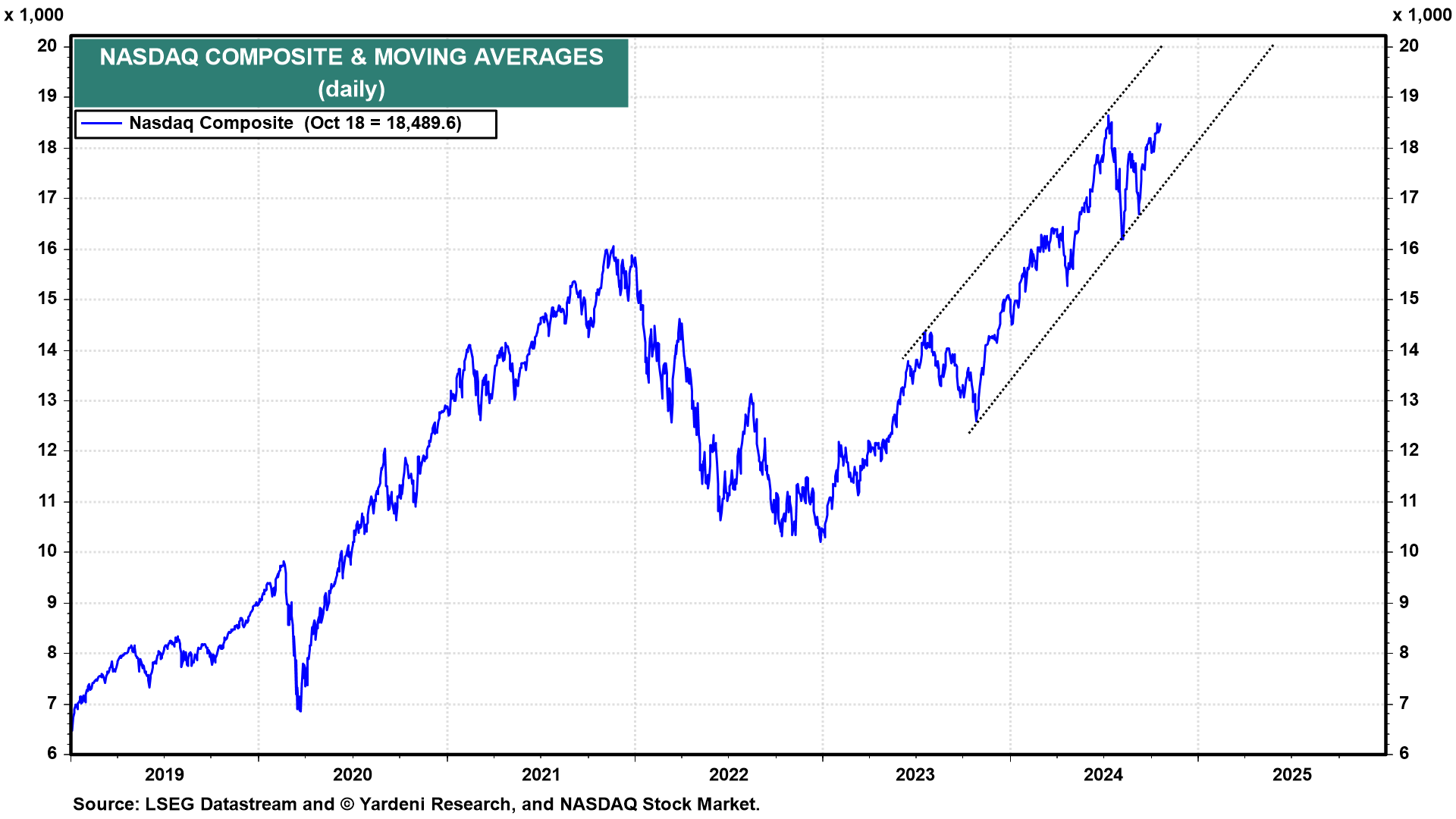

The economic week ahead will provide updates on the overall economy, manufacturing, and housing. Last week's jobless claims (Thu) will also be important for gauging how significant bad weather and worker strikes impacted the labor market. We expect more upside surprises during the current earnings season for Q3. The Nasdaq is likely to rise to a new record high before the end of the month and is currently on course to hit 20,000 before the end of May 2025 (chart).

