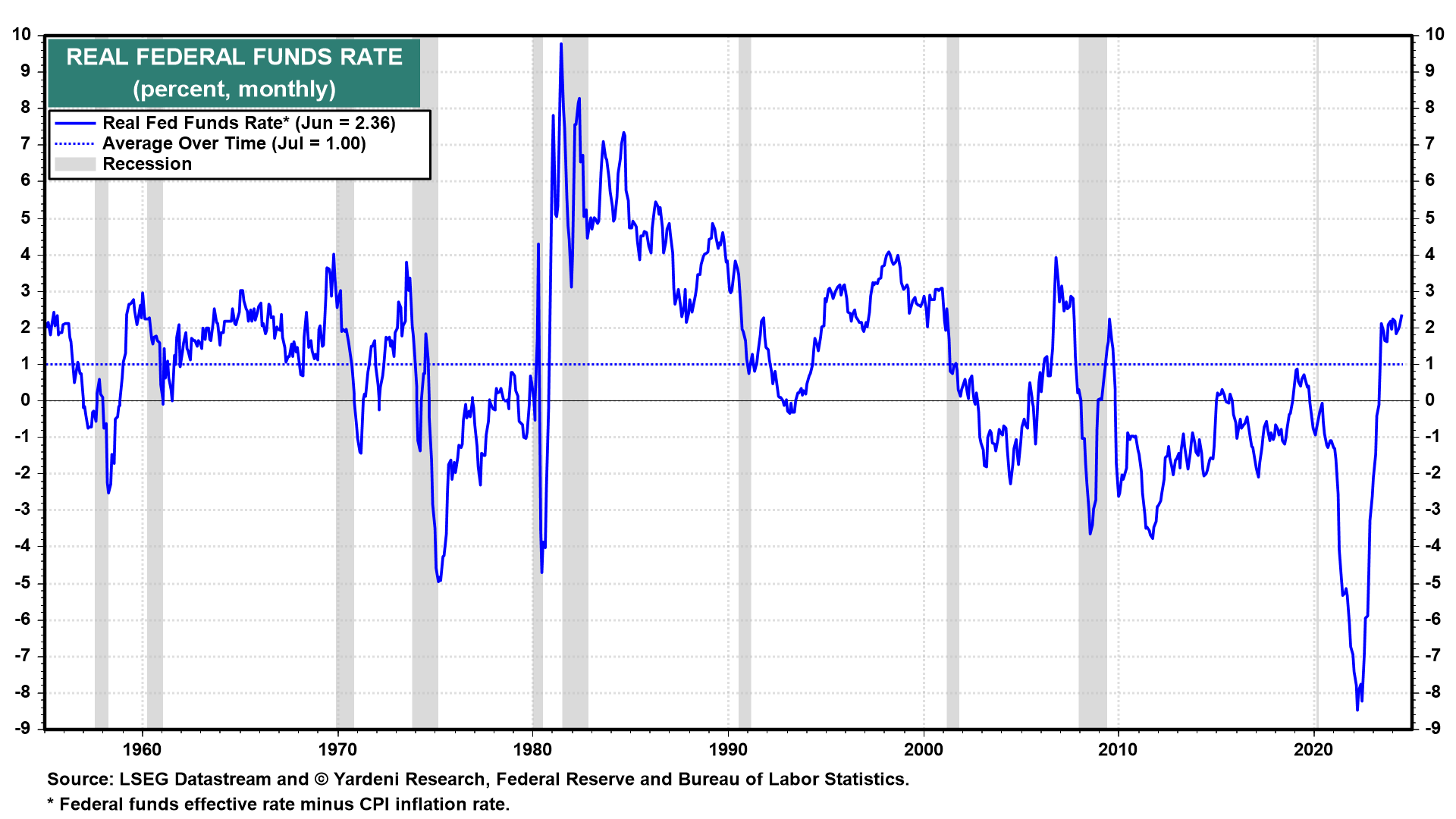

The week ahead is packed with economic indicators, but all eyes will be on the Fed's interest rate decision on Wednesday and payroll employment on Friday. We don't expect the Fed will alter the stance of monetary policy at the July meeting, but Fed Chair Jerome Powell could signal that a September cut to the federal funds rate (FFR) is likely. That's because as consumer inflation has fallen, the real FFR has risen (chart).

