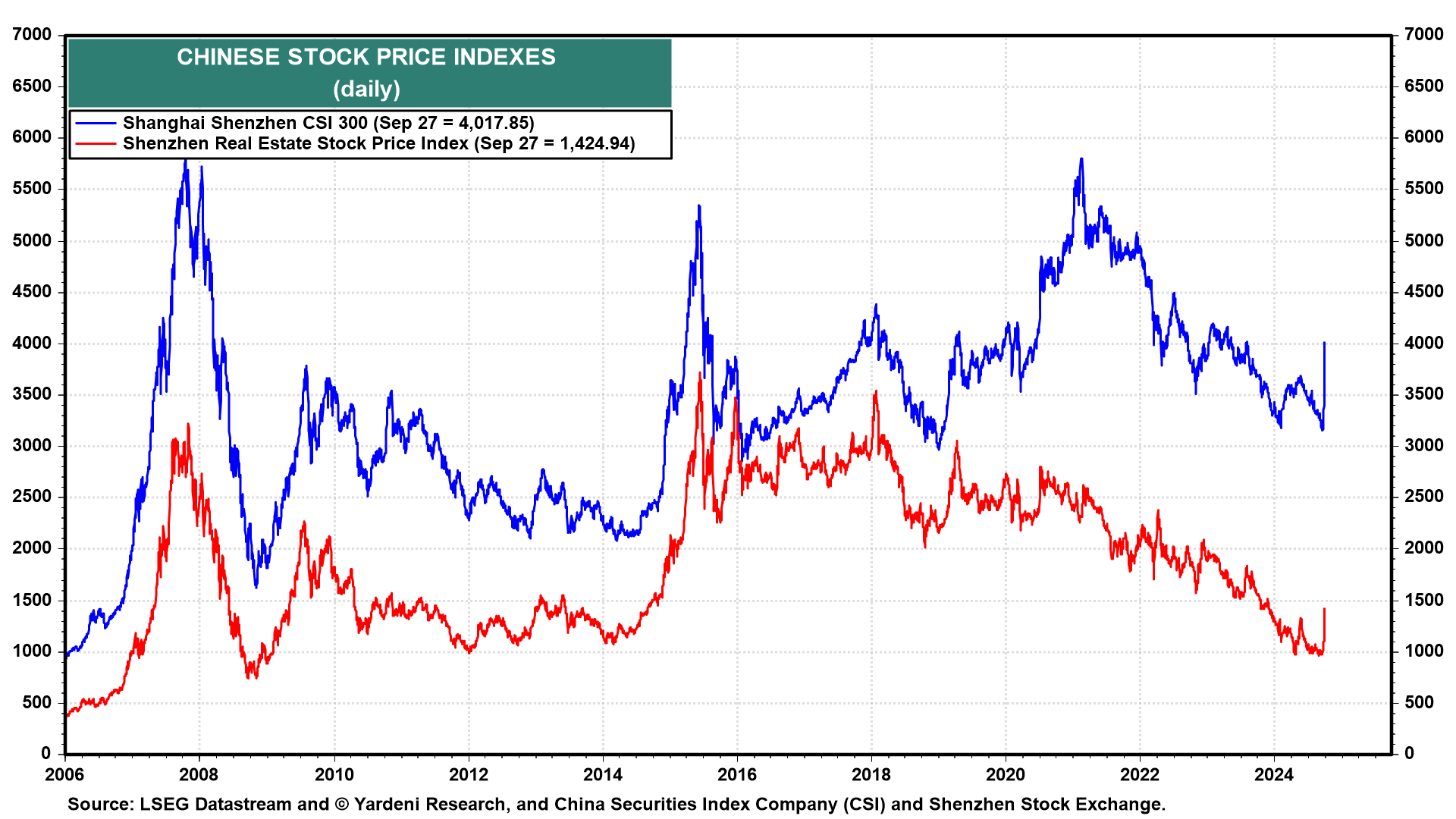

Over the past several days, China has unleashed several fiscal and monetary stimulus measures. China investor Jason Hu called these the "twin bazookas" policy of "[p]rint money and spend money." It's having an immediate effect, at least on stock prices. The Shanghai CSI 300 is up 27% since its low on September 17 (the day before the Fed's 50bps rate cut). The Shenzen Real Estate Stock index has surged 44% (chart).