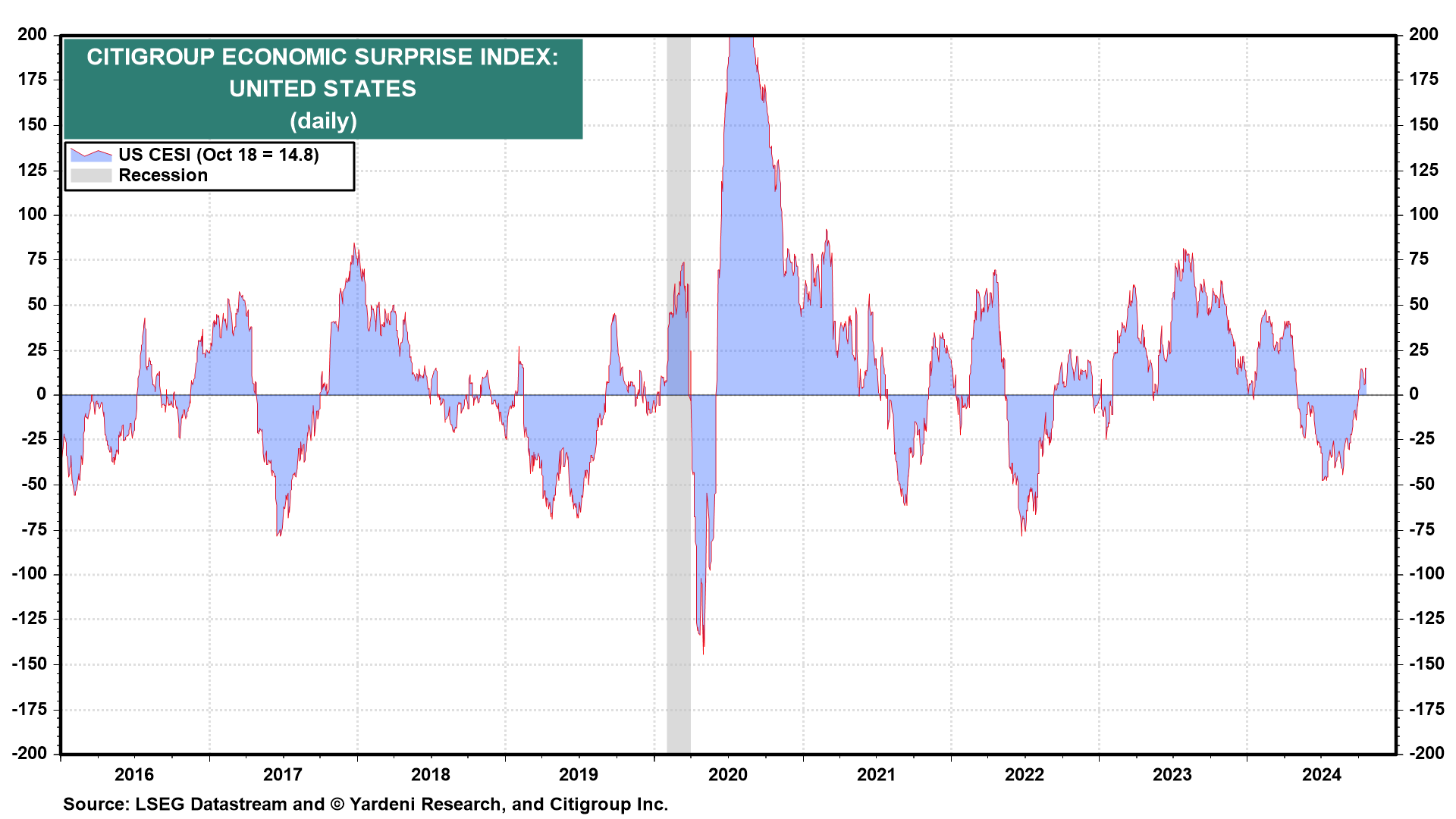

The S&P 500 closed last week at a new record high while the 10-year US Treasury was around 4.10%. Investors may be wondering how high bond yields can go before they weigh on stock prices. As long as bond yields are being driven higher by strong economic growth–as evidenced by the rising Citigroup Economic Surprise Index–stocks should benefit (chart). Rebounding inflation would be the scenario that raises bond yields and hurts stocks.

