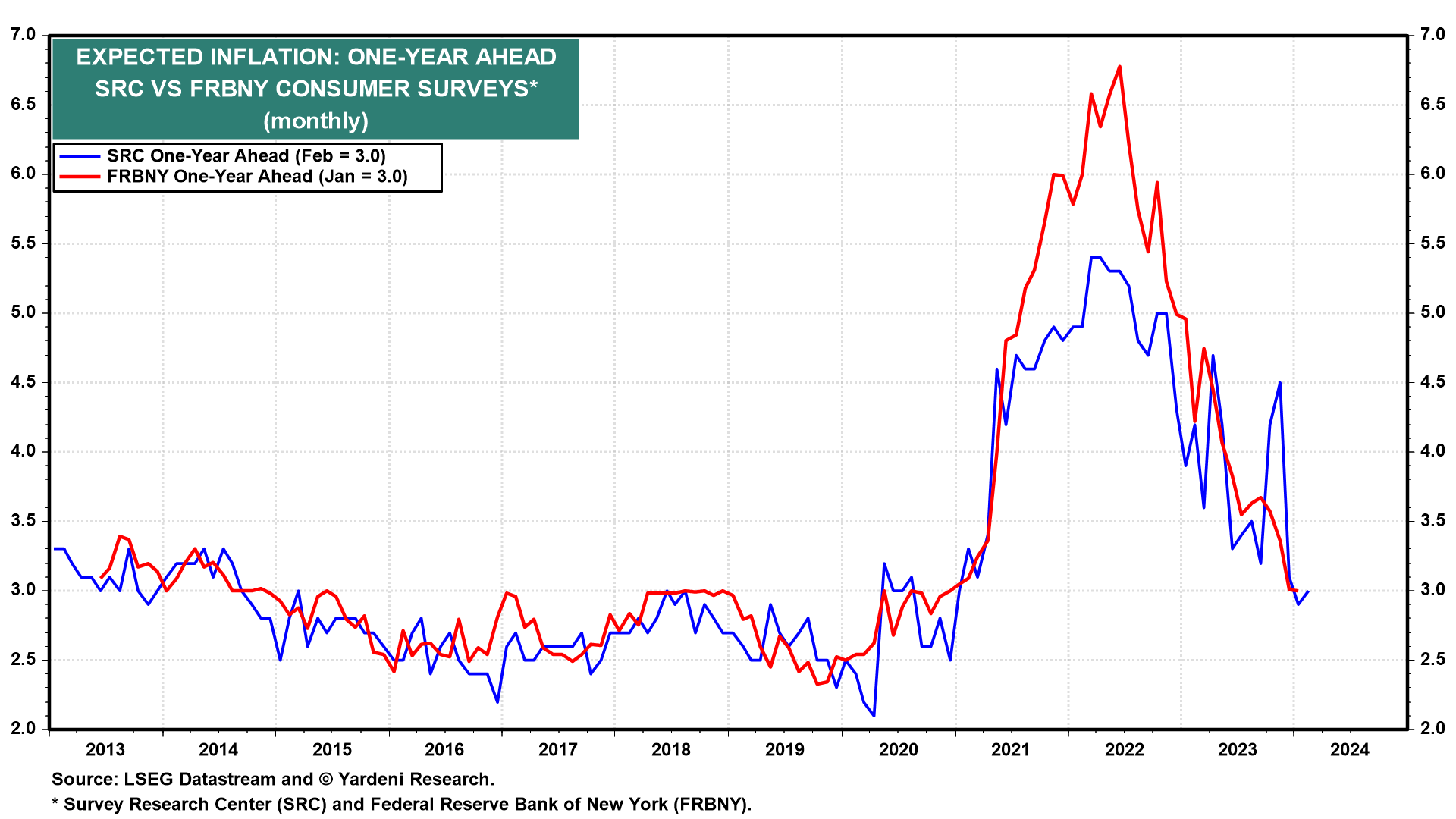

The coming week starts with a couple of key inflation indicators. Both were probably boosted by rising gasoline prices. The retail pump price is up 9.1% since the last week of January. This bounce might have boosted February's reading on the year-ahead expected inflation rate in the FRBNY consumer expectations survey (Mon). It did so, though only slightly, in a similar series from February's SCR consumer survey (chart).

More important for the bond and stock markets will be February's CPI release (Tue). The Cleveland Fed's Inflation Nowcasting shows gains in the headline and core CPI inflation rates of 0.43% and 0.32%. The former reflects the upturn in gasoline prices (chart). Food inflation should be continuing to moderate along with agricultural commodity prices. February's import prices release (Fri) should show that China continues to export goods deflation to the US and the rest of the world.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a