It's slim pickings this week on the US economic front. The news is mostly about credit conditions. Then again, earnings reporting season isn't over. And, we can always count on the members of the Federal Open Mouth Committee to make headlines now that their blackout period is over. Here is what we can expect from this week's credit market indicators:

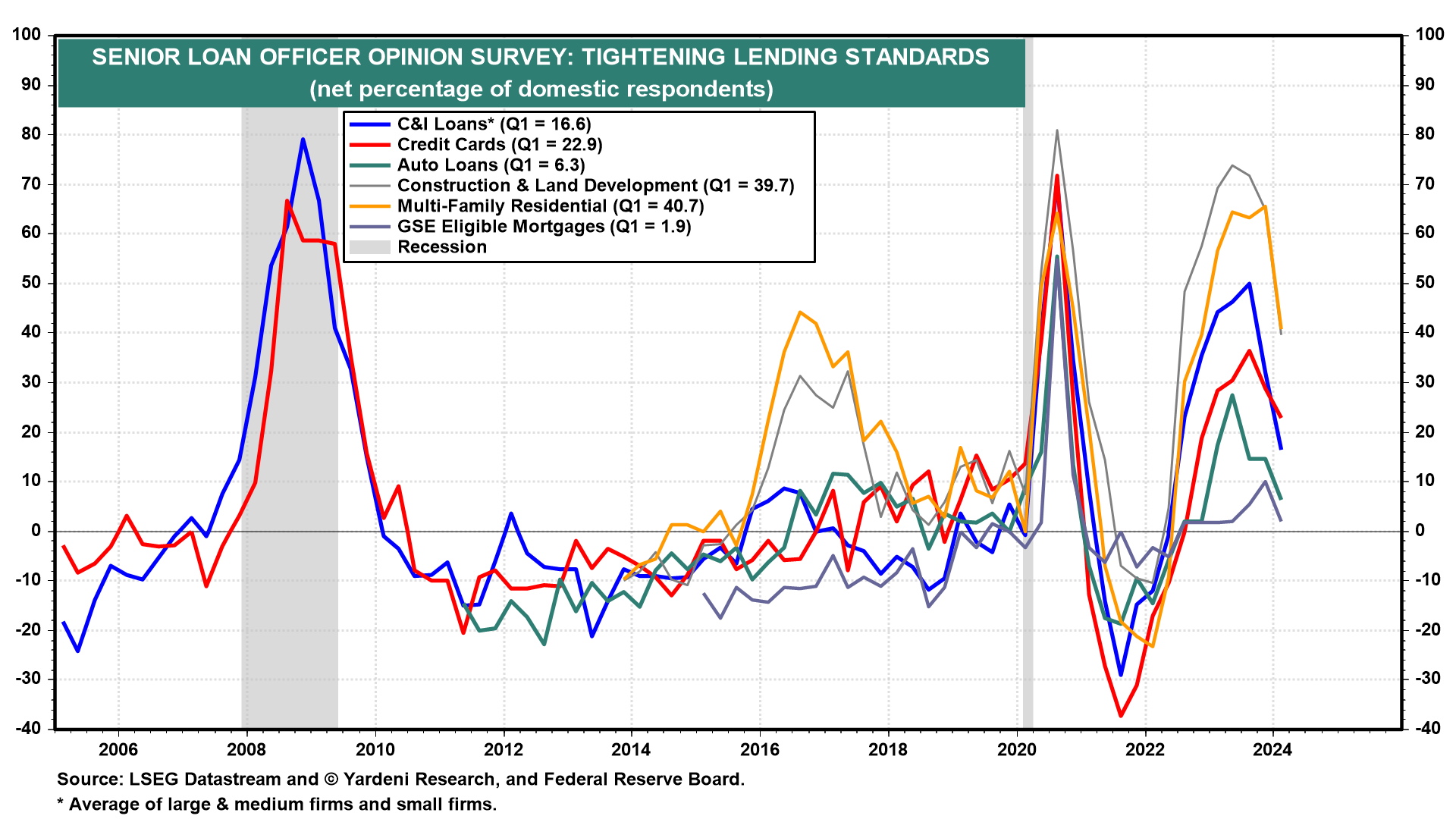

(1) Q2's Senior Loan Officer Opinion Survey (Mon) should show that fewer banks are tightening lending standards (chart). These series all peaked last year and fell sharply during Q1 of this year. Now that the Fed has finished tightening and with the economy still growing, credit conditions should continue to ease.

