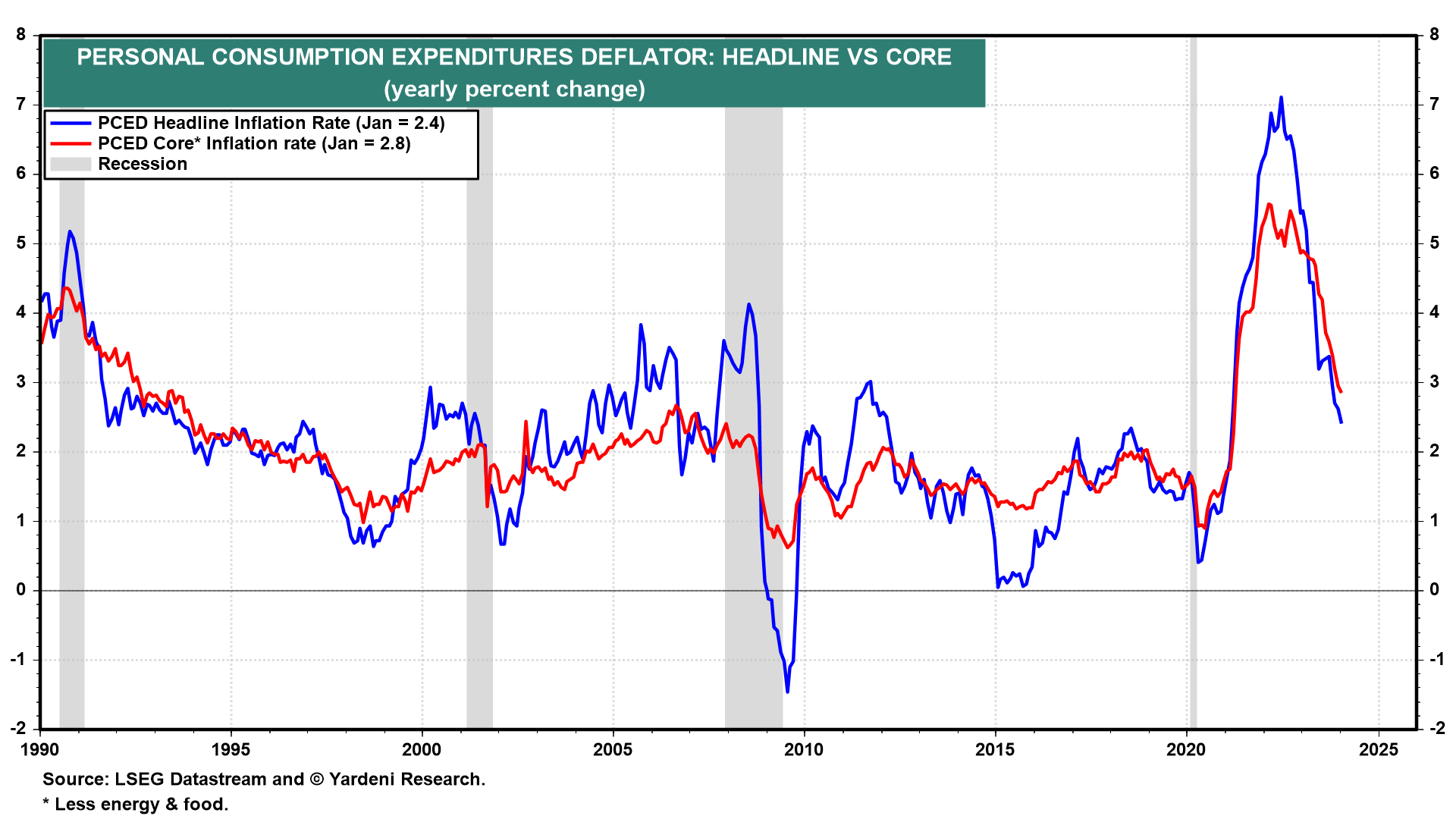

The most important economic indicator for the week ahead will be February's PCED inflation rate, which comes out on Friday. The Cleveland Fed's Inflation Nowcast shows the headline and core rates rising 0.4% and 0.3% m/m, and 2.5% and 2.8% y/y. Those results would be about the same as January's, possibly raising concerns that inflation has stalled and stopped moderating (chart).