The question now is whether this rally is sustainable, or if it's a short-term bounce after sentiment toward Chinese equities reached extreme pessimism. Investor David Tepper on Thursday, September 26, said on CNBC to buy "everything" related to China.

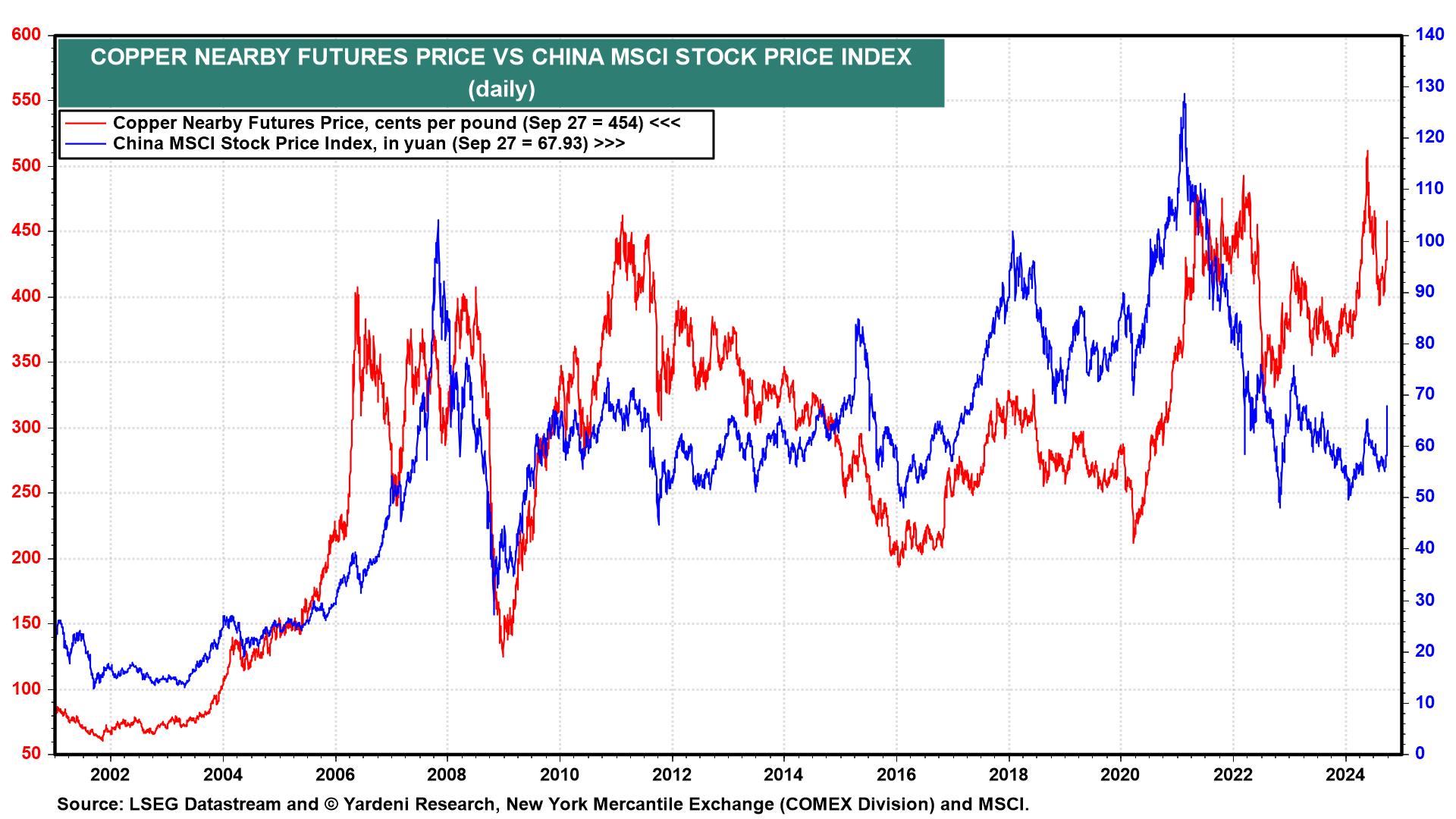

Time will tell if these twin bazookas shoot the silver bullets needed to revive China's weak consumer demand and ailing property rubble. Speaking of silver bullets, it's the copper bullet that will likely signal how well the economy is taking to the stimulus. The nearby copper futures price is up 11% over the past month but fell by 1.3% today. Copper is highly correlated with the Chinese economy and stock market (chart).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a