We don't subscribe to this view of measuring the restrictiveness of monetary policy, but won't ignore it since many Fed officials use it as a barometer. It's possible that the Fed holds back any signals of a policy pivot until the Jackson Hole symposium in late August. Here's what we're expecting in the week ahead:

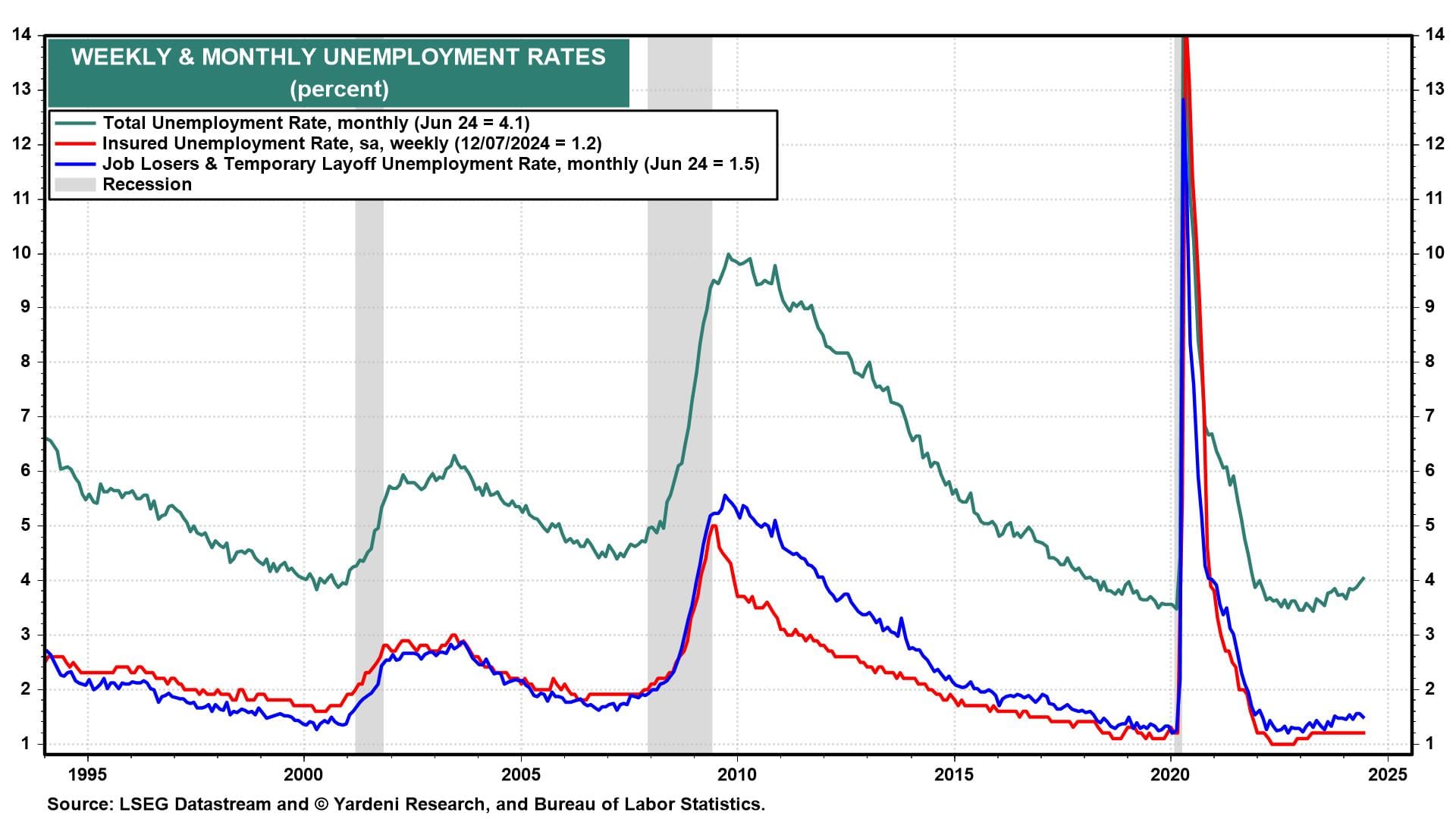

(1) Employment. July's employment report (Fri) should show payrolls rose by 150,000-200,000 to another record high. Still, there's a decent chance the unemployment rate ticked higher to 4.2% in July. We wouldn't be concerned as rising unemployment has been fueled by a growing labor force rather than job losses (chart).

