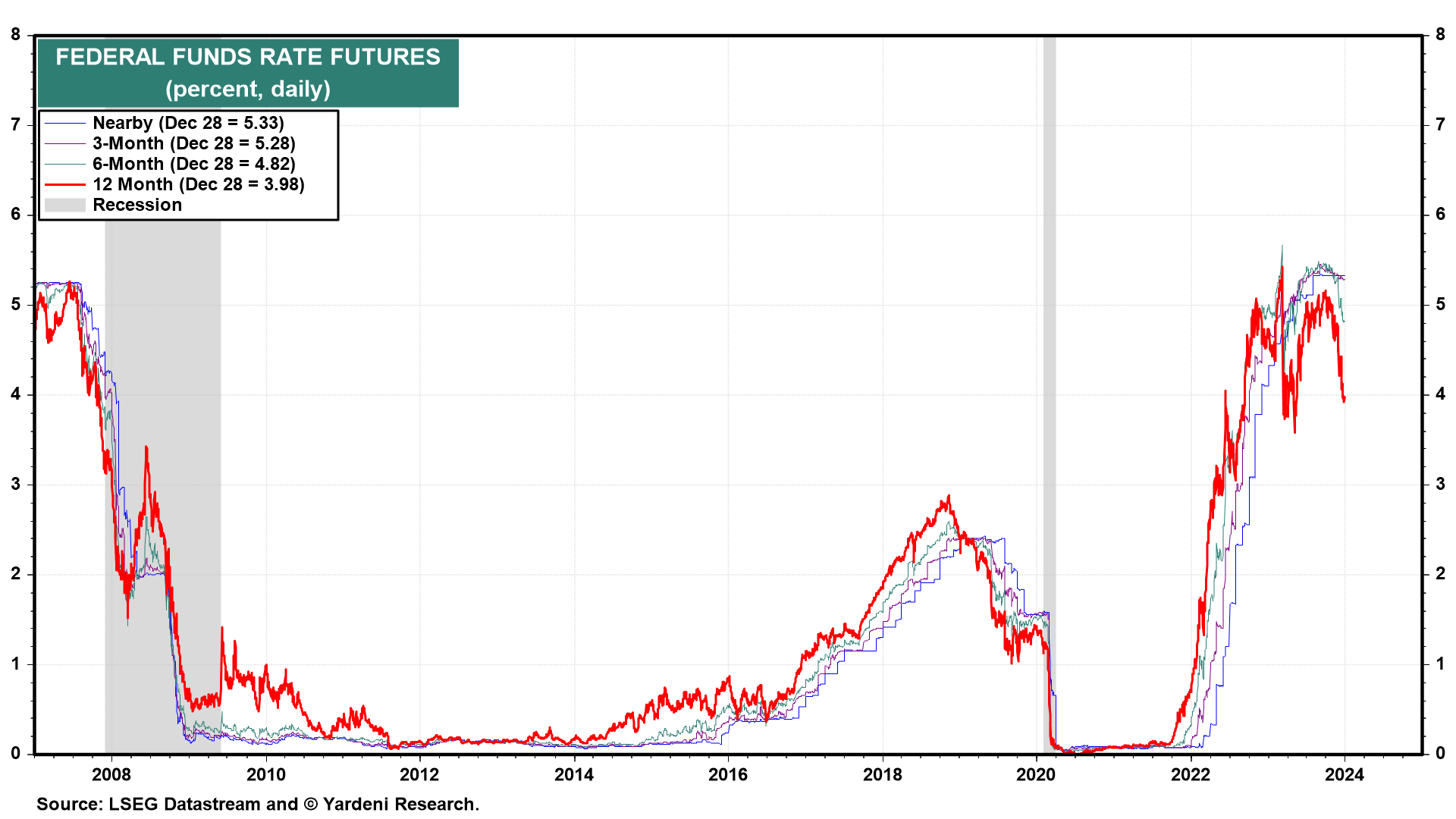

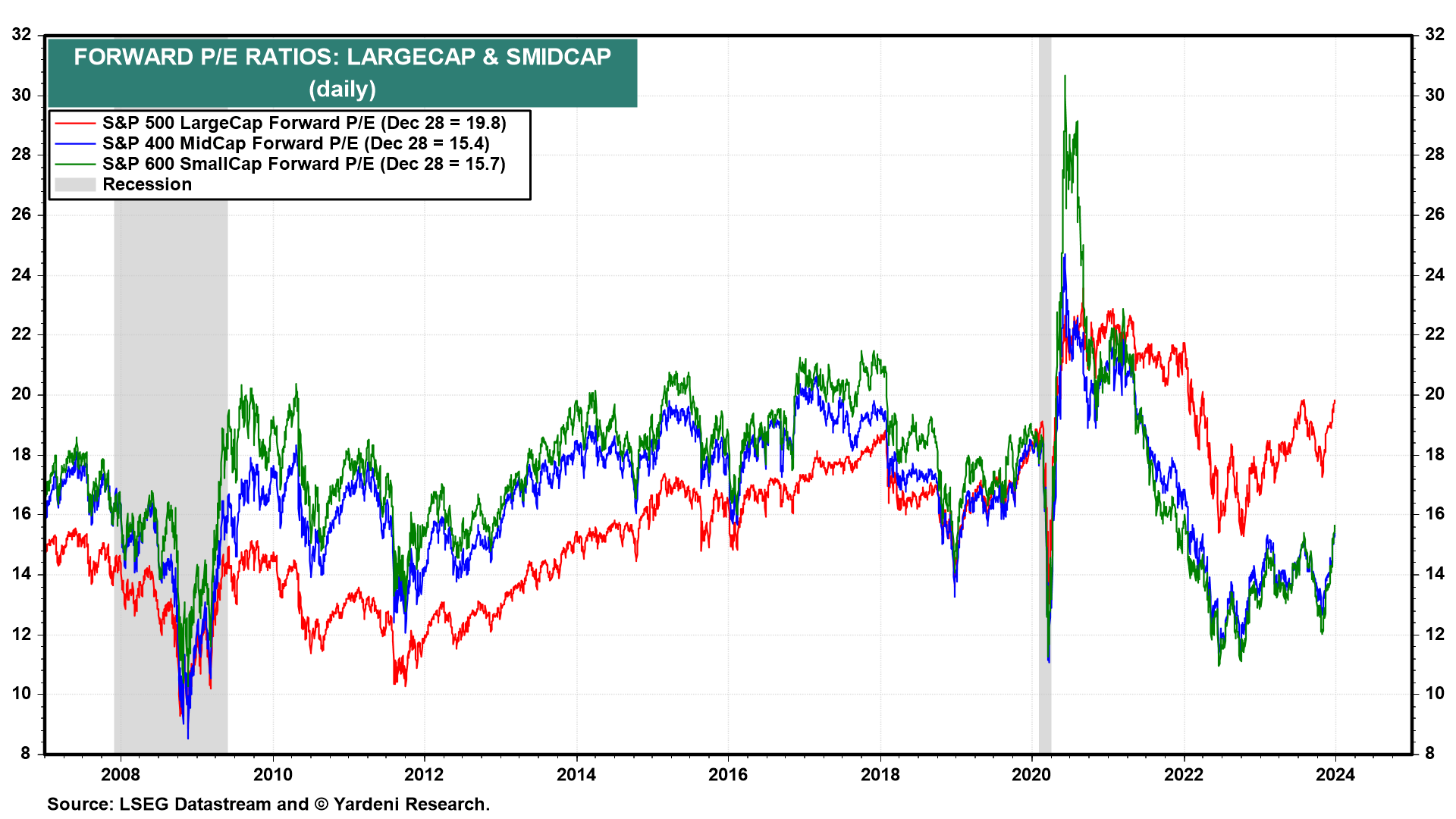

Meltups and meltdowns in the stock market are mostly attributable to rapid increases or decreases in earnings valuation multiples. The current meltup is no different. The S&P 500 is up 16.2% with its forward P/E up 14.5% since the October 27 correction low. That's mostly because investors have become more confident that inflation will continue to slow while the economy continues to grow. Instead of more hikes in the federal fund rate (FFR), the consensus view now is that the Fed will be cutting the (FFR) in 2024 to boost economic growth. Indeed, the 12-month FFR futures is down to 3.98%, implying five 25bps cuts in the FFR during 2024 (chart)!

So the forward P/E of the S&P 500 is up 14.5% since October 27 from 17.3 to 19.8 (chart). The forward P/Es of the S&P 400 MidCaps and the S&P 600 SmallCaps are up 21.3% (from 12.7 to 15.4) and 28.3% (from 12.0 to 15.4). All the concerns about the narrow breadth of the bull market since October 12, 2022 vanished in a matter of just two months as the widening breadth of the market has been, well, breathtaking!

The SMidCap stocks remain quite cheap both in absolute terms and relative to the S&P 500 LargeCaps (chart).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a