The main event this week is the FOMC meeting (Wed). The Fed is widely expected to cut the federal funds rate (FFR), but with a heated debate over whether it will be 25bps or 50bps. Perhaps more important than the size of the first cut will be the Summary of Economic Projections (SEP), which will provide Fed officials' updated forecasts for real GDP growth, the unemployment rate, inflation, and the FFR. The big questions are where they believe the so-called neutral rate of interest lies, and how quickly do they want to get there.

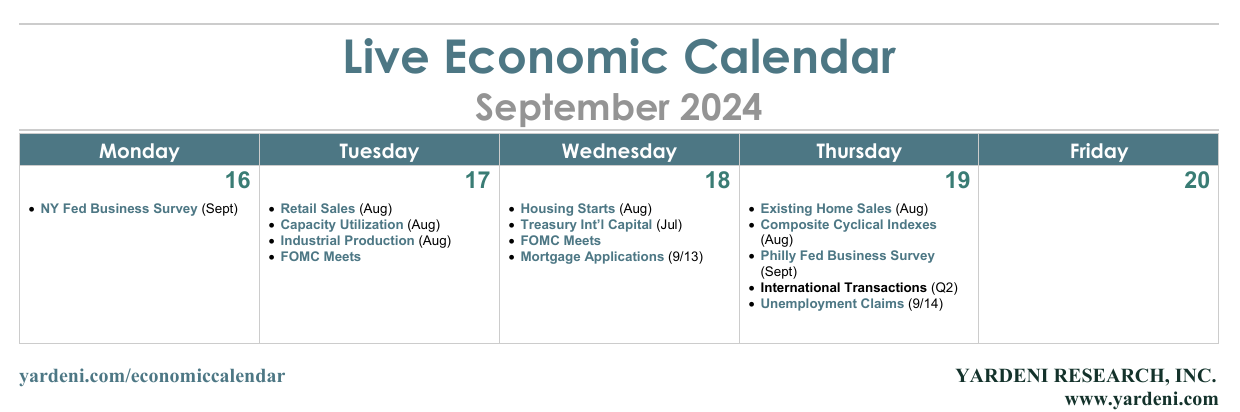

There is a lot of economic data due out this week as well. We think the economy is on stronger footing than many of the die-hard hard-landers who are calling for rapid rate cuts. Stronger-than-expected indicators could put upward pressure on the bond yield. Let's review what we're watching this week:

