The week ahead is relatively light in terms of economic reports. It's also light on talking Fed heads. But, we won't be surprised if one or two of them pops up on CNBC. We think they might push back against the rate-cut mob that is calling for a 50bps cut in the federal funds rate in September. It would be a shame if they joined in the recession hysteria since financial markets are on edge after the surge in market volatility on Friday.

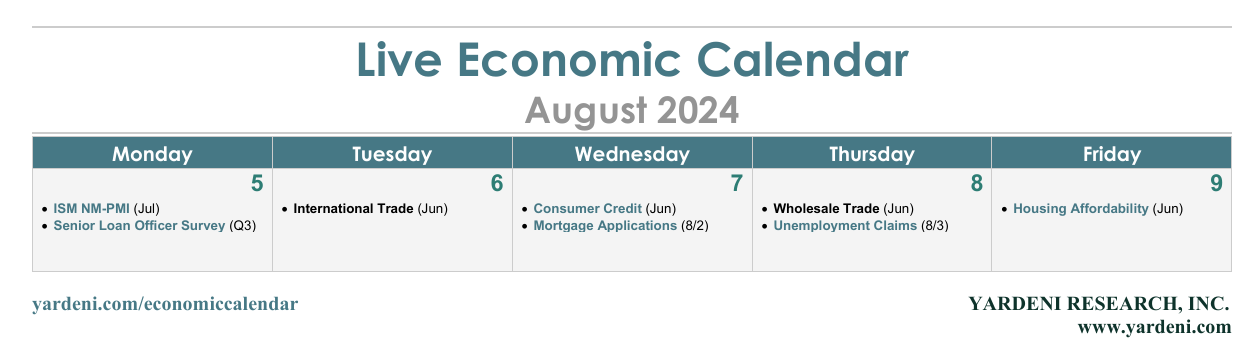

The weekly unemployment claims report (Thu) will likely be the most important one. Markets will look for confirmation of last week's reports that the labor market is substantially slowing. We don't think they'll get it. Here's what we're watching:

(1) Unemployment claims. Initial claims (Thu) increased by 14,000 to 249,000 (sa) in the week ended July 27–within striking distance of 250,000. We still don't expect claims to breach that level. Continuing claims rose by 33,000 to 1.88 million in the week ended July 20 (chart). We expect to see that both fell in Thursday's report.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a