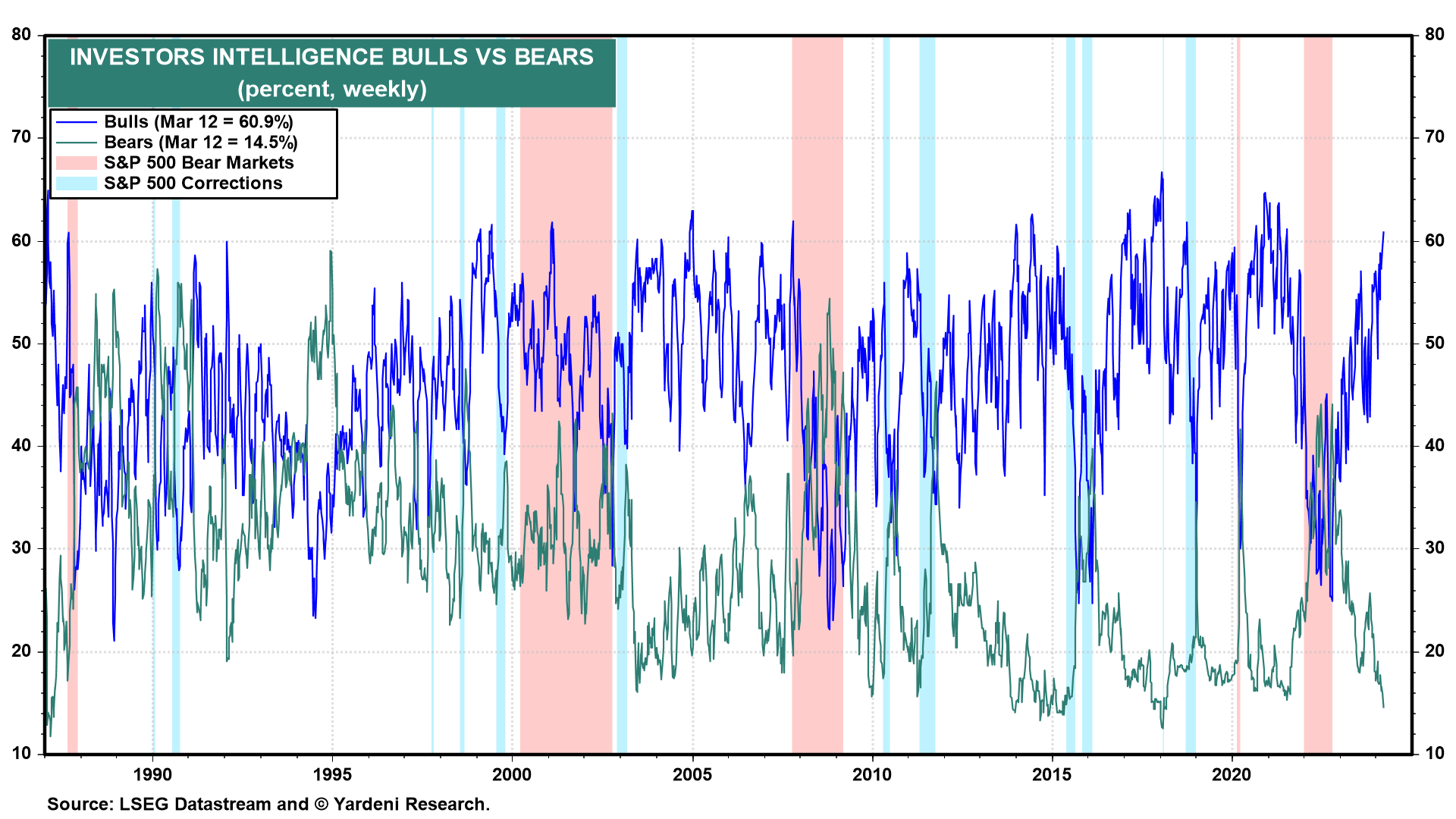

The percent of bulls was 25.0% at the end of the previous bear market. It rose to 60.9% this past week (chart). The percent of bears was 44.1% at the end of the previous bear market. It recently plunged to 14.5%, the lowest since February 27, 2018.

