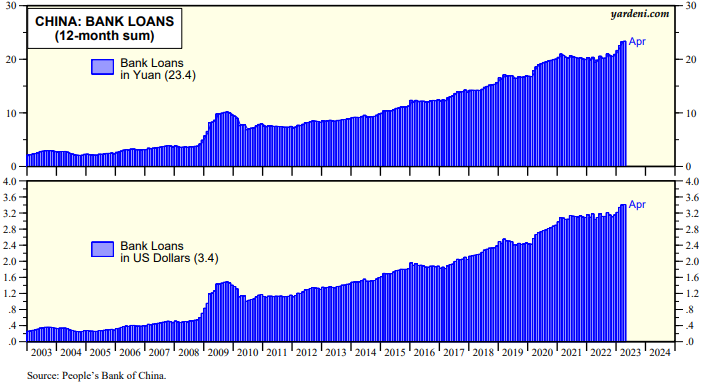

The People’s Bank of China (PBOC) stands out among the major central banks. It is the only one that has been continuing to provide additional monetary policy stimulus. This suggests that China’s economy isn’t performing as well as the government would like to see. The PBOC’s reserve requirement ratio for commercial banks has been lowered three times since the start of 2022. Over the past 12 months through April, bank loans have increased by a record $3.4 trillion (chart). That's trillion dollars!

Another red flag is China’s inflation rate. The CPI was up just 0.1% y/y in April despite the flood of bank loans (chart). The PPI for total industrial products was -3.6% over the same period.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a