The Fed's ultra-easy monetary policies, in response to the pandemic, caused home prices to soar, and now rents are soaring. Over the 24 months through May, the median single-family home price is up a whopping 44.5%. This year's jump in mortgage rates only exacerbated the affordability problem facing first-time would-be homebuyers. As a result, many of them have no choice but to rent.

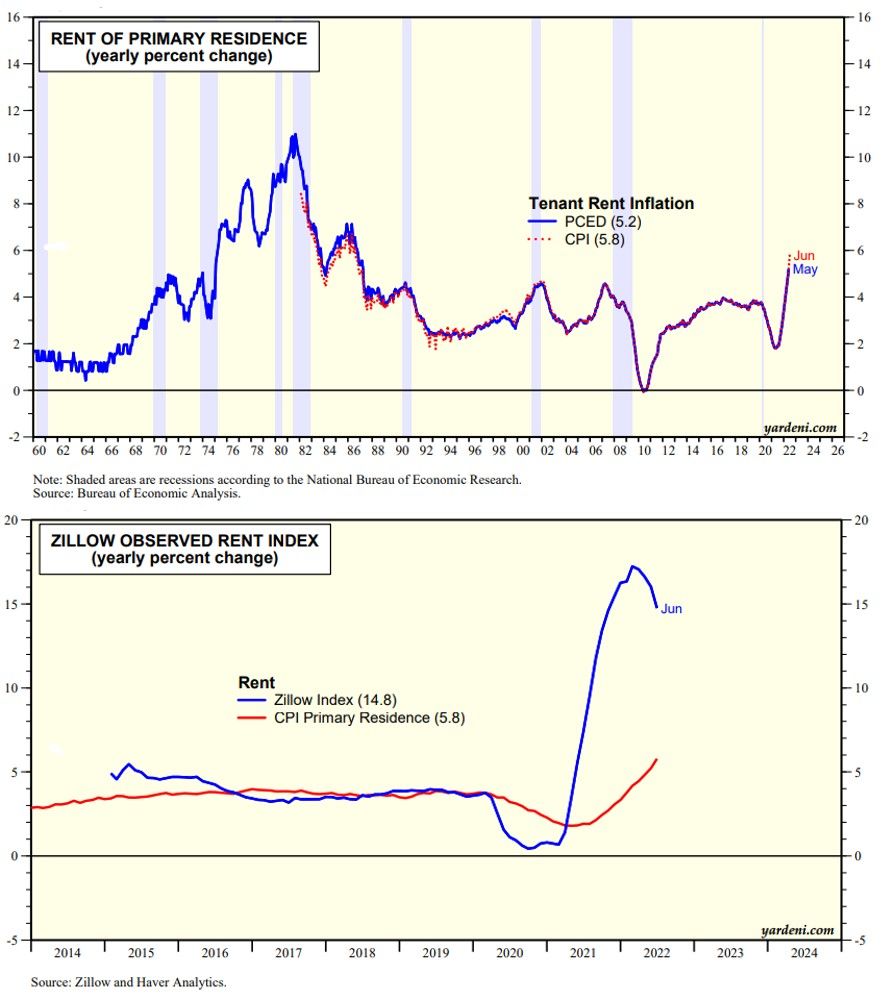

Today's CPI report showed that rent of primary residence rose to 5.8% y/y, the highest since the mid-1980s (chart below). Previously, we've shown that this measure of rent inflation closely tracks wage inflation. Rents have been rising almost as fast as wages over the past year or so. In some urban areas, they've been rising faster, thus forcing workers to spend more of their budgets on rent.

The Zillow rent survey shows that rents on new leases are up 14.8% y/y through June (chart below). The CPI rent measure reflects rents on all current leases, so it is likely to rise at a faster pace over the coming 12-18 months as the new leases with higher rents are reflected in the CPI's sample of rents.

Nevertheless, the headline CPI inflation rate could moderate during the second half of this year assuming, as we do, that both nondurable and durable goods inflation will do so. Rent inflation will remain persistently pesky and frustrate the Fed's goal of getting inflation back down to its 2% target.

Then again, the past five recessions brought wage inflation down significantly. We aren't convinced the Fed will want to cause a recession if inflation starts easing during the rest of the year.