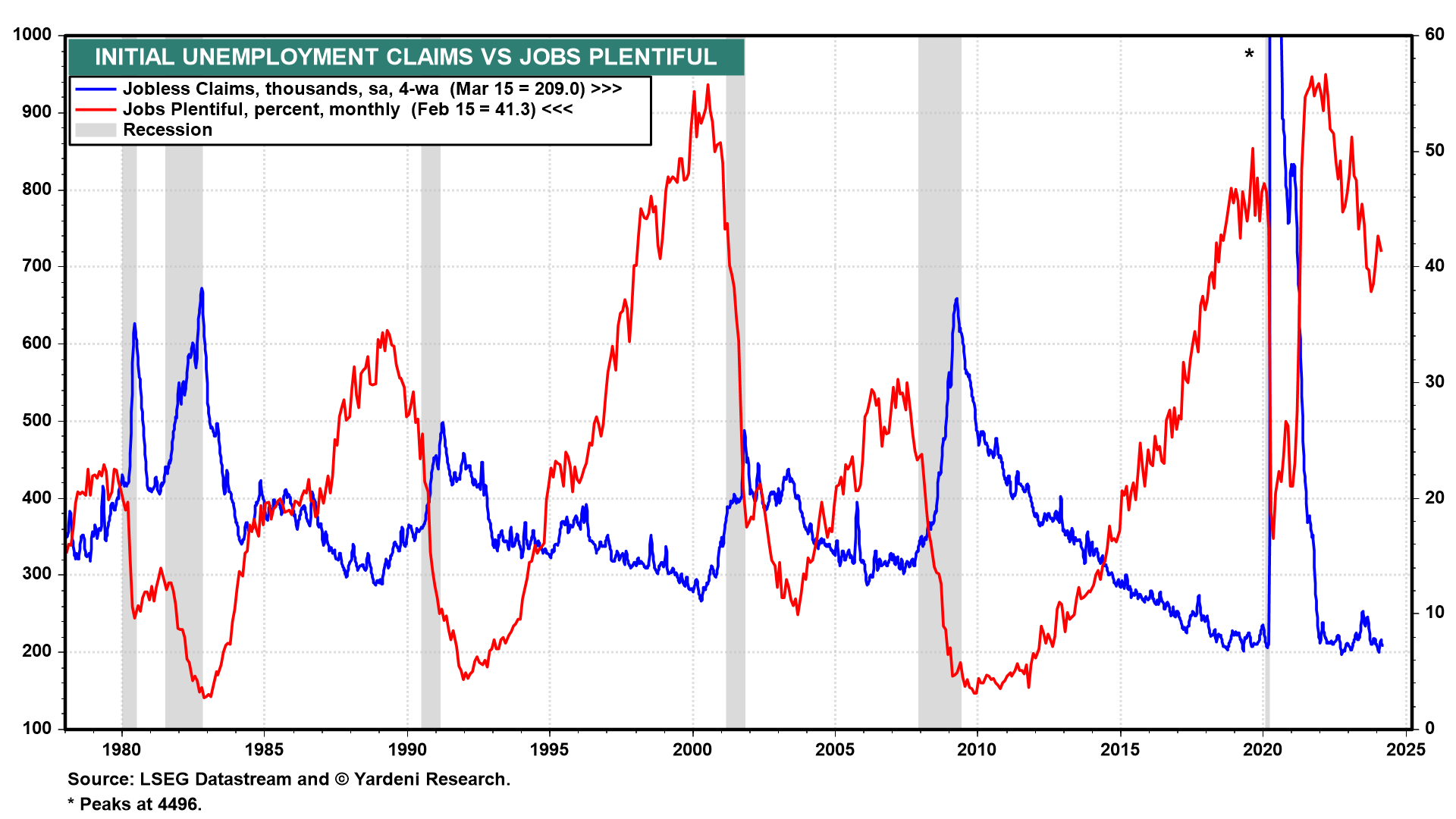

February's personal income report (Fri) should show that consumers' purchasing power rose to another record high with record highs in both labor and nonlabor income. The low readings in initial unemployment claims through the March 15 week suggest that the "jobs plentiful" reading in the March Consumer Confidence Index survey (Tue) remained relatively high (chart):

The regional business surveys conducted by the Federal Reserve Banks of Dallas (Mon), Richmond (Tue), and Kansas City (Thu) should confirm the modest weakness shown by the New York and Philadelphia surveys (chart).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a