Are Fed officials making another big mistake? They were behind the inflation curve during 2020 and the first half of 2021 because they prioritized lowering the unemployment rate relative to keeping inflation down. Now they are scrambling to get ahead of the inflation curve, or at least catch up with it. So they raised the federal funds by 75bps at each of the last three FOMC meetings to a range of 3.00%-3.25%.

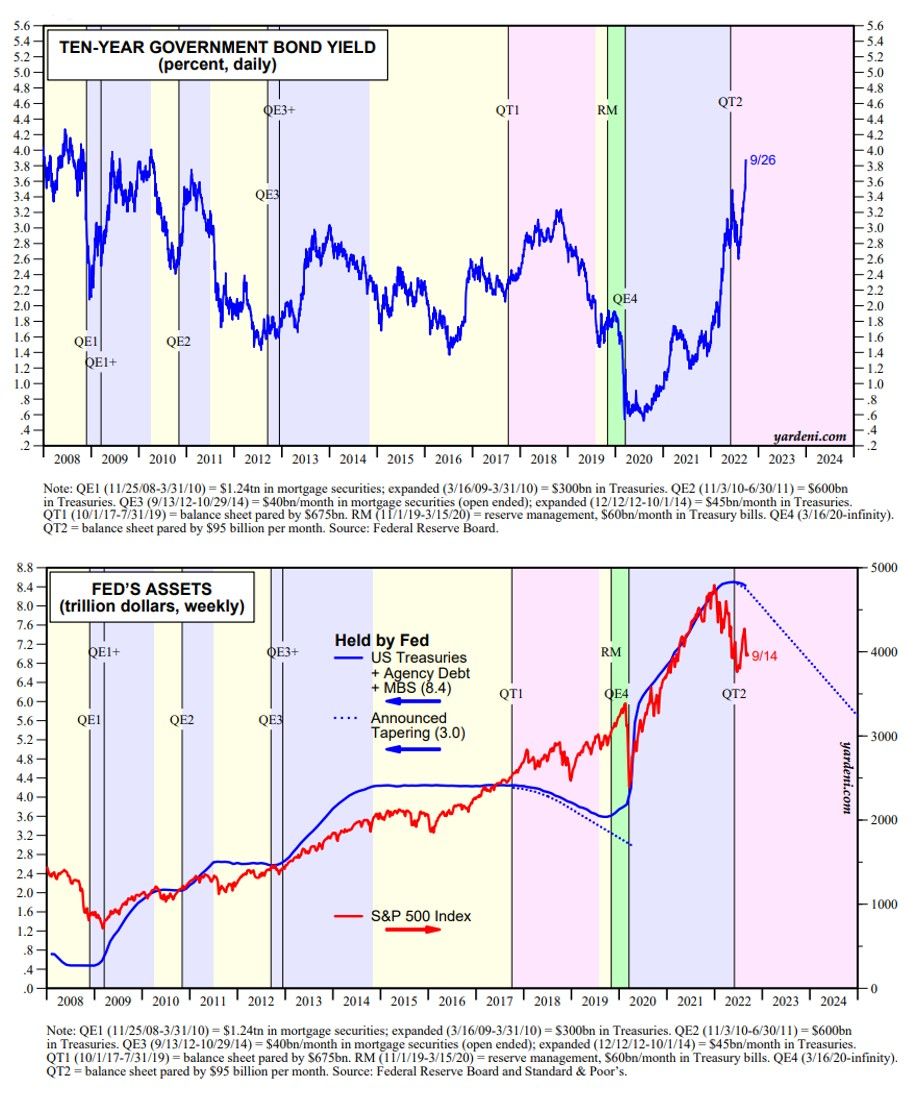

The committee's latest Summary of Economic Projections showed that they are expecting to raise the rate to 4.40% by the end of the year. That caused the 2-year Treasury note yield to jump over 4.00% and the 10-year Treasury bond yield to approach that level rapidly in recent days. The stock, bond, commodities, and forex markets are saying that's too much, too fast (charts below).

We have to agree:

(1) Previously, we've explained that the dollar has been soaring because the Fed has been more hawkish than the other major central banks, forcing them to tighten more aggressively to stop the free fall in their currencies--which is exacerbating their inflation problems. In effect, the Fed is exporting inflation to the rest of the world, forcing the other central banks to slam on their brakes.

(2) At his press conference on September 21, Fed Chair Jerome Powell said that the federal funds rate is “probably into the very lowest level of what might be restrictive.” However, at the same time as the Fed is aggressively hiking the federal funds rate, it has increased the pace of paring its balance sheet with QT2 to $95 billion per month.

(3) The markets are looking at the combination of a higher fed funds rate, inverted yield curve, QT2, and a strong dollar as approaching the very highest level of what might be restrictive.

Powell will have to pivot again, and at least press the pause button.