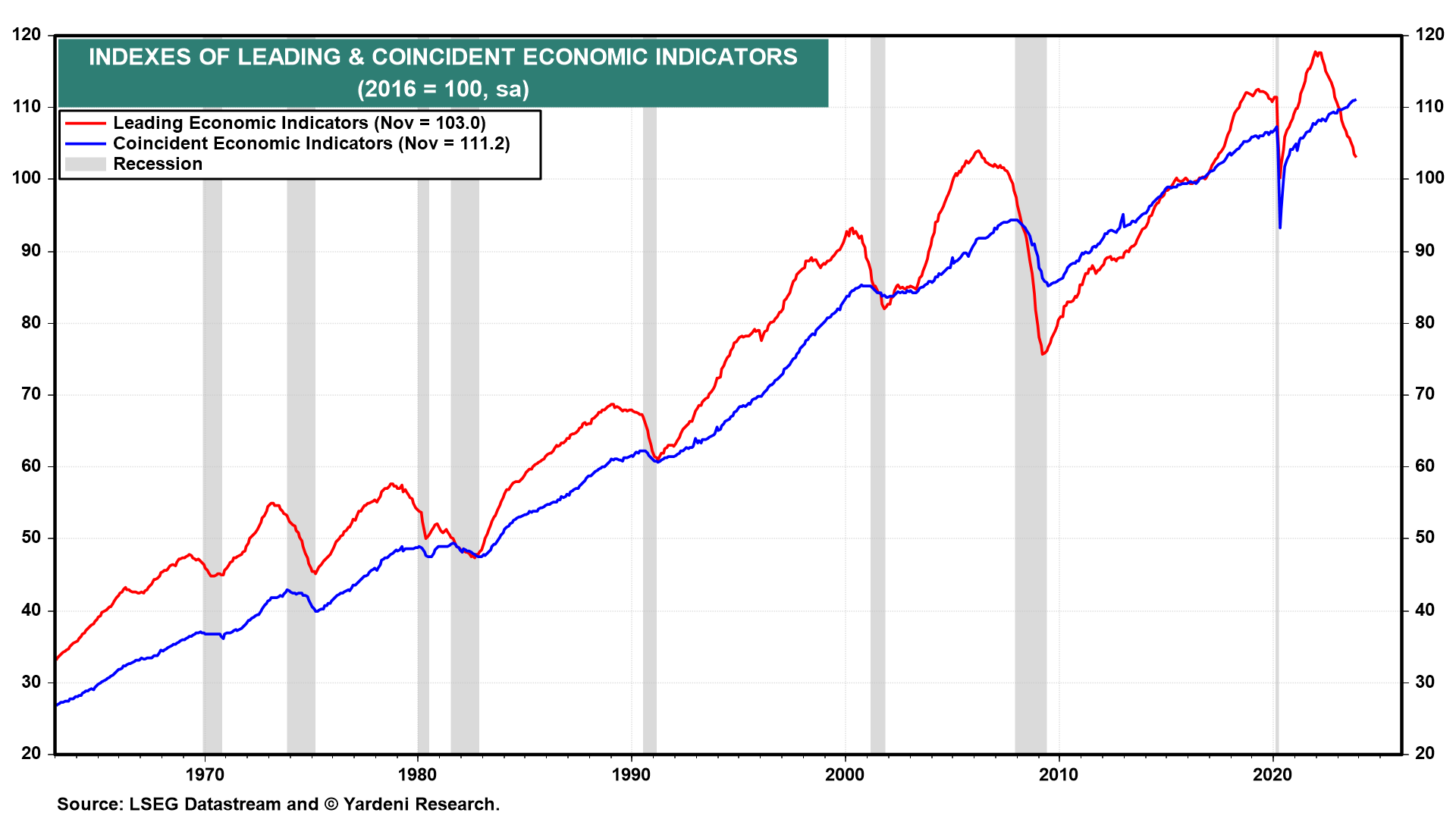

The week ahead should be another good one for our "immaculate disinflation" scenario. December's Index of Coincident Economic Indicators (Mon) probably rose to another record high (chart). Payroll employment rose to a new high last month. Real personal income and real business sales of goods probably did the same. Production upticked in December. The Index of Leading Economic indicators has been misleadingly pessimistic since December 2022. December's LEI might show a small uptick (for a change).

