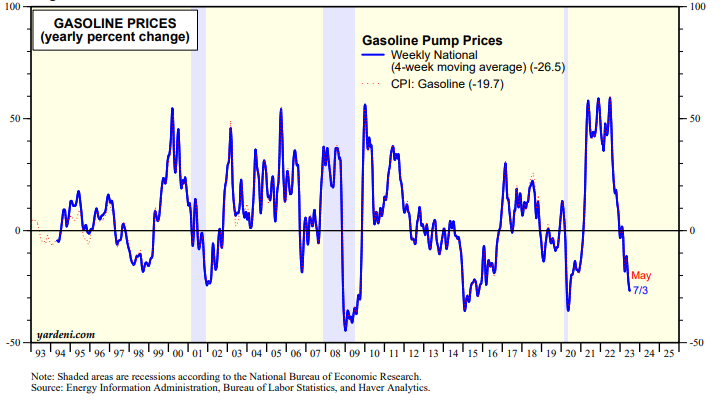

This week is jampacked with June's inflation indicators. On balance, they should show that inflation continues to moderate. On Monday, the FRBNY survey of consumer inflationary expectations should decline from May's 4.1% for the one-year-ahead and 3.0% for the three-years-ahead readings. The price of gasoline has a big impact on these expectations, and it was down 26.5% y/y during the four weeks through July 3 (chart).

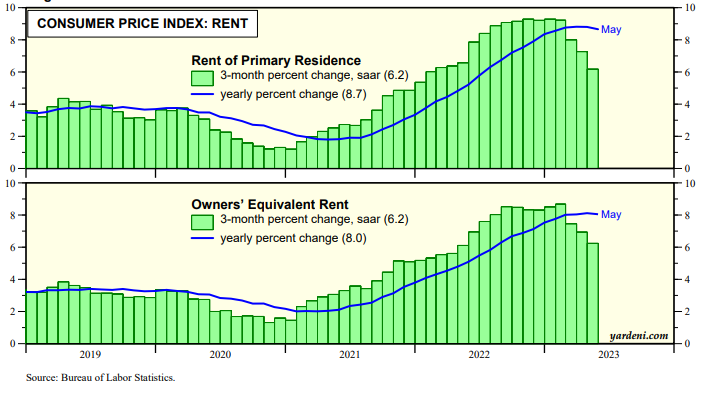

On Wednesday, the CPI inflation rate should show more moderation in the rent index. It was 8.7% y/y in May, The Zillow index was down to 4.8% in May and the Apartment List index was down to 1.7% in April. The 3-month annualized CPI rent inflation rates suggest that the y/y comparisons have peaked (chart).

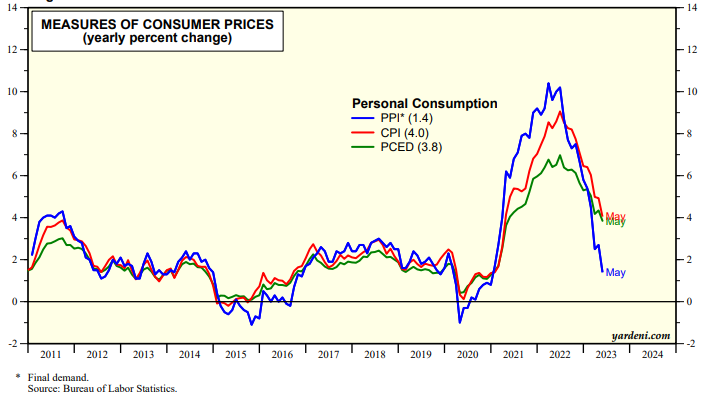

May's final demand PPI for personal consumption, which does not include rent, was down to 1.4% y/y suggesting more downward pressure on the CPI, which rose 4.0% in May (chart).

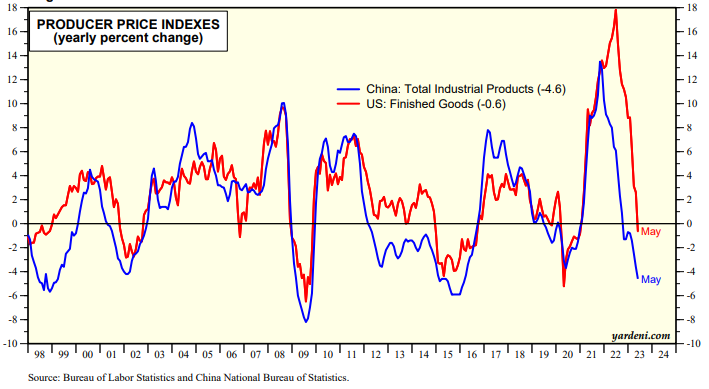

Thursday's PPI inflation rate for June might surprise to the downside. The US PPI for finished goods inflation has been highly correlated with China's PPI for industrial products inflation (chart). In May, the former was -0.6% while the latter was -4.6%. China's weak post-pandemic recovery may be deflationary for the global economy.

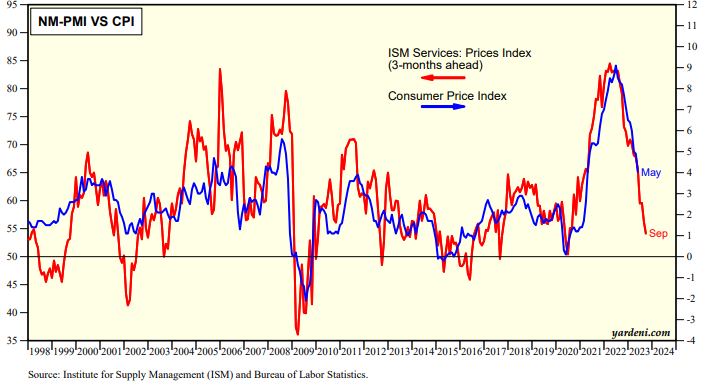

Here's more: The CPI inflation rate is highly correlated with the ISM non-manufacturing prices-paid index pushed ahead by three months and suggests that the former could drop to 1.0% by September (chart)!