The blockbuster event in the week ahead is Tuesday's presidential election. We're rooting for gridlock, or a divided government. Both parties seem intent on passing policies which would widen the federal government budget deficit that's already too wide. Notwithstanding the stimulative outlook for fiscal policy, the Fed is widely expected to cut the federal funds rate (FFR) by 25 bps on Thursday to a range of 4.50% to 4.75%.

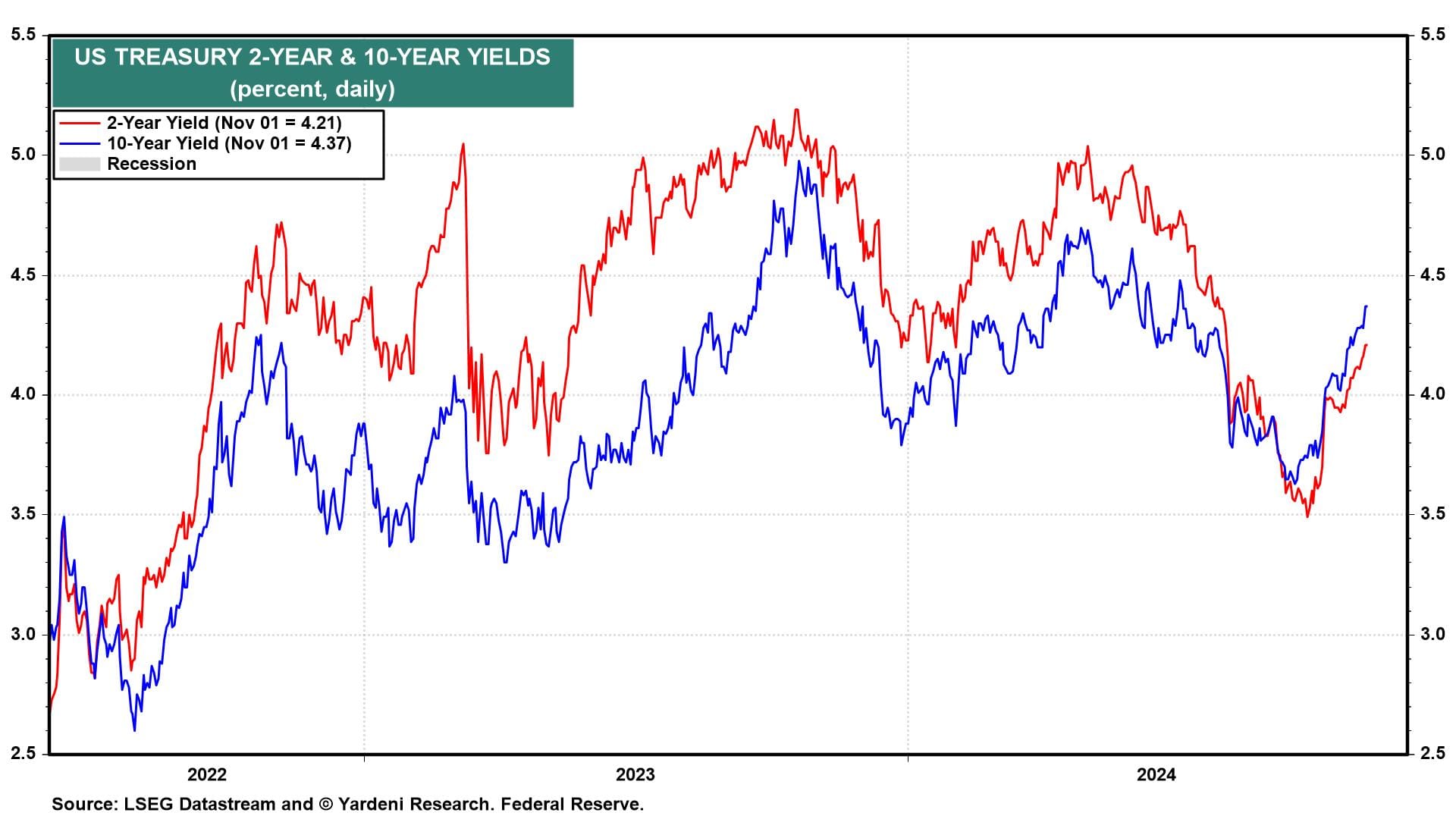

The Bond Vigilantes have been voting early (and voting often) by selling US Treasury notes and bonds. The 2- and 10-year Treasury yields are up 62bps and 75bps, respectively, since the Fed cut the FFR by 50bps on September 18 (chart).

