When the banking crisis occurred during March, we concluded that the Fed's emergency liquidity response would contain the problem. We predicted that investors soon would be scrambling to determine which regional banks might be acquired rather than worrying about which of them might be seized by banking regulators. We argued that the higher costs of regulation that would soon be imposed on the smaller banks would force the industry to consolidate. We've been recommending overweighting Financials since then.

According to a post by CNN's Matt Egan, Treasury Secretary Janet Yellen in a May 18 meeting with the CEOs of large banks said that more bank mergers may be necessary as the industry continues to navigate through the crisis. On Tuesday, we learned about a possible merger between PacWest and Banc of California, creating one of the largest banks by deposits in California.

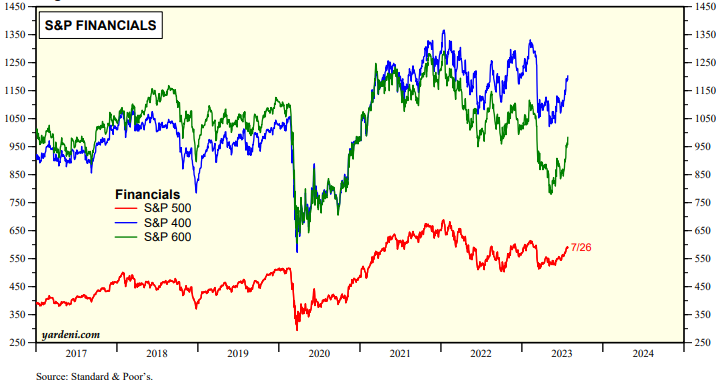

The S&P 400 and 600 MidCap and SmallCap bank stock price indexes bottomed at the start of May and are up 17.9% and 25.5% since then (chart). The banking crisis turned out to be a buying opportunity.

The fear now is that the S&P 500 is overbought and due for a correction. Sentiment has turned very bullish, which is bearish from a contrarian perspective (chart). Maybe so, but SMidCap Financials may continue to outperform since they are still well below their 2022 highs at the start of that year.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a