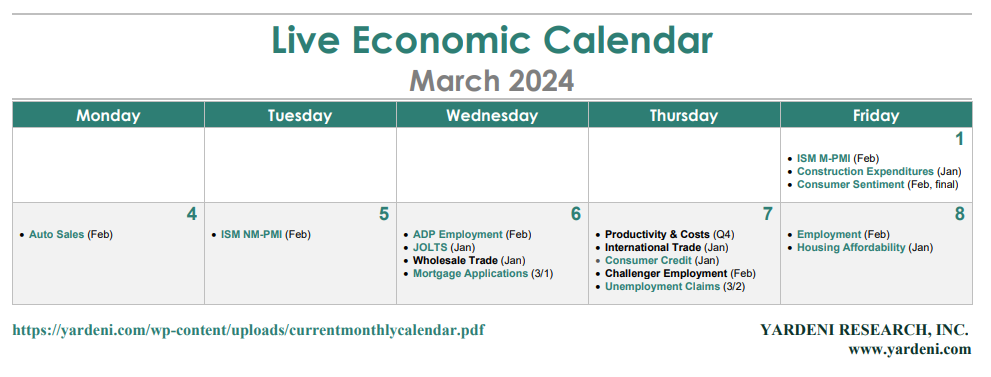

The week ahead is jampacked with employment indicators. We expect that January's JOLTS report (Wed) and February's employment report (Fri) will confirm that the labor market remains strong. That's based on weekly initial unemployment claims remaining just north of 200,000 in recent weeks and February's consumer confidence survey showing that 41.3% of respondents agreed that jobs are plentiful (chart). Bad weather depressed average weekly hours worked during January. It undoubtedly rebounded last month.

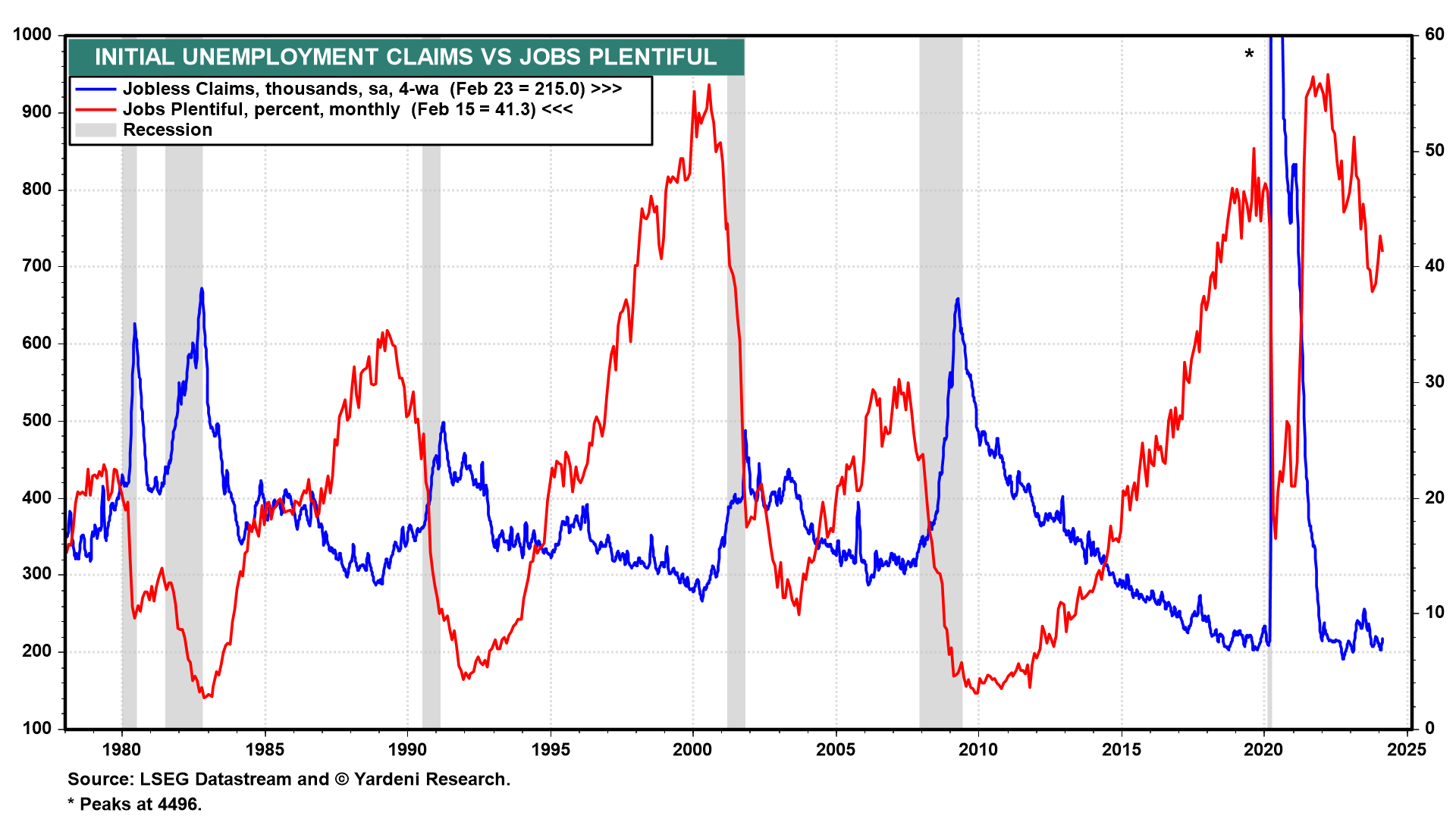

Wage inflation should continue to moderate in February's employment report, but remain relatively high around 4.0%-4.5% (chart). Concerns about wage inflation should be mitigated by Q4's revised productivity report (Thu). It should show that productivity growth remained strong during the last three quarters of 2023.

Causing more angst among investors, particularly those who are prone to be pessimistic, will be January's consumer credit report (Thu). It is likely to show that consumer credit rose to another record high. Personal nonmortgage interest payments rose to a record $573 billion (saar) during January (chart). On the other hand, consumers earned a record $1.83 trillion (saar) during January. High interest rates are having a mixed effect on cosnumers.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a