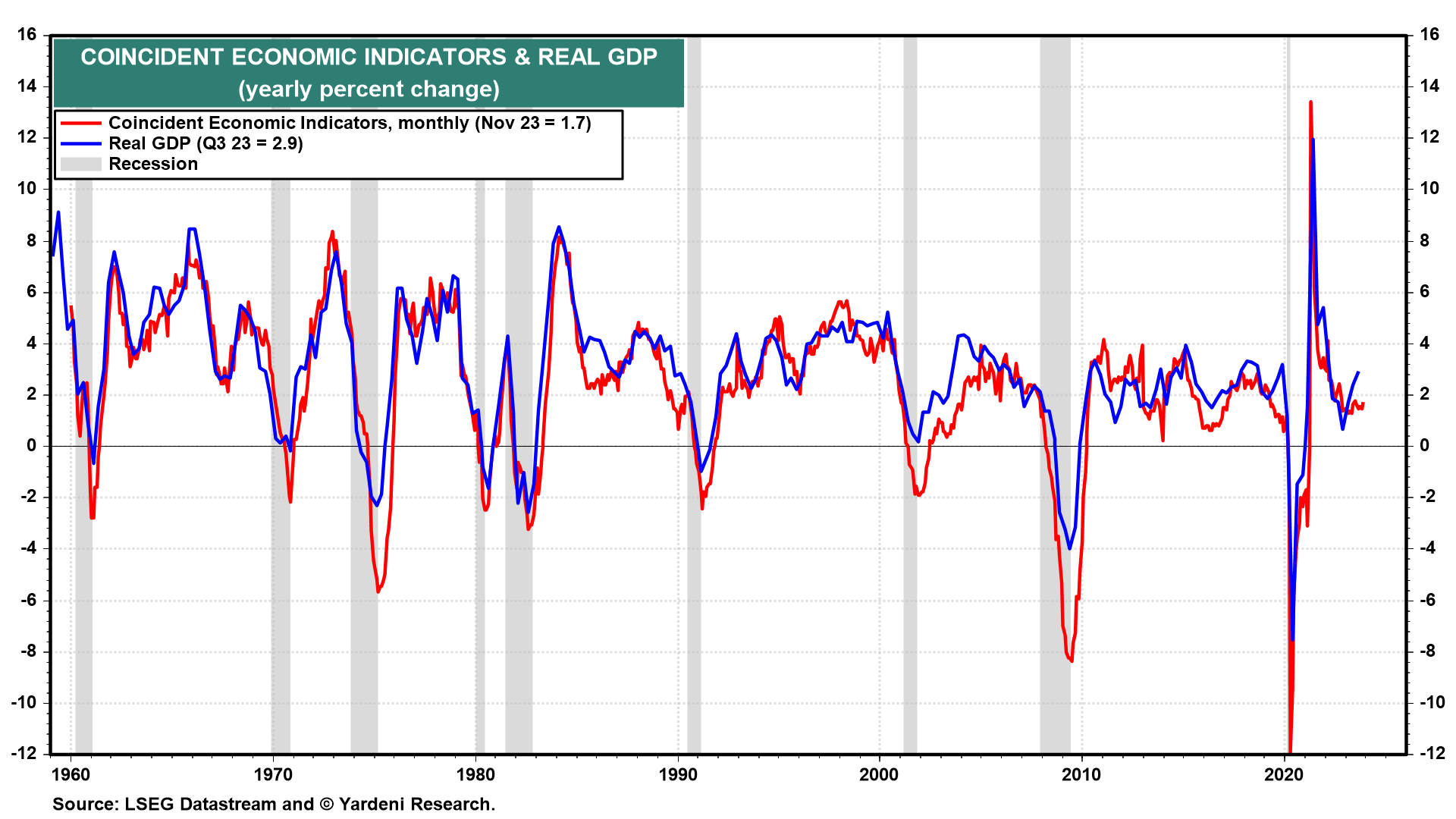

The y/y growth rate of the monthly CEI closely tracks the comparable growth rate of quarterly real GDP (chart). The former suggests that the latter (Thu) continued to grow around 2% during Q4. On the other hand, January's Richmond Fed and KC business surveys (Tue) ill probably confirm last week's NY Fed and Philly Fed surveys showing ongoing weakness in manufacturing.

