The vertical momentum rally that started on October 27, 2023 seems to be losing some of its momentum. Maybe. That's OK with us. We would rather see our 5400 S&P 500 target achieved by yearend, then by mid-year. But as the Rolling Stones observed, "You can't always get what you want."

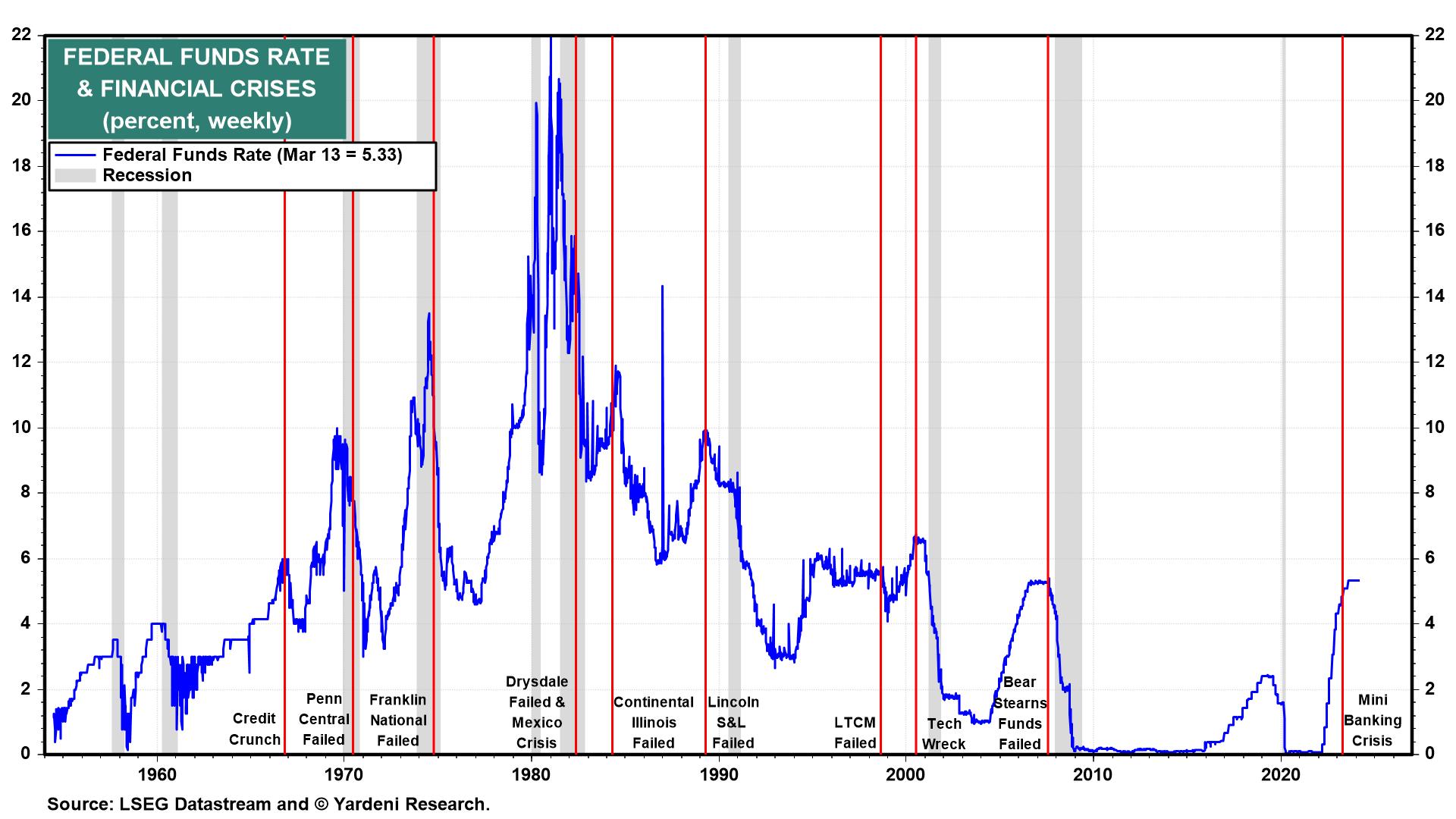

Slowing the pace of the advance this week have been hotter than expected CPI and PPI reports for February. That increases the likelihood that Fed rate cuts will be fewer and later than most investors expected at the start of the year. We've been in the no-rush-to-ease camp. We are still there and won't be surprised if the Fed doesn't cut this year at all. Previous rate cutting periods were triggered by financial crises and recessions (chart). Such a bad outcome isn't on our radar screen for this year.

There's no sign of trouble in today's initial unemployment claims report. In the week ending March 9, jobless claims totaled 209,000, a decrease of 1,000 from the previous week's revised level. The previous week's level was revised down by 7,000 from 217,000 to 210,000. Continuing claims for the March 2 week, were up by 17,000 to 1.811 million. Notably, the estimate of continuing claims for the February 24 week was revised down by a large 112,000.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a