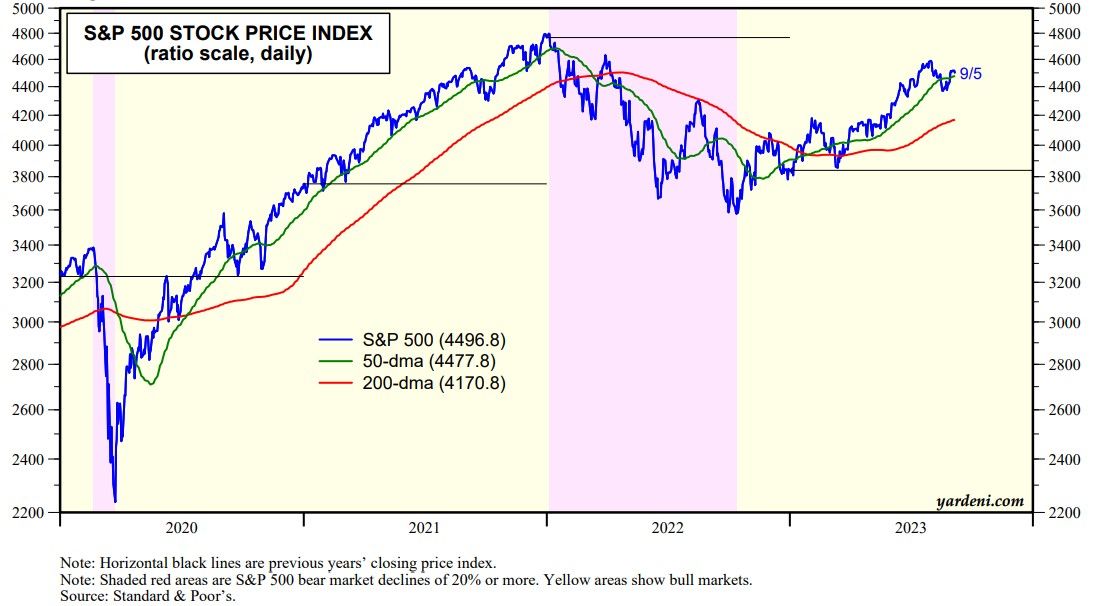

The S&P 500 has been marking time recently around its 50-day moving average waiting for a verdict (chart). The jury is no longer debating whether the economy is falling into a recession. The issue has been resolved. The economy is growing. But now the debate is whether it is growing too strongly so that inflation stops moderating. Or will it slow down so that inflation can continue to moderate. The verdict will determine whether the bond yield is on the verge of moving even higher than it has so far this year since it bottomed at 3.31% on April 5. It closed at 4.27% on Friday.

As we noted in the previous QuickTakes, this is a big week for inflation and business cycle indicators. We are expecting more signs of moderating inflation and slower economic growth. That would increase the likelihood that the Fed won't hike the federal funds rate on September 20. If, instead, the week's batch of indicators heightens fears that inflation is no longer moderating, then the bond yield will move higher and the stock market's valuation multiple will move lower (chart).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a