The week ahead will provide updates on inflation, consumer spending, and manufacturing. We expect inflation might have stalled in October, interrupting its decline toward the Fed's 2.0% target. We still expect a solid increase in inflation-adjusted incomes last month, which should fuel strong consumer spending. The goods sector likely remained depressed last month, especially as hurricanes and worker strikes weighed on manufacturing hours worked.

Here's what we're watching:

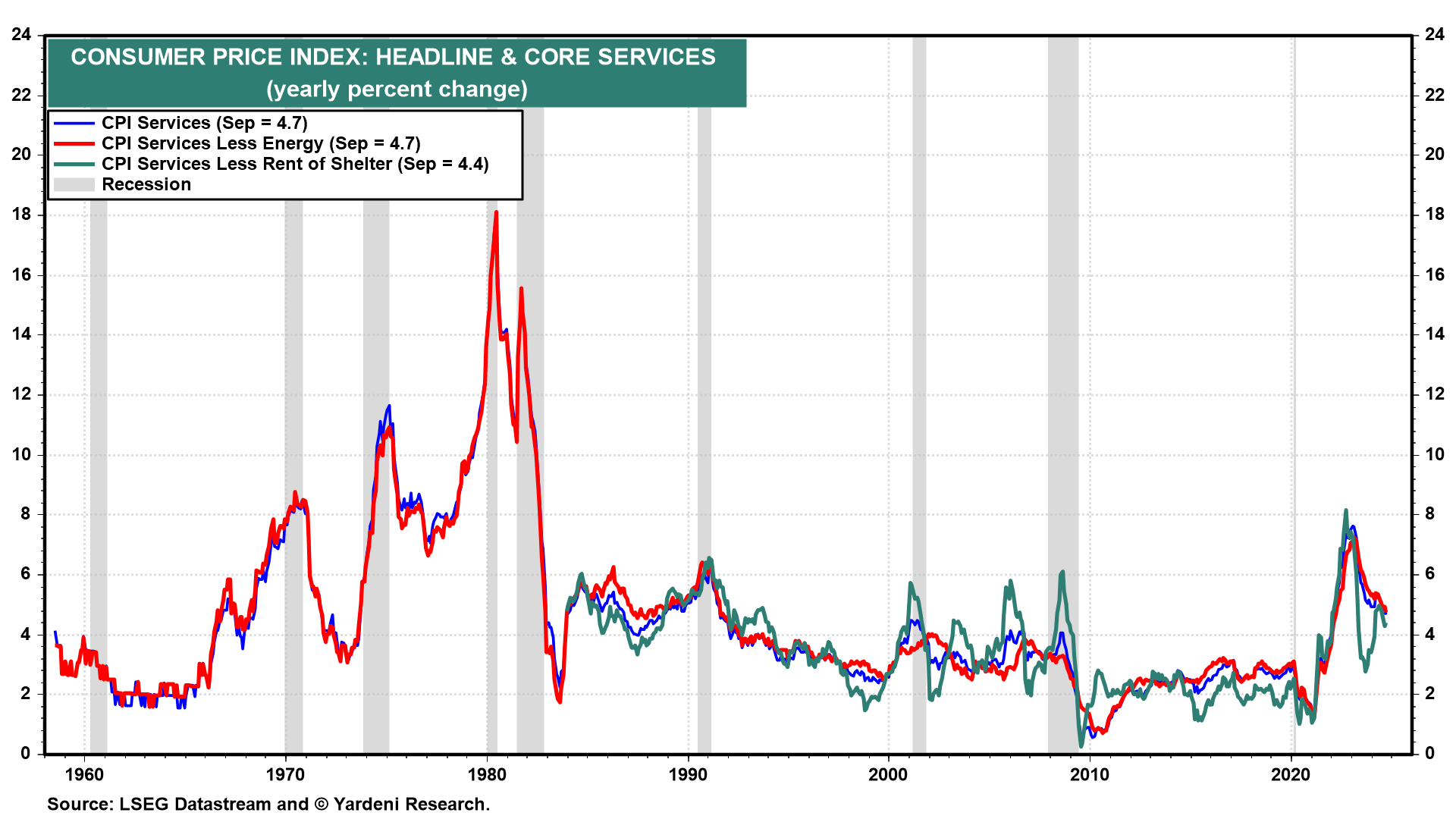

(1) Consumer inflation. October's CPI (Wed) should show that inflation stalled. The Cleveland Fed’s Inflation Nowcasting model projects that the headline and core CPI rose 2.56% and 3.34% y/y (0.18% and 0.27% m/m) last month. Weaker base effects (or lower y/y prints from a year ago) mean that monthly price changes will need to be weaker for disinflation to stay on track. The Fed has projected that the PCED inflation rate will reach 2.0% gradually over the next couple years, so bumps along the way may not disrupt the Fed's plan for further rate cuts.

Still, with CPI services inflation stuck around 4.5% y/y recently, the Bond Vigilantes may take matters into their own hands if overall inflation gets stuck somewhat higher than 2.0% (chart).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a