This week is packed with July's composite cyclical indicator releases which should ease fears that economic growth might be too strong given that real GDP is tracking at 4.1% (saar) for Q3 currently. That's quite a reversal from a few months ago when there were widespread fears of a recession. Consider the following:

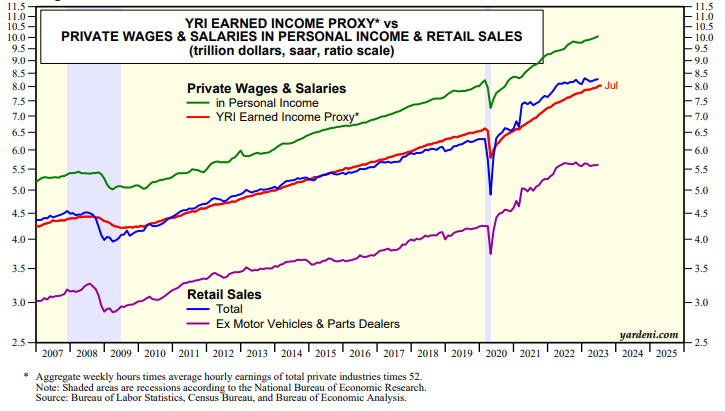

(1) The YRI Earned Income Proxy for private-industry wages and salaries in personal income rose just 0.2% in July the same increase as in the CPI. So real wages were flat last month suggesting that inflation-adjusted retail sales (Tue) was also flat (chart). Industrial production (Wed) was probably also flat in July since aggregate weekly hours in manufacturing was flat.

This is all consistent with our view that the goods sector has been in a rolling recession since late 2021. However, we are expecting signs of a rolling recovery in the Fed's regional business surveys out this week for NY (Tue) and Philly (Thu).

July's LEI and CEI (Thu) should show that the former is still falling, while the latter has been flat for the past two months. The hard-landers will undoubtedly take some comfort from these numbers.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a