The big event of the coming week will occur on Friday at 10:00 am EDT, when Fed Chair Jerome Powell will address the annual global central banking conference in Jackson Hole, Wyoming. Nothing much has changed since his press conference on July 27 other than that the S&P 500 is 7.8% higher. So he is likely to signal another rate hike in late September aimed at moderating inflation, which may have peaked but remains too high. Here's more of what's ahead this week:

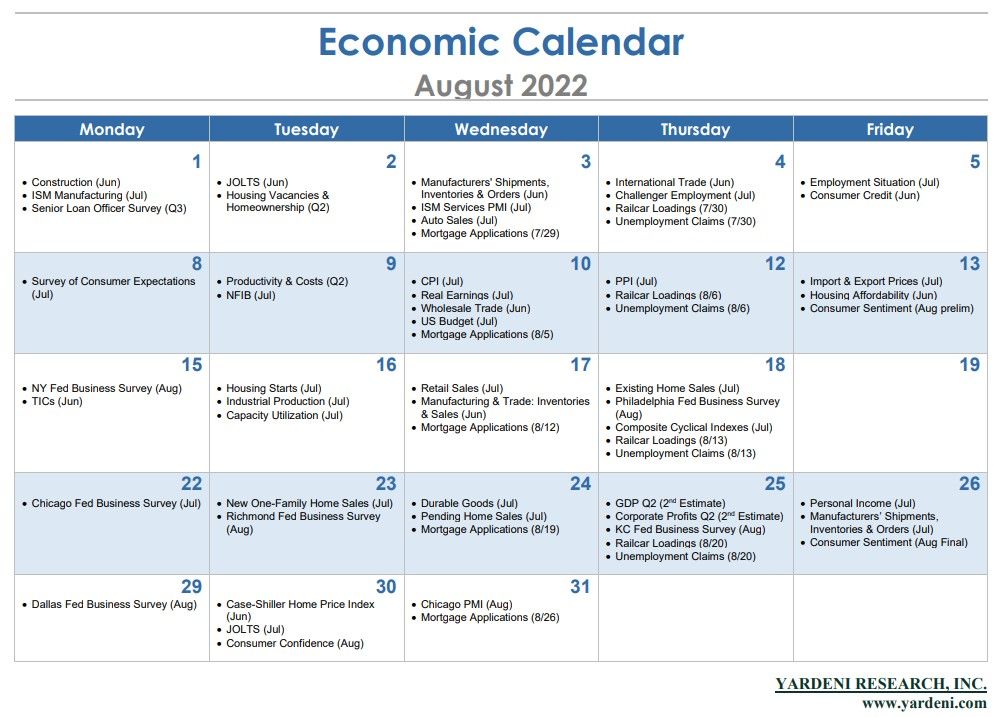

(1) Business. Three regional business surveys for August are coming out for Chicago (Mon.), Richmond (Tue.), and Kansas City (Thur.). They are likely to confirm the NY and Philly surveys that showed weaker economic activity and easing inflationary pressures.

(2) Housing. July's new home sales (Tue.) and pending existing home sales (Wed.) are likely to show ongoing weakness. We will be focusing on home prices. New home prices plunged in June.

(3) Consumers. In addition to Powell's presser on Friday, personal income, consumption, and saving (Jul.) and consumer sentiment (Aug.) will be released in the morning. July's employment and retail sales reports suggest that consumers' incomes and spending were strong last month. Consumer sentiment probably edged higher as gasoline prices have been falling.

(4) Capital spending. July's durable goods orders (Wed.) might show some slowing based on the month's regional business surveys, which will provide us with a glimpse of capital spending during August.