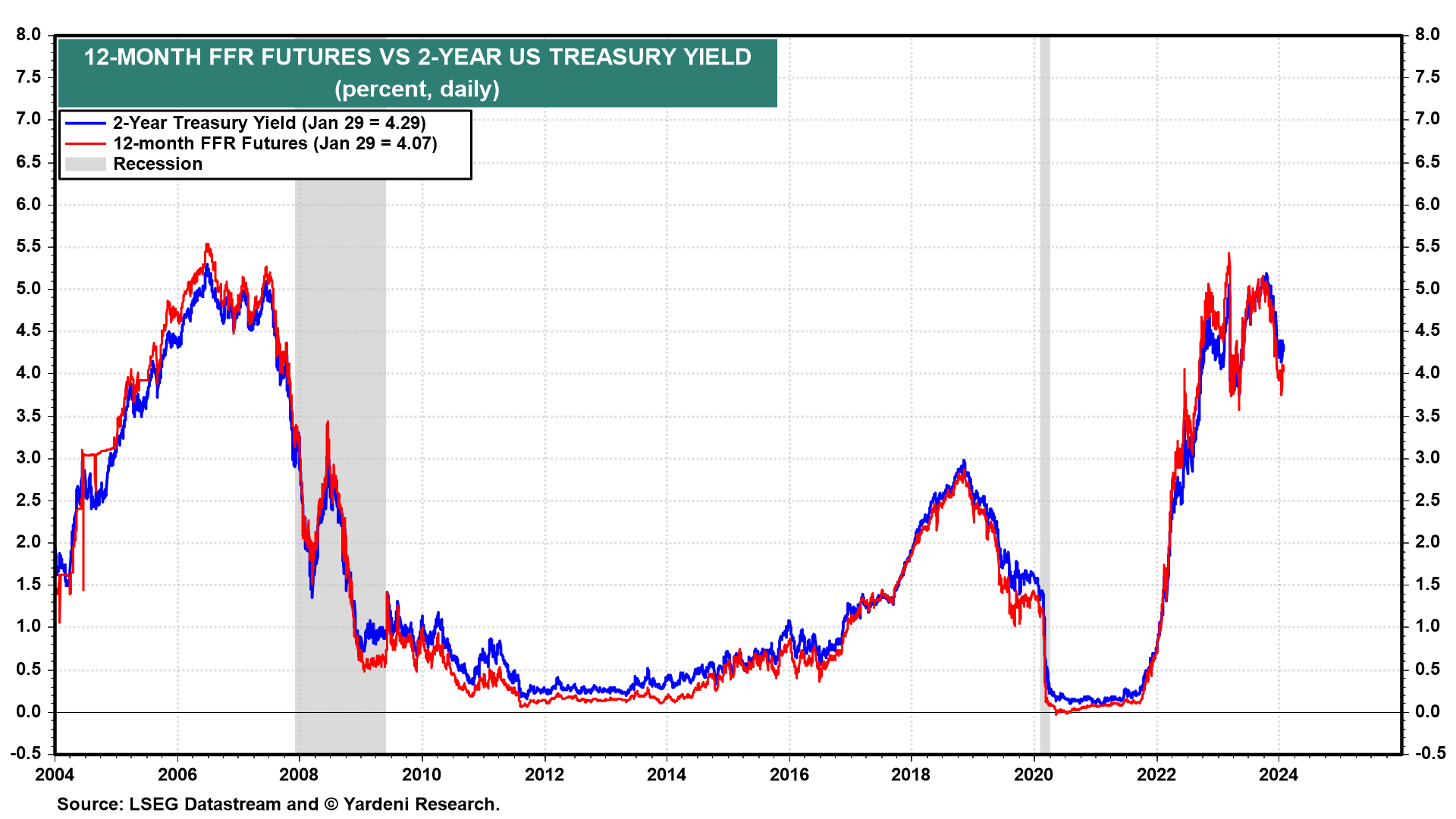

Now that the latest meeting of the Federal Open Mouth Committee is over, we can expect lots of chatter from its members. They are likely to echo Fed Chair Jerome Powell's comments in his presser last Wednesday. In essence, he said that the Fed is done raising the federal funds rate further, but is in no rush to lower it either. According to the 12-month federal funds rate futures, this market still expects five rate cuts this year (chart). So Fed officials are likely to continue to push back against that notion of so much cutting.

