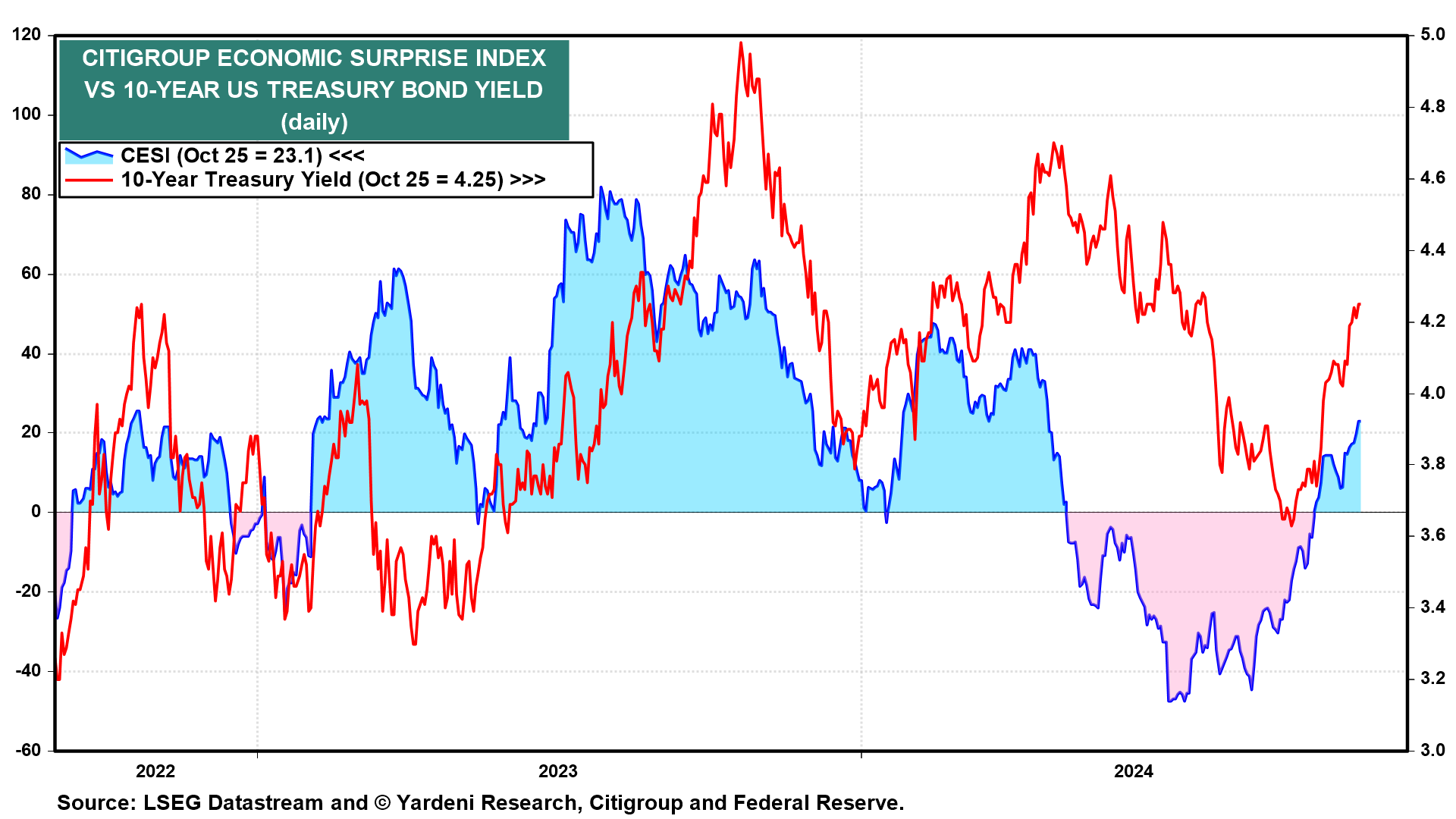

The week ahead is jampacked with key indicators for the labor market, economic growth, and inflation, as well as more Q3 S&P 500 earnings. The first estimate of Q3 GDP will be followed by the September PCED inflation rate and October payroll employment. We're expecting continued strong growth and disinflation, though we anticipate that employment was muddled by one-time factors and that some components of the Fed's preferred PCED inflation rate remained sticky. Additional strong economic data, stickier inflation, and more-than-expected Treasury financing needs could raise the 10-year Treasury yield into the 4.25% to 4.50% range (chart). That could unsettle the stock market.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a