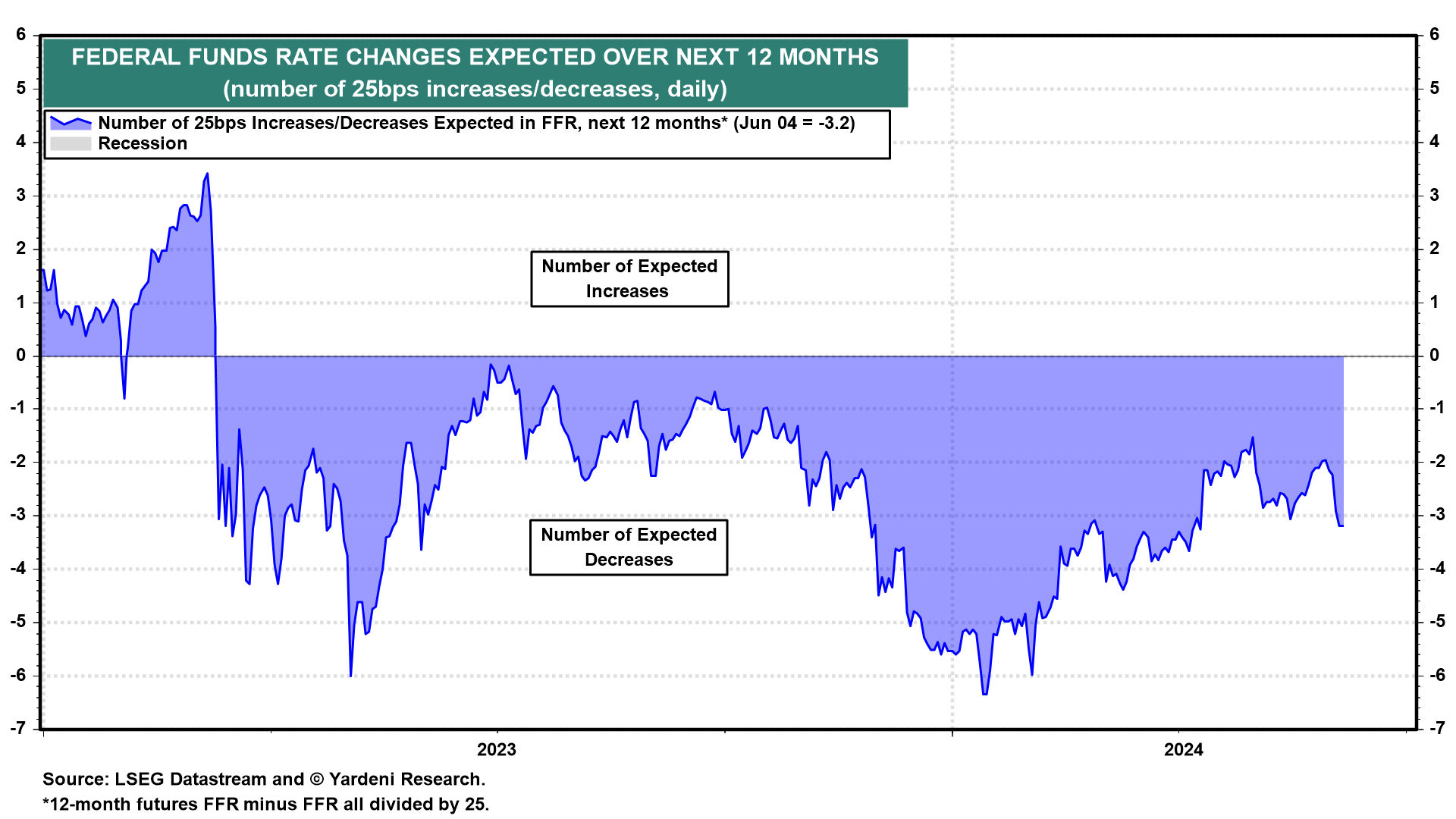

The financial markets seem to believe that the Fed Put is back. The recent batch of weaker-than-expected economic indicators raised the number of expected 25bps cuts in the federal funds rate (FFR) from 2 to 3 over the next 12 months (chart). That's according to the basis-point spread between the 12-month FFR futures and the actual FFR divided by 25bps. Investors must be confident that inflation is getting close enough to the Fed's 2.0% target so that it will respond quickly if the economy is (finally) about to fall into a recession. If so, then it won't fall into a recession! That explains why the stock market keeps bouncing back on the initial negative reaction to bad news, which is good news if it means the Fed Put is back!

There are two assumptions being made that might be wrong. First: Inflation might not be close enough to the Fed's target to warrant easing even if the economy continues to weaken. Second: The latest batch of weak economic indicators doesn't mean the economy is falling into a recession. More likely, it might finally be experiencing a soft landing rather than going into a hard landing. The Citigroup Economic Surprise Index is negative currently, but not signaling a recession (chart). Furthermore, it usually swings back into positive territory as long as there's no recession out there.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a