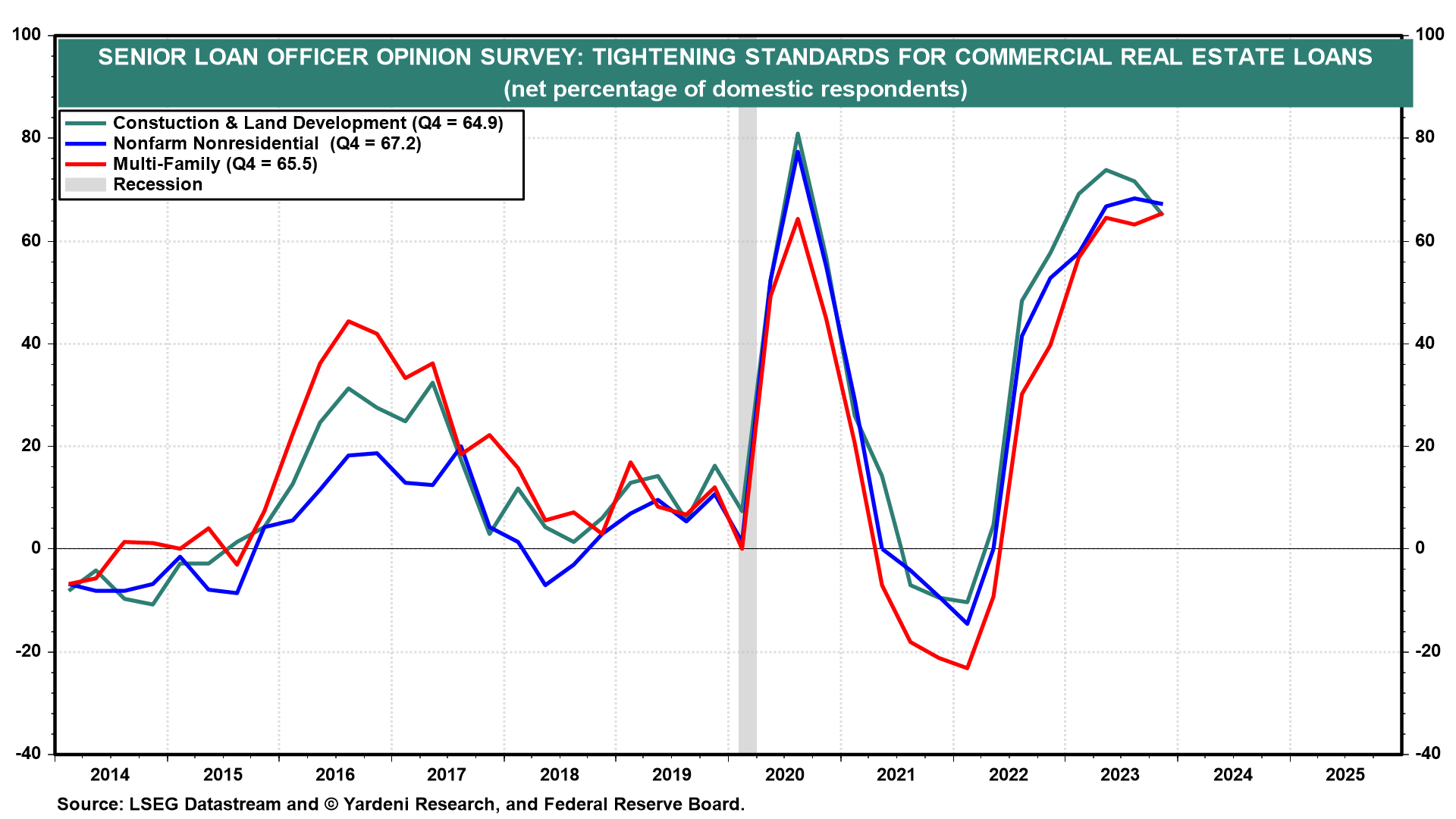

The second week of each month tends to be light on economic indicators. This one starts with Q1's Senior Loan Officer Opinion Survey (SLOOS) on bank lending. It is likely to show that lending conditions have eased a bit for commercial and industrial loans and home mortgages, but tightened for consumer credit and commercial real estate loans (chart).

