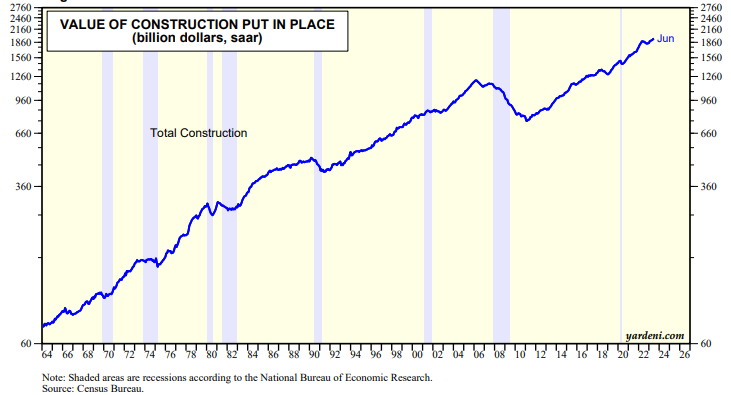

Today's batch of economic indicators was relatively upbeat. June's JOLTS report showed that jobs remained plentiful. July's M-PMI suggests that the rolling recession experienced by goods producers and distributors may be bottoming. June's construction spending rose to yet another record high (chart). The Atlanta Fed's GDPNow tracking model estimates that real GDP rose a whopping 3.9% during Q3.

That estimate is bound to be revised, but it certainly supports our view that our old soft-landing-rolling-recession scenario of the past year and a half may be morphing into our new no-landing-rolling-recovery scenario for the next year and a half. We now assign 85% subjective odds to the new scenario and 15% to a hard-landing one through the end of next year. We are still targeting the S&P 500 at 5400 by the end of next year.

So what could possibly go wrong for the stock market? Well, we could be wrong. We are expecting a rolling recession to roll through the commercial real estate sector. Perhaps that will cause an economy-wide credit crunch and recession. The labor market remains tight and labor unions are pushing for higher wages. The result could be a renewed wage-price spiral that would force the Fed to raise the federal funds rate to a level that triggers a recession and a new bear market.

New on our worry list is the possibility that the 10-year Treasury yield, which is back up to 4.00%, continues to move higher. On a 13-week change basis, it is highly correlated with the Citigroup Economic Surprise Index (CESI) (chart). The CESI rose to 76.1 yesterday, up from zero earlier this year.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a