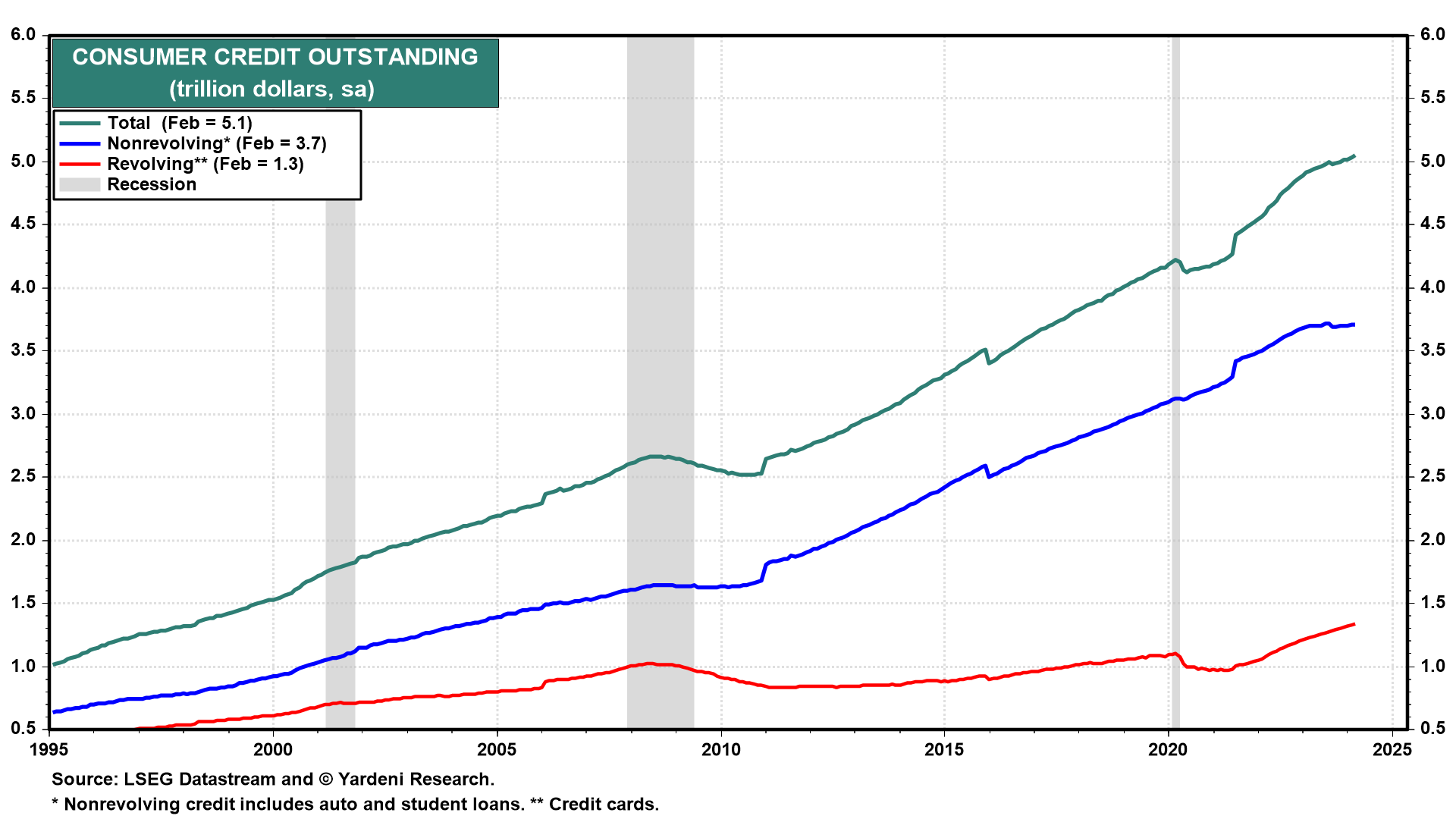

(2) March consumer credit (Tue) undoubtedly rose to yet another record high (chart). Consumer revolving credit is also at a record high raising fears that the delinquency rate will rise and force consumers to retrench, thus causing a recession. Consumer debt doesn't cause recessions, but it can certainly make them worse if consumers' debt burden is too high. Currently, the ratio of consumer revolving credit to disposable personal income is a relatively low 6.5%.

