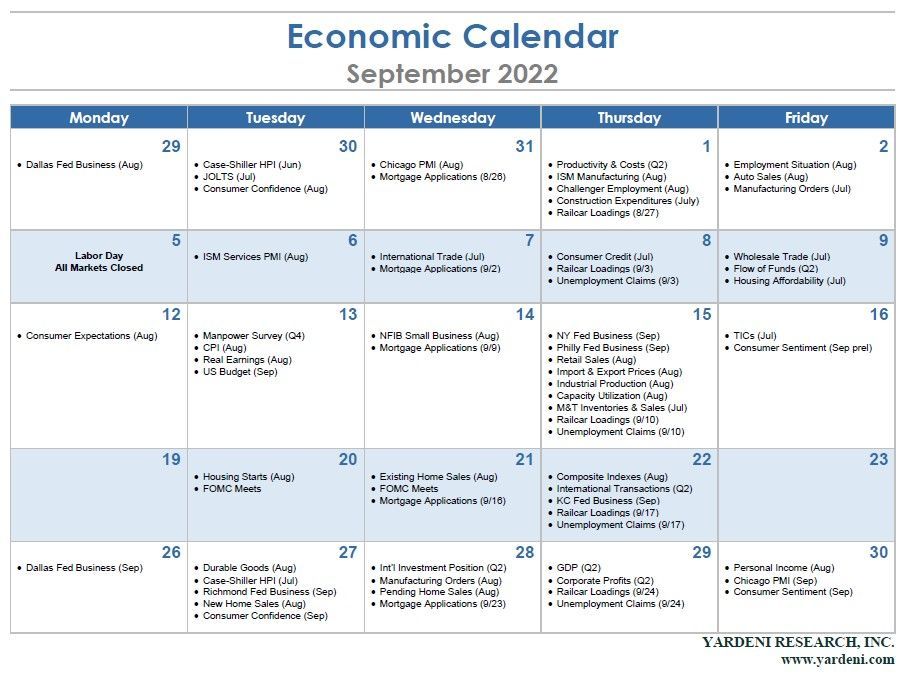

It's another action packed week ahead. On the inflation front, we are expecting that, on Monday, the FRB-NY survey of consumer inflationary expectations will show some moderation, reflecting the plunge in gasoline prices, while food inflation remained elevated. On Tuesday, August's CPI should do the same. August's NFIB survey of small business owners (released on Wednesday) is likely to show that lots of them are still raising their selling prices and continuing to struggle with labor shortages.

Among the first hints about September's economic performance will be the NY and Philly business surveys, released on Thursday. They should show that inflationary pressures continue to ease and the supply chain disruptions continue to abate. They should also confirm that economic growth remains weak, but not recessionary. August's industrial production (also on Thursday) should do the same.

Thursday's retail sales report for August could be stronger than expected because wages rose faster than prices (especially pump prices) during July and August. Then again, many consumers are spending more on services and less on goods. Friday's preliminary September reading of consumer sentiment should continue to rebound since it too is very much affected by gasoline prices.

Finally, July's Treasury International Capital report is likely to confirm that significant foreign net capital inflows into US financial markets can easily explain the strength of the dollar.