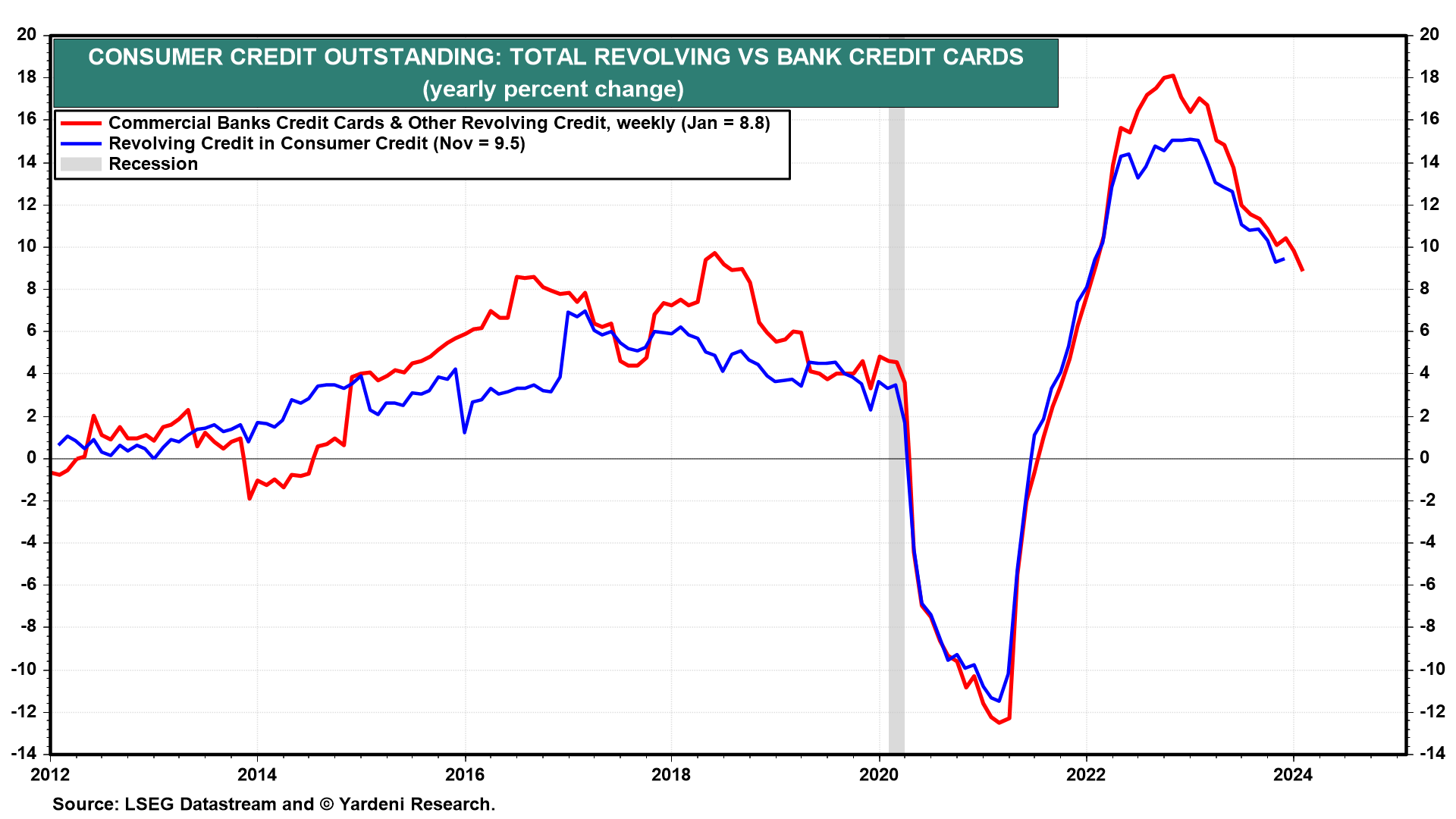

December's consumer credit report (Wed) should show some slowing of revolving credit growth, according to the comparable weekly series for such lending by the commercial banks (chart).

