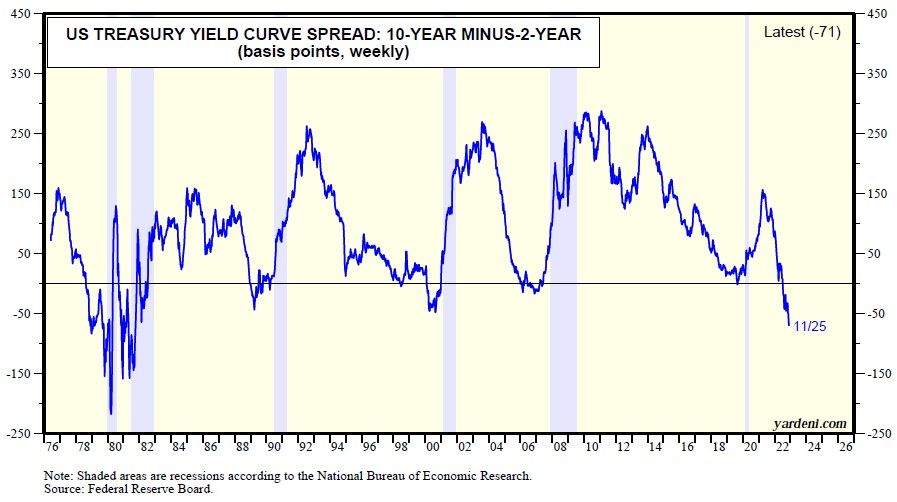

The yield curve spread between the 2-year US Treasury note and the 10-year US Treasury bond is a leading indictor of several cyclical financial and economic developments. It tends to invert (i.e., to turn negative) before economic downturns (chart). So it tends to predict recessions. We think that yield curve inversions actually predict that the Fed's monetary policy is getting too tight, which could trigger a financial crisis that could quickly morph into a credit crunch, causing a recession.

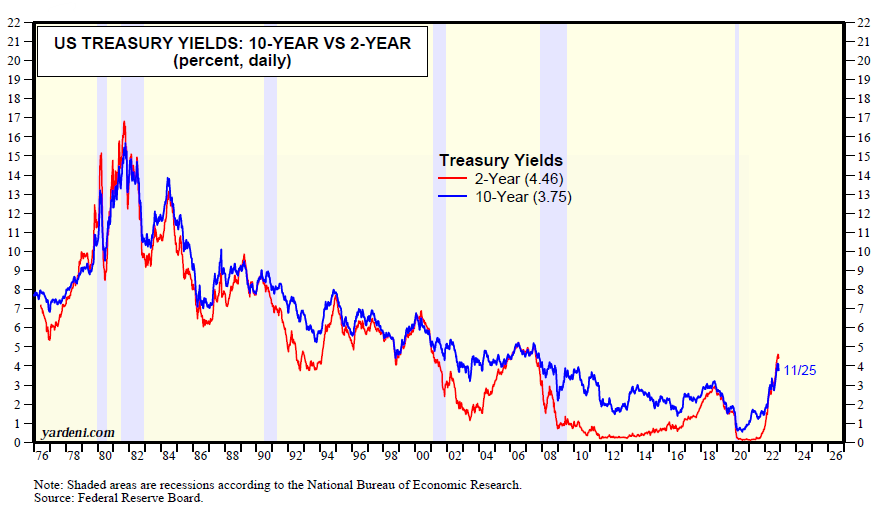

The Fed should be done tightening early next year, as anticipated by the inversion of the yield curve since this past summer, which also implies that the 10-year Treasury bond yield might have peaked at 4.25% on October 24. When the yield on the 2-year Treasury note equals or exceeds the 10-year Treasury bond yield, both tend to be close to their cyclical peaks (chart). Also anticipating the nearing of the end of the Fed’s monetary policy tightening cycle is the trade-weighted dollar, which peaked on October 19.

Arguably the Fed's tight monetary policy has already triggered several financial crises, including the meltdowns of cryptocurrencies and of ARK, meme, and SPAC stocks. Yet, there's no sign of an economy-wide credit crunch so far this time. Of course, the most-widely anticipated recession of all times is still widely anticipated to occur in 2023. But we think it is more likely to be a soft-landing rather than a hard-landing. We are still expecting a "growth recession" or a "mid-cycle slowdown" rather than the more typical recession predicted by similar yield curve inversions in the past.

Our analysis suggests that the bear markets in stock and bonds might have bottomed on October 12 and October 24, respectively.