Last week had plenty of indicators that allowed us to assess the latest readings on US inflation: It is continuing to moderate. This week has plenty of reports that will allow us to assess the strength of the economy: They are likely to show some mixed readings for the goods sector.

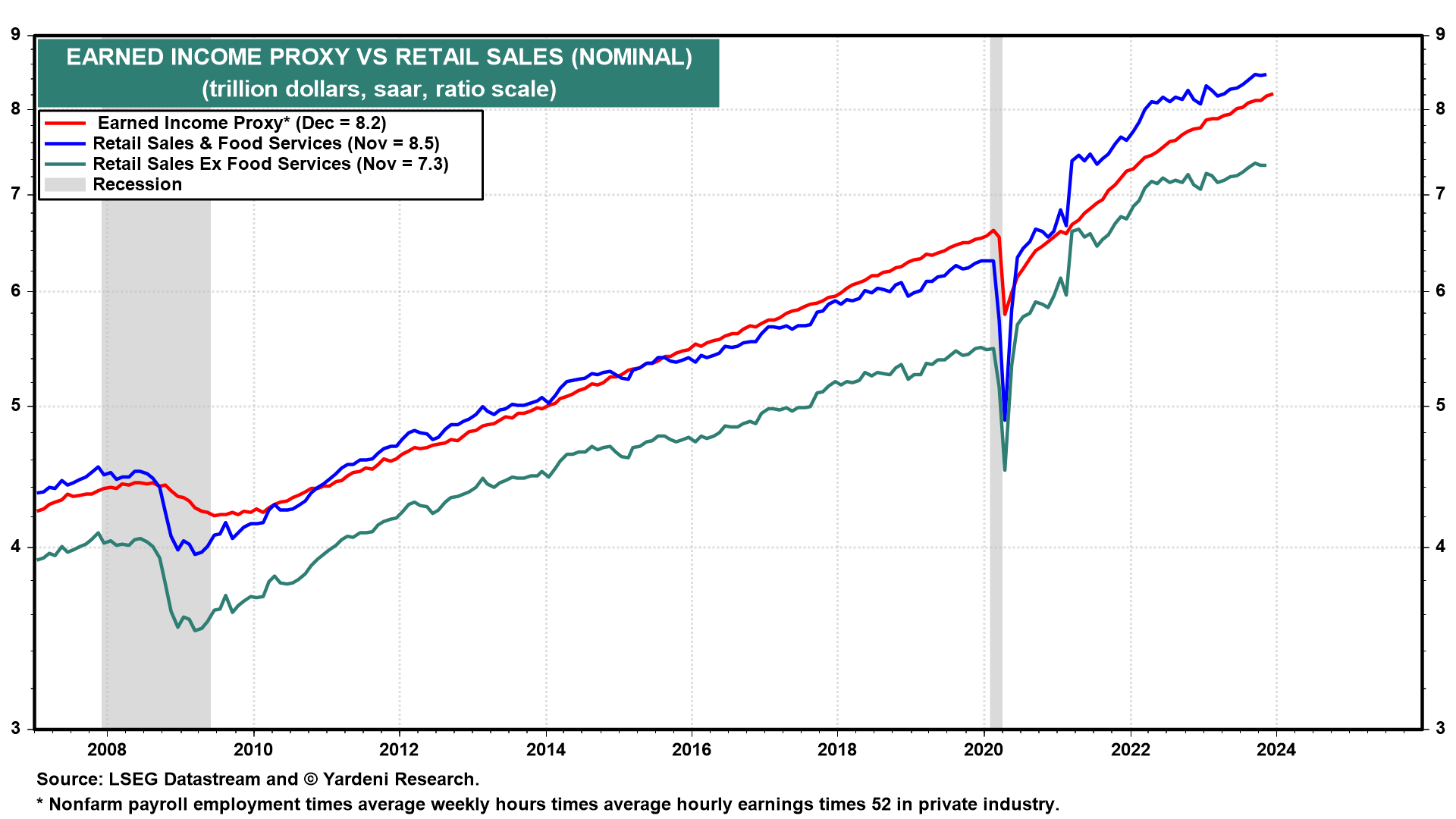

Most important will be December's retail sales (Wed). We know that aggregate hours worked fell 0.2% m/m, while average hourly earnings rose 0.4% during the month. So our Earned Income Proxy for private wages and salaries edged up by just o.2% in nominal terms and fell 0.1% in real terms (since the headline CPI for all goods and services was up 0.3%). That augurs for a weak increase in nominal retail sales (chart). However, keep in mind that the CPI for goods fell 0.8% m/m and 1.2% m/m excluding food. So real retail sales could actually boost Q4's real GDP growth rate.

The index of aggregate weekly hours in manufacturing decreased 0.2% m/m during December suggesting that industrial production (Wed) also ticked down last month (chart). We think that the rolling recession for goods producers and distributors will turn into a rolling recovery in coming months. January's business surveys conducted by the New York Fed (Tue) and Philly Fed (Thu) should confirm their recent signs of bottoming.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a