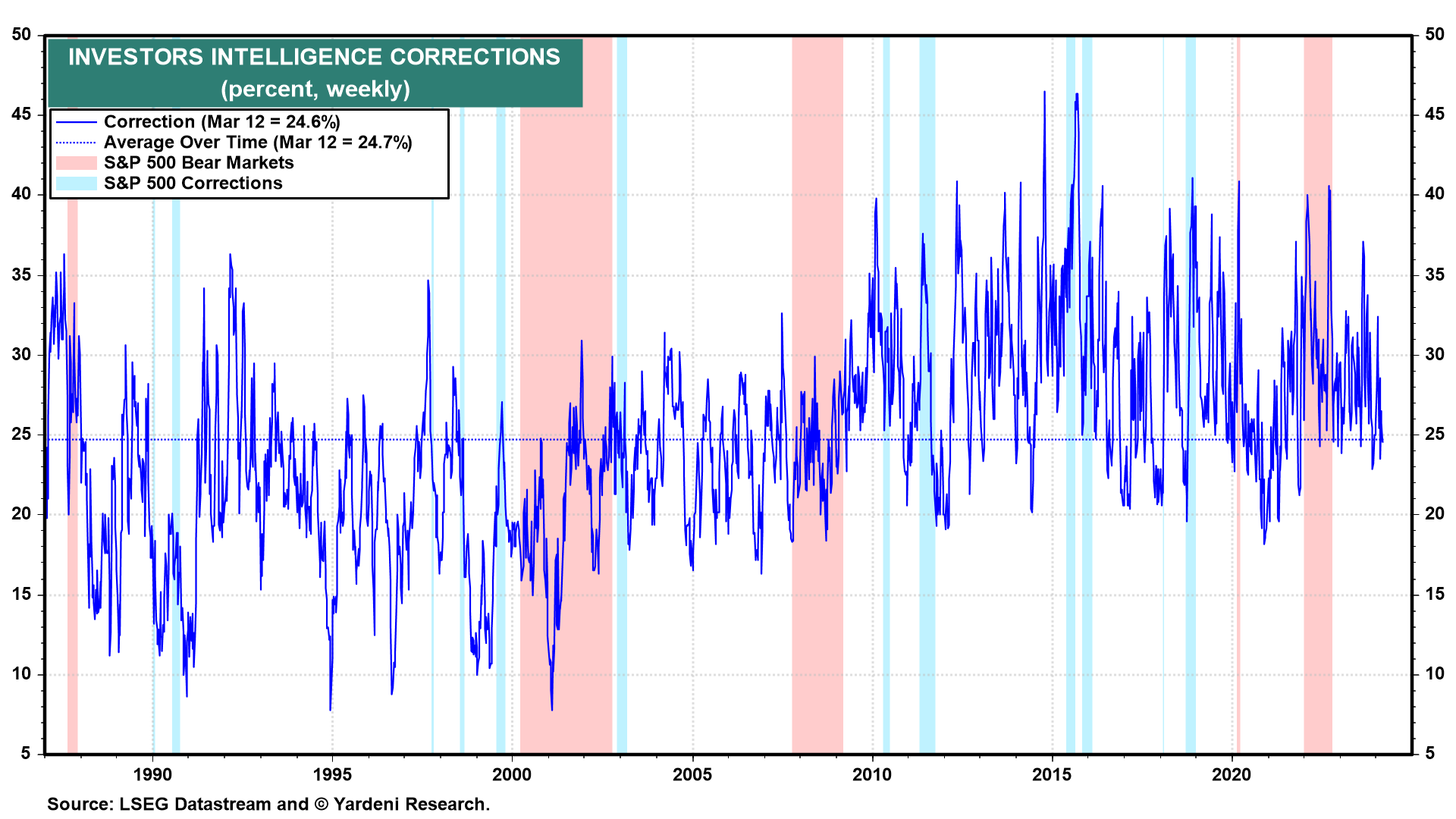

By the way, the percent expecting a correction was relatively low at 24.6% this past week (chart).

We will be watching to see how the stock market reacts to the AI hoopla during next week's Nvidia conference from March 18-21. The market could rally briefly then fall on selling-on-the-news profit taking. Then again, the BBR could move still higher.

Interestingly, the BBR remained just above 2.0 during 1999, just before the Tech Wreck.

We've previously noted that BBRs below 1.0 work better as contrary buy signals than do readings exceeding 3.0 work as sell signals. However, assuming that the bulls are mostly fully invested, there may not be enough bears flipping to bulls to keep the momentum of the bull market going. So we are sticking with our 5400 year-end target for the S&P 500, for now. Stay tuned.