Ever since Hamas attacked Israel on October 7, 2023, we've warned that the latest war in the Middle East between these arch enemies could be protracted and spread to the rest of the region. On October 10, we wrote: "This one isn’t likely to lead to a quick ceasefire between Israel and Hamas, as occurred in the past, because it is in fact a war between Israel and Iran. For Israel, it is existential. This time, Israel’s goal is to wipe out Hamas, which is Iran’s surrogate in Gaza. The war is also existential for Iran’s mullahs, who need it to distract the population from discontent over their authoritarian regime by moving forward on their machinations to wipe out Israel."

Yesterday's WSJ warned: "Israel is preparing for a direct attack from Iran on southern or northern Israel as soon as Friday or Saturday, according to a person familiar with the matter. A person briefed by the Iranian leadership, however, said that while plans to attack are being discussed, no final decision has been made." The Iranians are reportedly considering a direct attack on Israel. Diplomatic efforts are underway to avert such a calamity by both the US and Russia.

The financial markets are bracing for this calamitous scenario. The S&P 500 has had a nearly vertical ascent of 27.6% from 4117.37 on October 27, 2023 to 5254.35 on March 29 (chart). That might be it for a while, especially if push does come to shove between Israel and Iran. This morning, the S&P 500 is falling towards its 50-day moving average (dma). For now, we are sticking with our yearend target of 5400, but we can't rule out a test of the 200-dma under the circumstances.

Also this morning the price of a barrel of brent crude oil is back up above $91 (chart). If push comes to shove between Israel and Iran, $100 or more is likely.

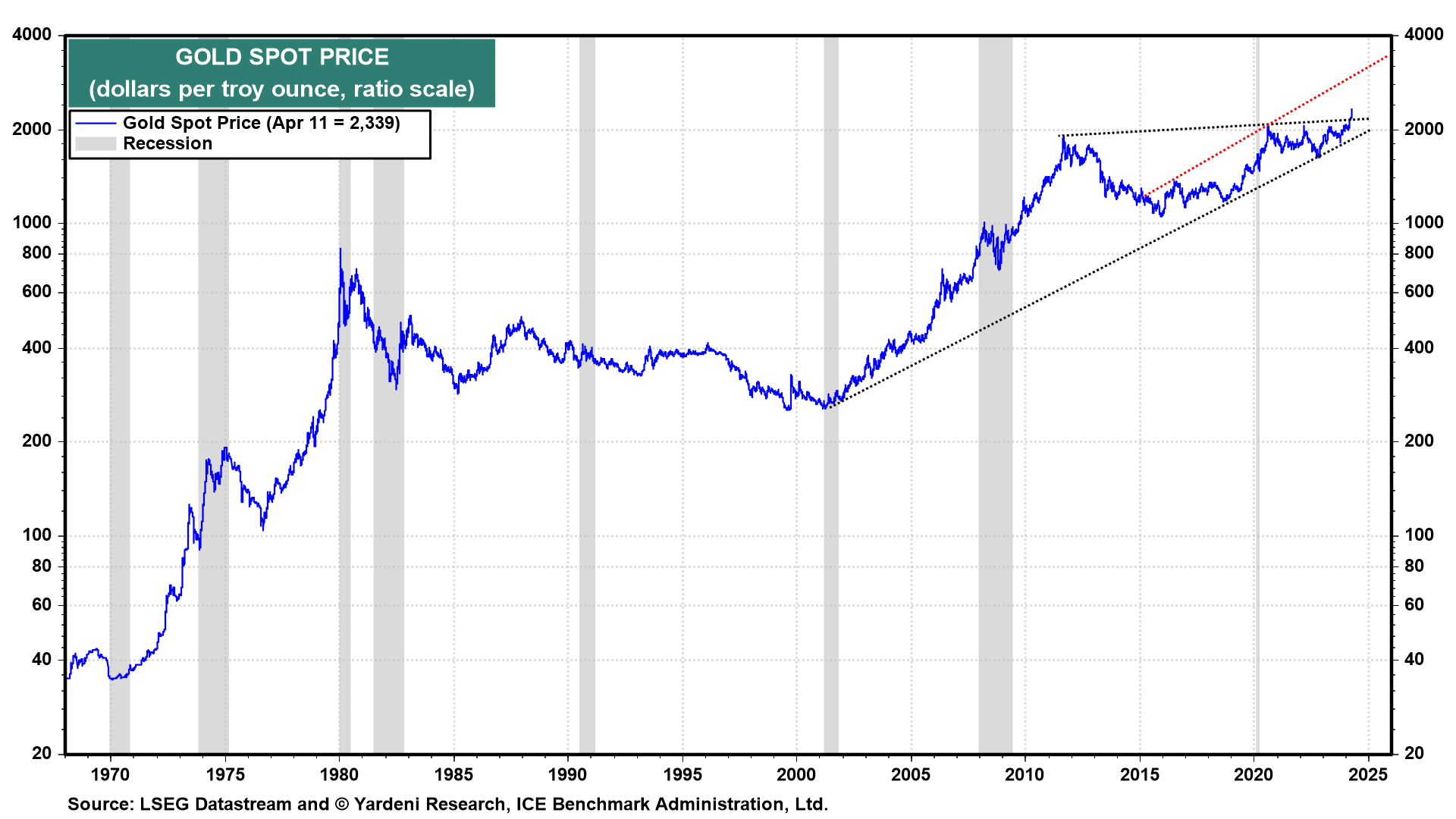

The price of an ounce of gold is soaring into record high territory as well this morning approaching our yearend target of $3000 ahead of schedule (chart). The nearby gold continuous contract price is up more than $70 this morning to $2446. That's happening even as the dollar is strengthening.

Silver is also going vertical (chart). We reiterate our April 7 opinion: "We continue to recommend overweighting the S&P 500 Energy sector. We would also add to precious metals positions under the circumstances. Taking some profits in other positions might be a good idea."