Let's assess the outlook for this week's major economic indicators:

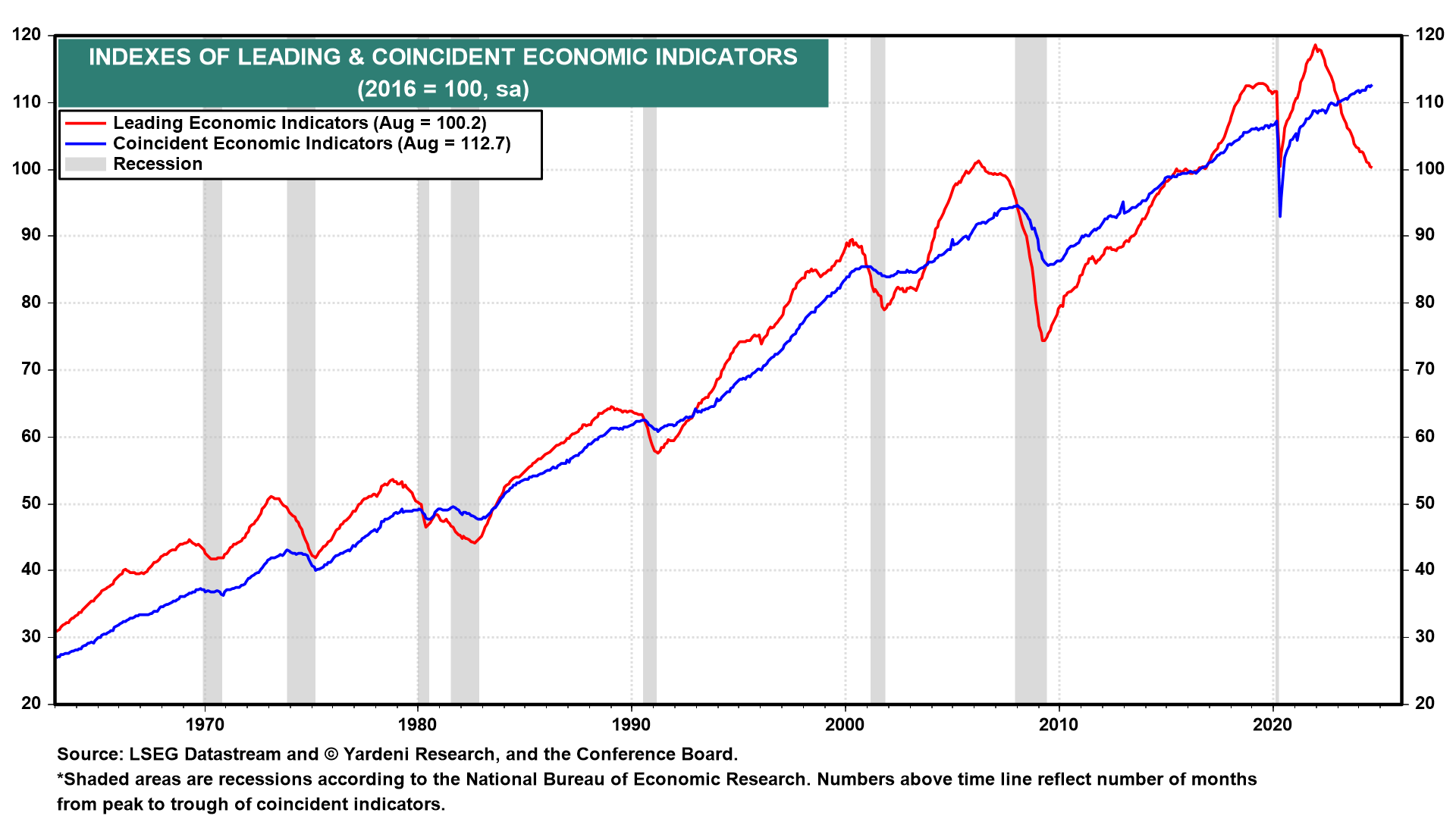

(1) Composite indexes. Strong growth in September's payrolls and retail sales should boost the Index of Coincident Economic Indicators (CEI) (Mon). However, industrial production was weak last month and will likely weigh on the CEI. According to the Federal Reserve, bad weather and worker strikes temporarily depressed production. So the CEI should remain on its uptrend to record highs. The Index of Leading Economic Indicators (LEI), on the other hand, likely continued to misleadingly predict a recession.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a