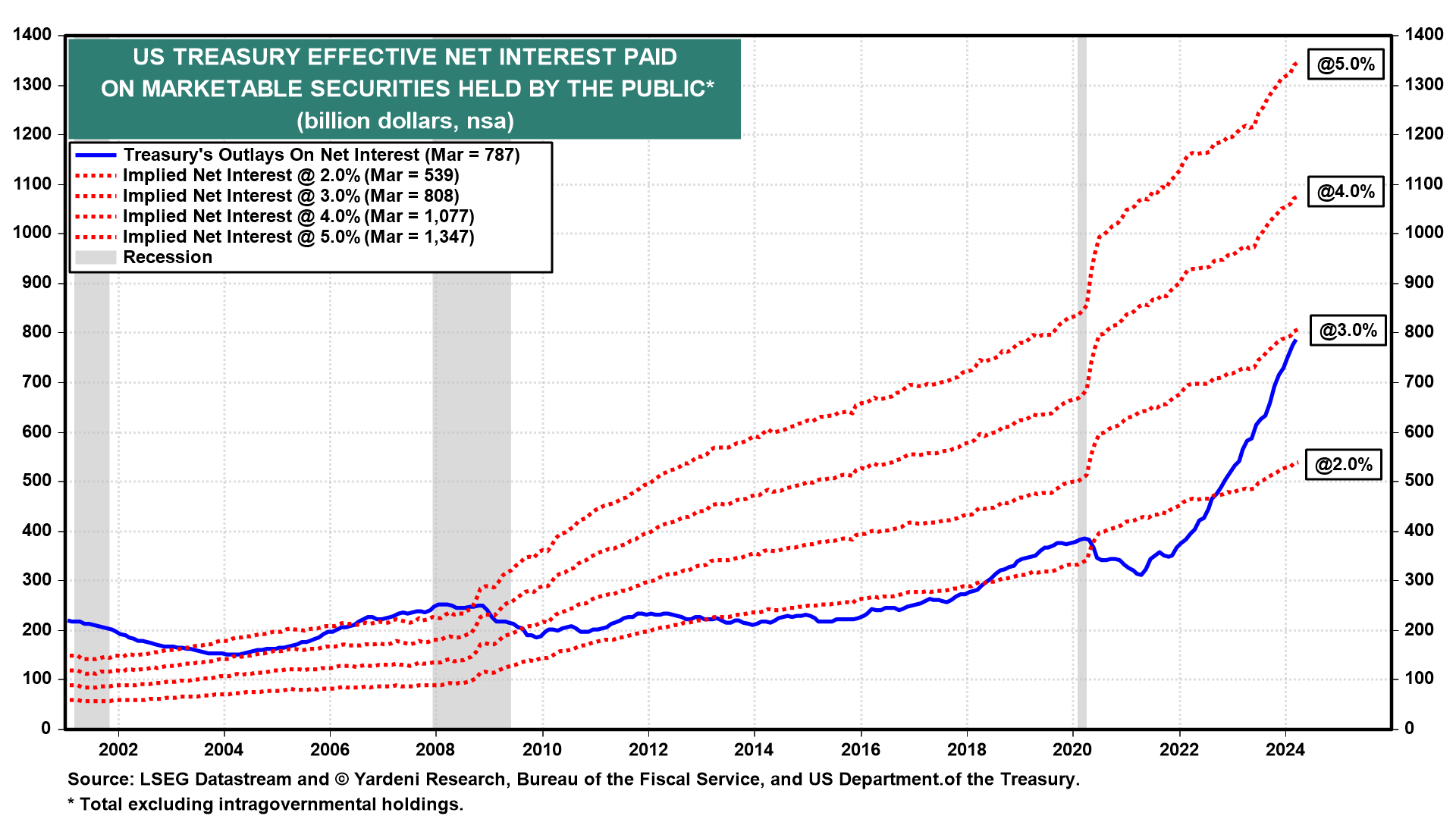

(3) April's federal government budget balance (Fri) will be a seasonal surplus, but the 12-month sum will show red ink totaling around $1.7 trillion. This deficit is increasingly bloated by the net interest paid by the federal government on its record amount of marketable debt held by the public, currently at $26.9 trillion (chart). The 12-month sum of net interest outlays rose to a record $787 billion during March, implying an average interest rate of 3.0%. This sum is likely to rise above $1.0 trillion by early next year as more of the maturing debt is refinanced at still higher interest rates.