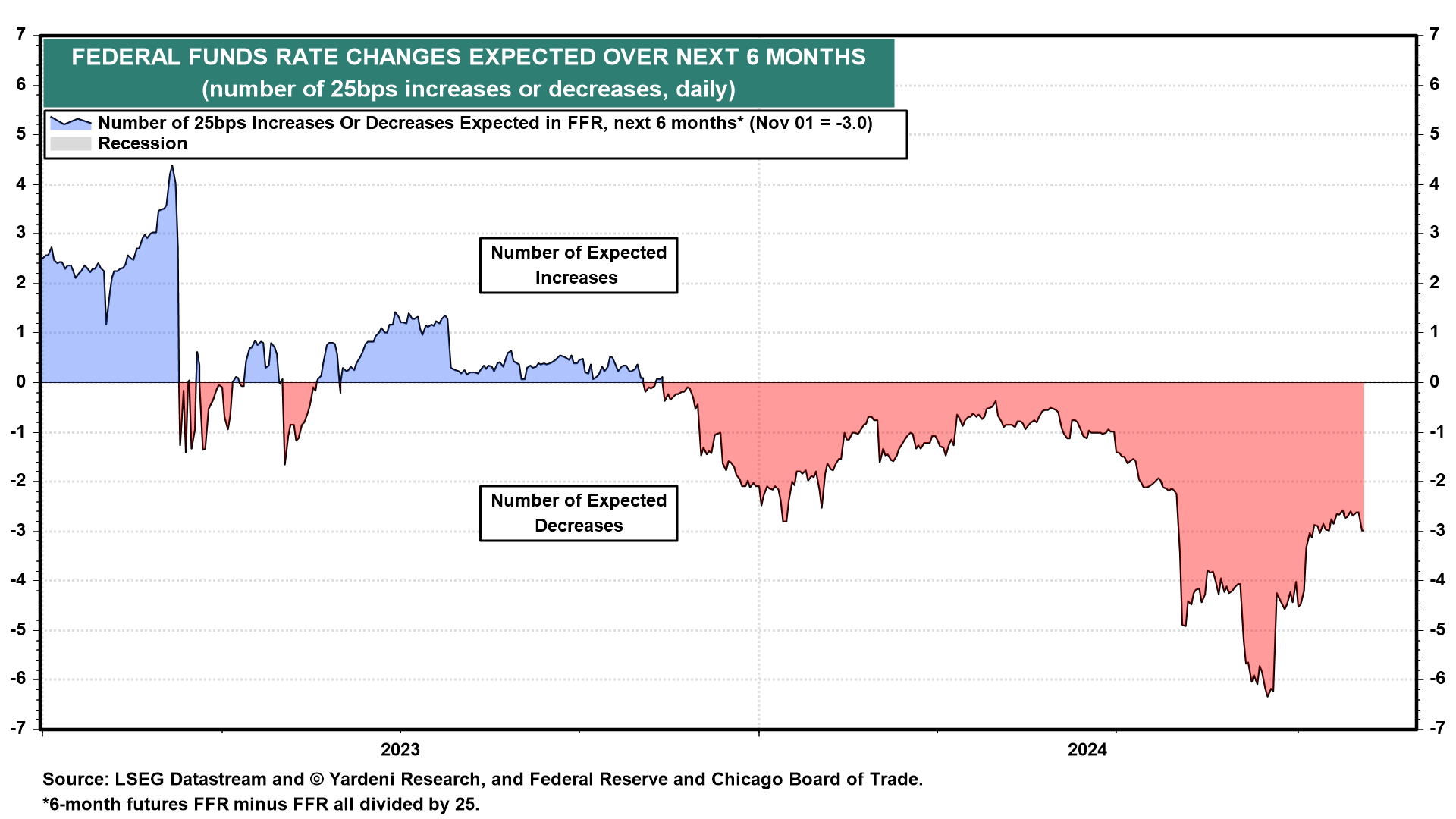

At his presser on Thursday, Fed Chair Jerome Powell might try to justify cutting the FFR again by pointing to the recent weak manufacturing PMI and payroll employment numbers and the falling PCED inflation rate. Bond yields might continue to rise in response, or they might fall if Powell signals that the Fed will pause further rate cuts to assess the strength of the economy. As of Friday, the FFR futures market expects three more 25bps cuts over the next six months (chart).

Here's what else we're watching this week:

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a