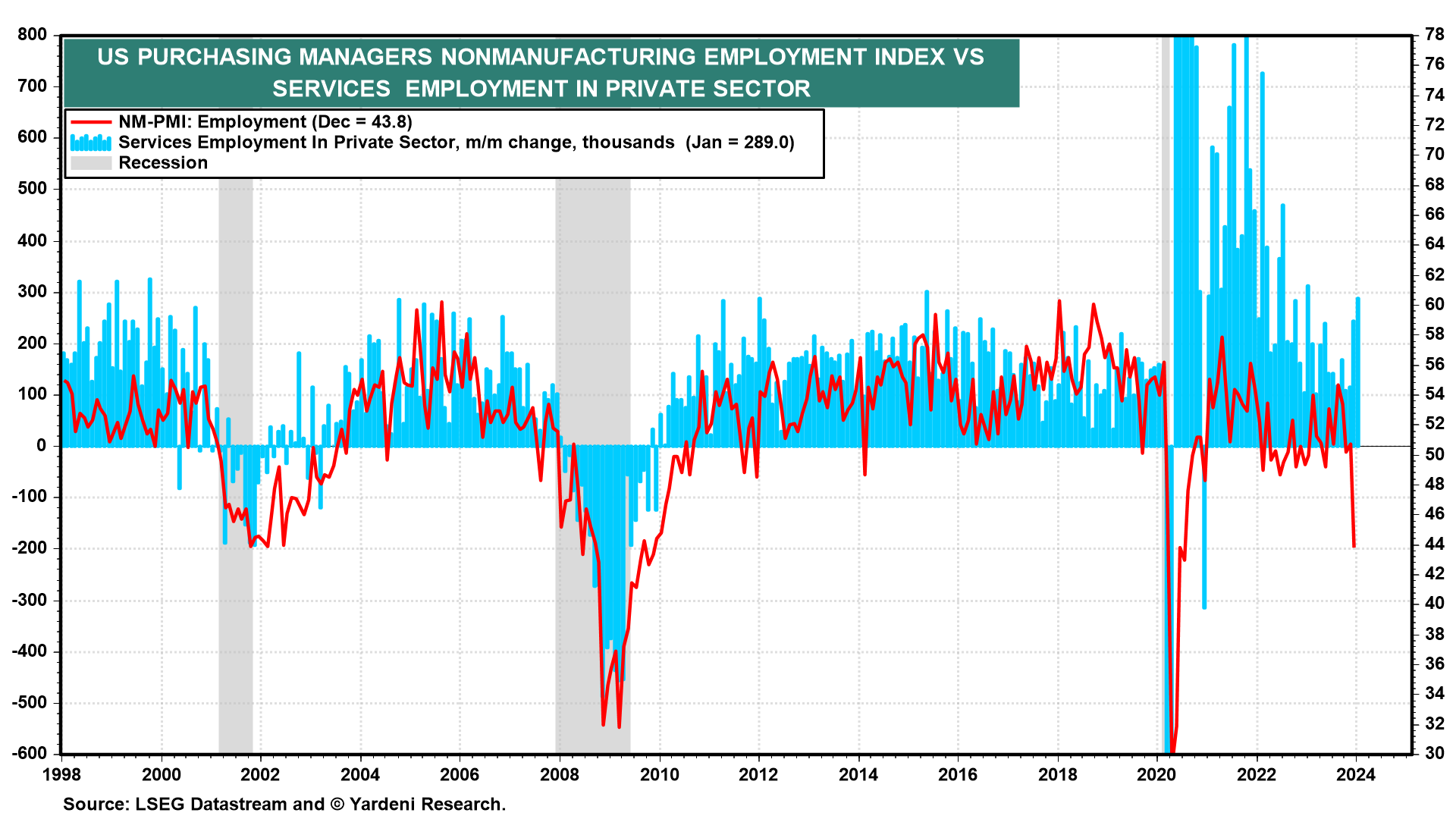

January's ISM NM-PMI report (Mon) should show some improvement. December's weakness was extremely misleading. The index fell to a relatively low reading of 50.5 led by a plunge in its employment sub-index to 43.8 (chart). In fact, payroll employment in the services sector soared by a whopping 534,000 during December and January! On balance, the economic calendar shouldn't move the needle much in either the stock or bond markets.