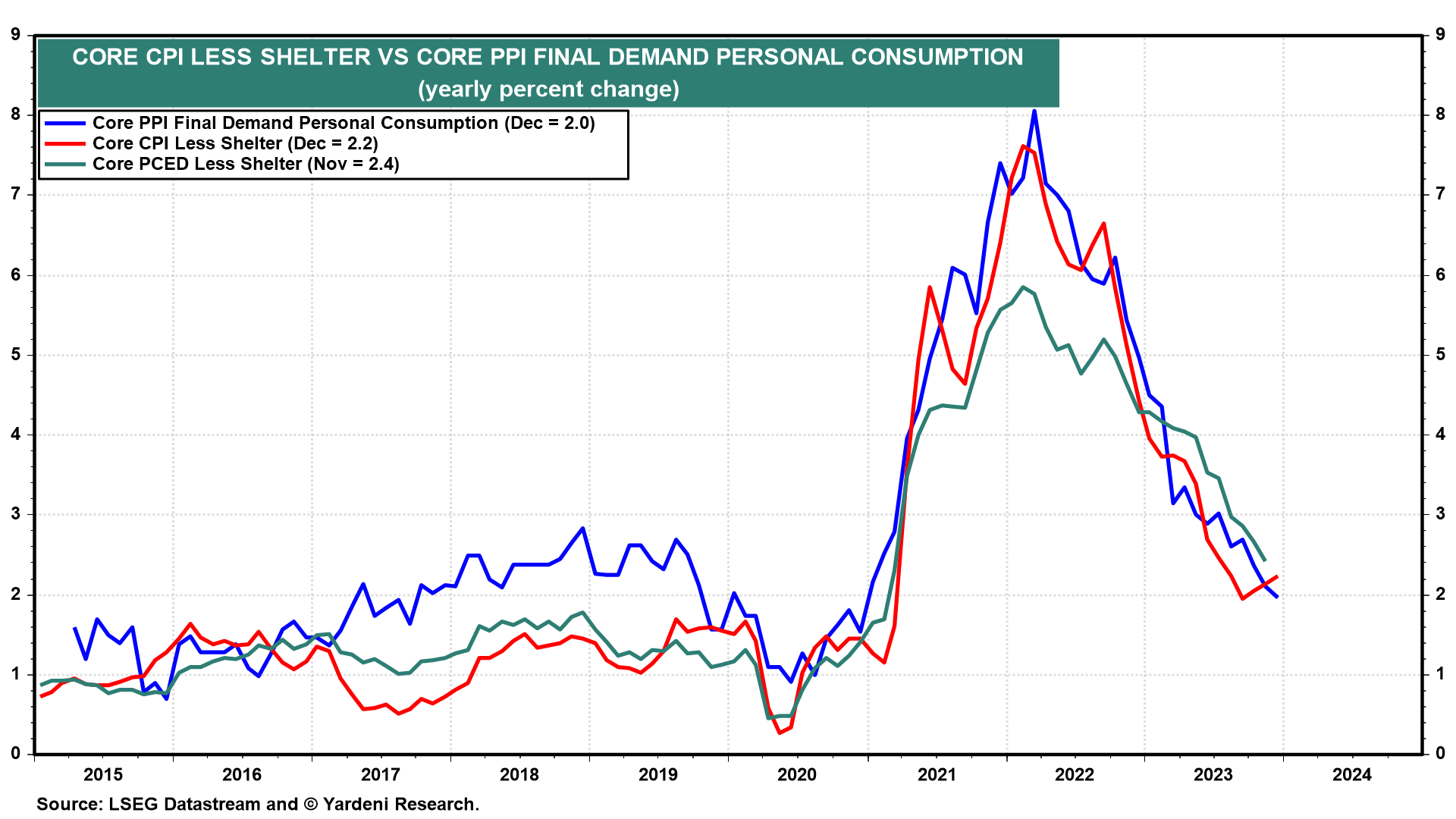

December's personal income report (Fri) should show that consumers are still doing what they do best and that the PCED inflation rate continues to moderate. The core PCED less shelter measure of consumer prices rose 2.4% y/y during November. December's comparable readings for the CPI and PPI were lower at 2.2% and 2.0% (chart). Shelter has been slower to disinflate, but it has a smaller weight in the PCED than in the CPI.