The S&P 500 fell 2.9% last week. Today, it rallied 2.6% to 3678.43, back above the June 16 low of 3666. Why did it do so well today? Because sentiment is so bearish.

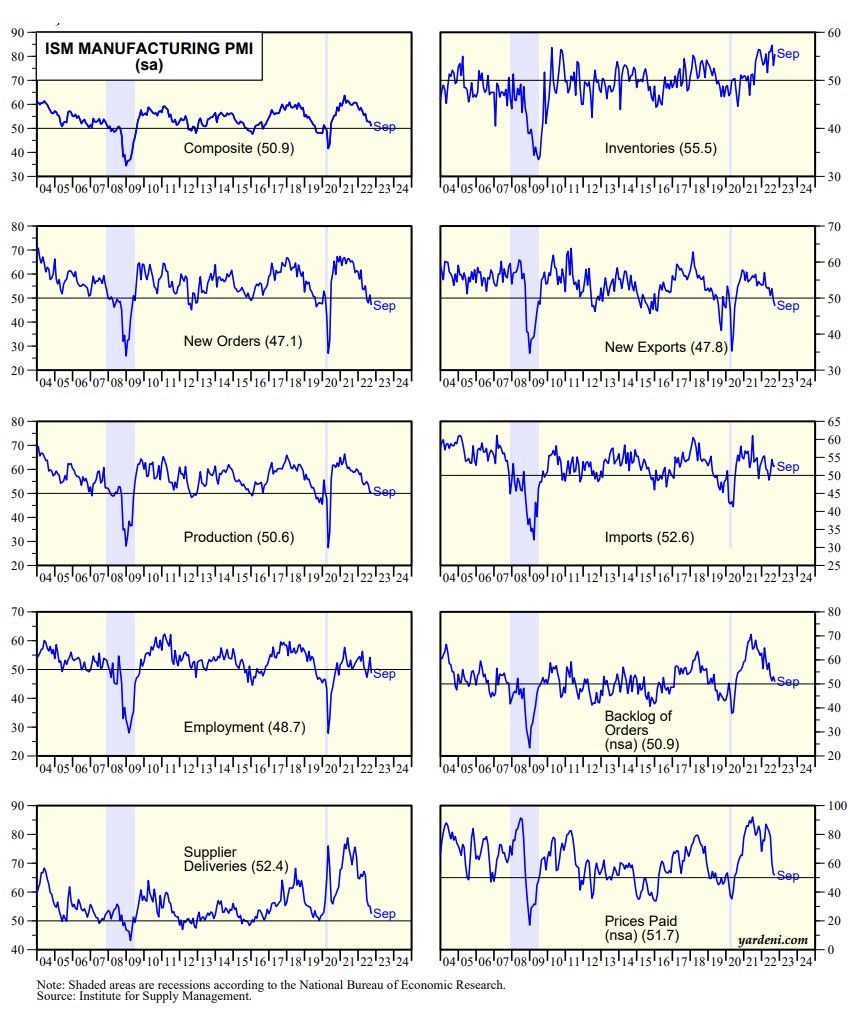

More fundamentally, bad news about the economy is good news for bonds and stocks. And this morning at 10:00 am the market moved higher on news that September's M-PMI fell to 50.9, the lowest since mid-2020 (chart). New orders fell to 47.1. Supplier deliveries (52.4) and backlog of orders (50.9) confirmed that supply disruptions have abated significantly. Perhaps most importantly, the prices-paid index fell to 51.7, suggesting that inflationary pressures are also abating.

The 10-year Treasury yield peaked at 4.01% on Wednesday around 6:00 am EST on news of the meltdown in the UK bond market. The BoE came to the rescue with a bond buying program. The US yield was back down to 3.61% today. Now everyone is wondering whether something else might break that will brake the Fed's QT2 and/or reduce the terminal FFR.

Joe Feshbach, our go-to trading strategist, anticipated that the S&P 500 would drop below its June 16 low before bouncing back above it. He still sees a trading range with more upside in the short term because sentiment has been so bearish. The bond rally and weaker dollar help as does last week's capitulation selling of widely-held Apple.