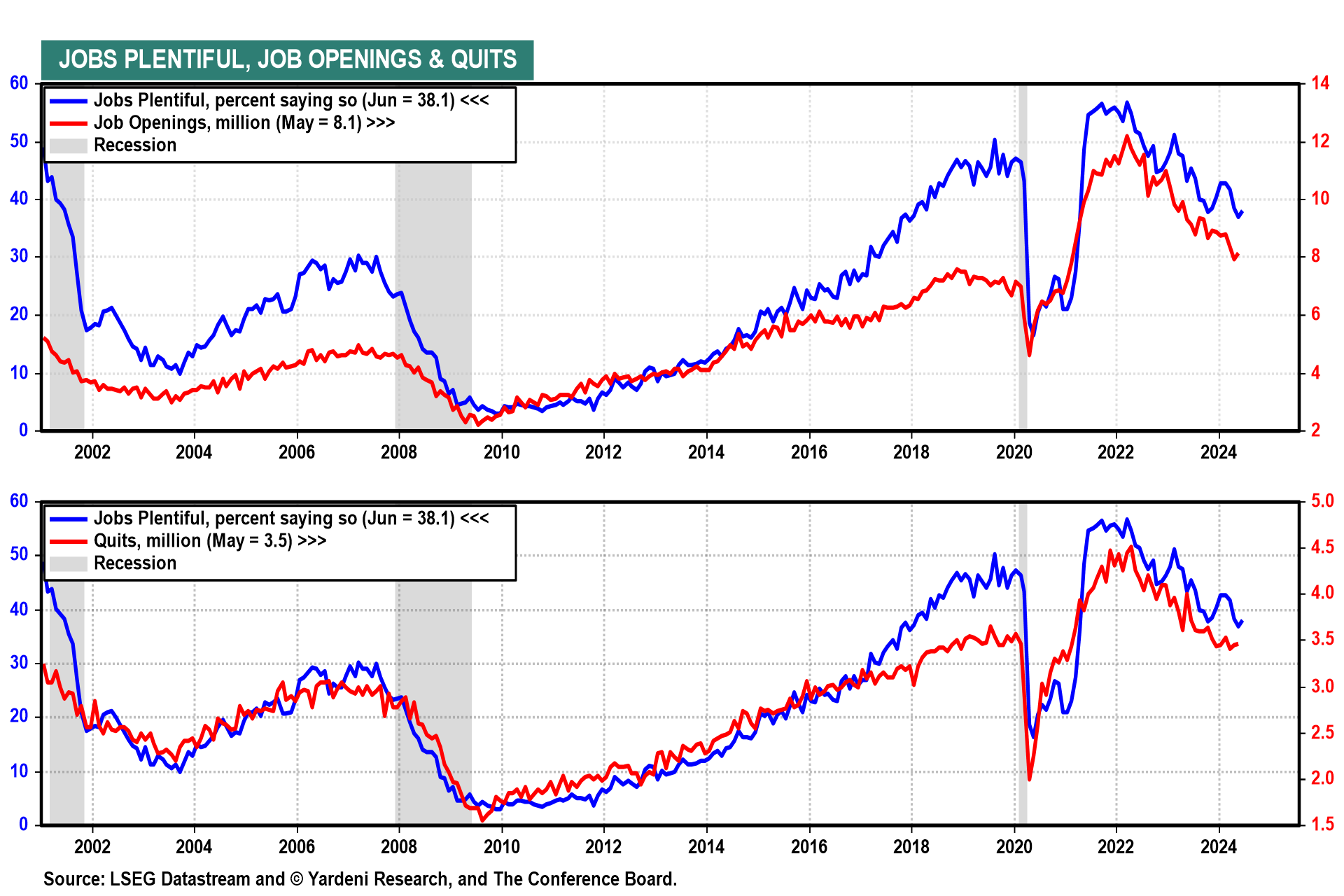

June's JOLTS report (Tue) will likely show job openings and quits remain historically high even as they fall from pandemic peaks. These series, which lag other labor market indicators by about a month, are highly correlated with the jobs-plentiful series in the Consumer Confidence survey (Tue).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a