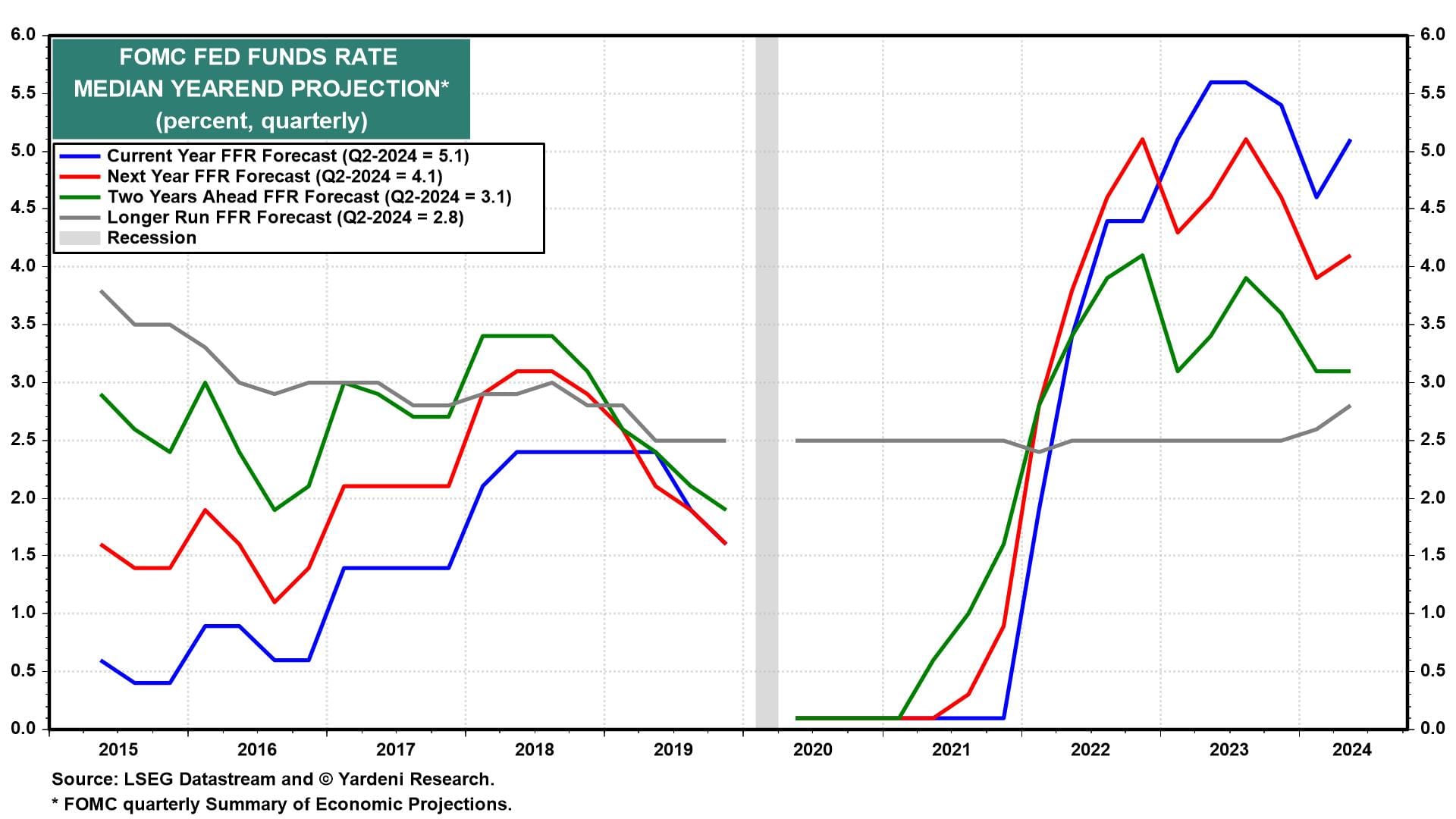

(1) Summary of Economic Projections. The SEP is released quarterly. Officials' median forecasts in June showed they expected the FFR to end the year at 5.1%, then fall by another percentage point in each of the next two years (chart). Those outlooks are likely to be revised lower, especially for 2024 and 2025.

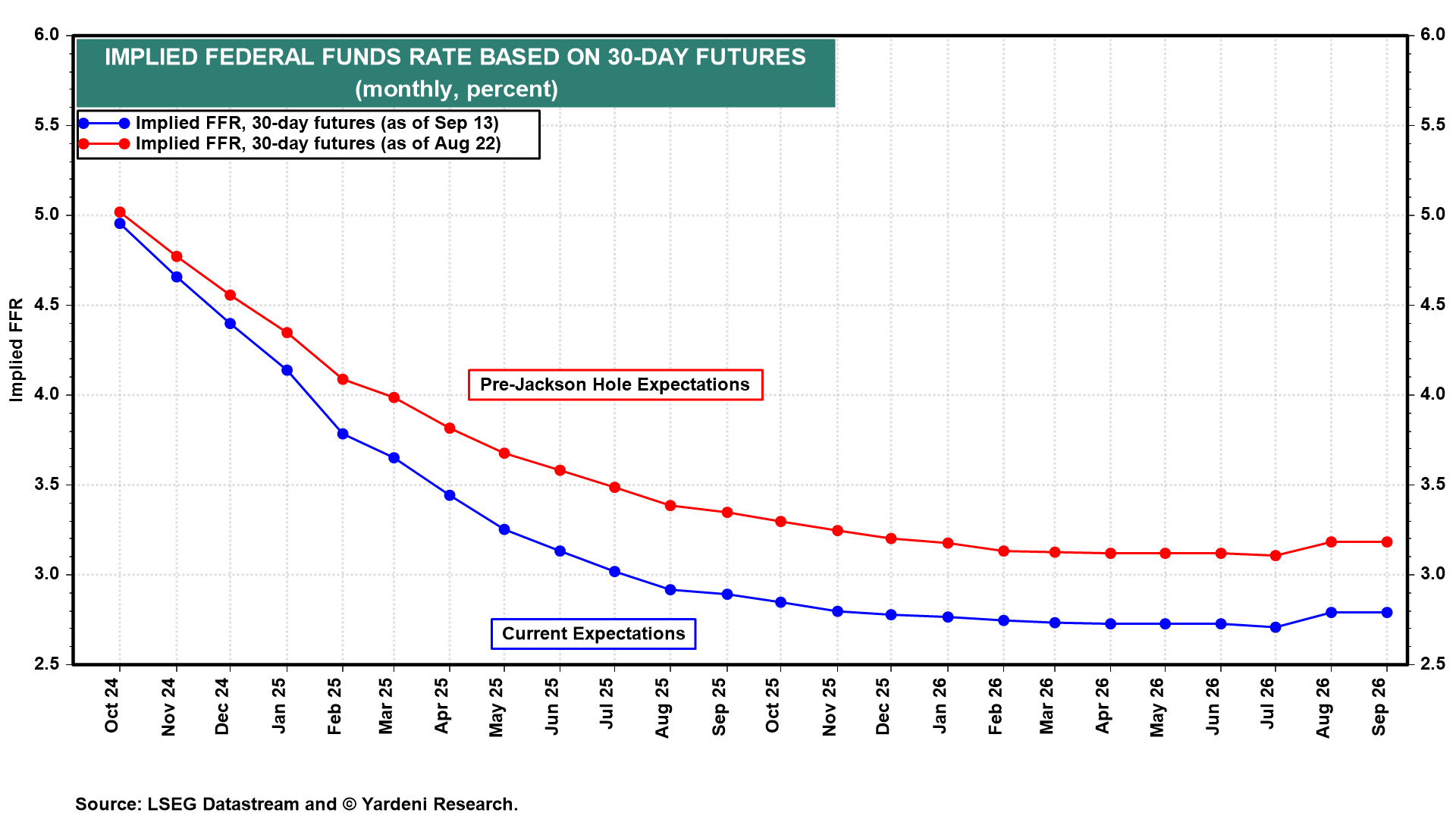

The FFR futures market shows the Fed cutting the rate below 3.0% in the next 12 months (chart). Barring a black swan event that causes a financial crisis, we don't expect this policy path to be realized. For starters, we are expecting a 25bps cut in the FFR on Wednesday rather than 50bps.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a