We asked Joe Feshbach for an update on his view of the market from a trader’s perspective: “Breadth has improved for the S&P 500. But the cumulative advance/decline line for the Nasdaq is a galaxy away from confirming the strength in the S&P 500. Sentiment is way too complacent here. Friday had the lowest put/call ratio in many months. Yes, it’s always difficult to predict the end and duration of a blow-off rally, but I'm in the camp that believes that the market rally is close to done—although in fairness, I've said that before. I think that the market could take a big hit to the downside when momentum breaks, as I expect it will.”

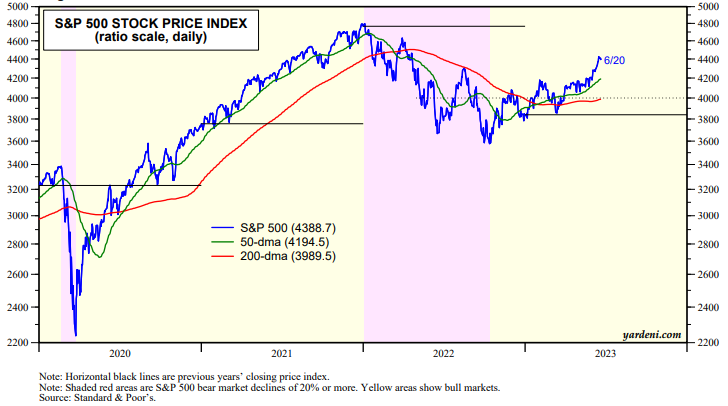

Joe has been a good friend since we worked at Prudential Securities in the 1980s. He has also been a very successful trader for over 40 years. We don't always agree, but we always feel better about our outlooks when we do agree. We agree that the market may be due for a correction, but we (at YRI) believe we've been in a bull market since October 12. Even if the S&P 500 retests its 200-day moving average that would be a 9.1% drop, less than an official 10%+ correction (chart)

Here are a few of the technical charts that support Feshbach's concerns:

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a