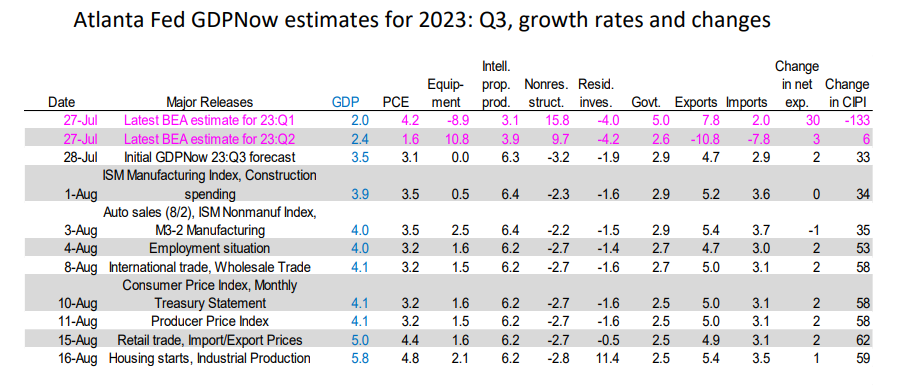

The economy isn't landing; it's flying high. Following better-than-expected July reports for housing starts and industrial production this morning, the Atlanta Fed's GDPNow tracking model raised Q3's real GDP growth rate to 5.8% (saar) from 5.0%, after raising it from 4.1% yesterday on a better-than-expected July retail sales report (chart). Consumer spending and residential investment are now tracking at 4.8% and 11.4%.

Positive economic surprises are bearish for bonds. The 10-year Treasury bond yield rose to 4.25%, matching last year's high after the releases. It rose to 4.27% about an hour after the Fed released (at 2:00 p.m.) the July FOMC Minutes, which was hawkish if inflation doesn't continue to moderate. We think it will.

By the way, June's Treasury International Capital data released on Tuesday showed that foreign private and official investors bought lots of US Treasury notes and bonds from March through June, a total of $289.3 billion.

Here are our quicktakes on today's releases:

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a