The first week of the month is always jampacked with economic indicators. In addition, at least one member of the Federal Open Mouth Committee will be speaking every day. The economic indicators should confirm that the economy remains resilient in the face of pockets of weakness (a.k.a., rolling recessions).

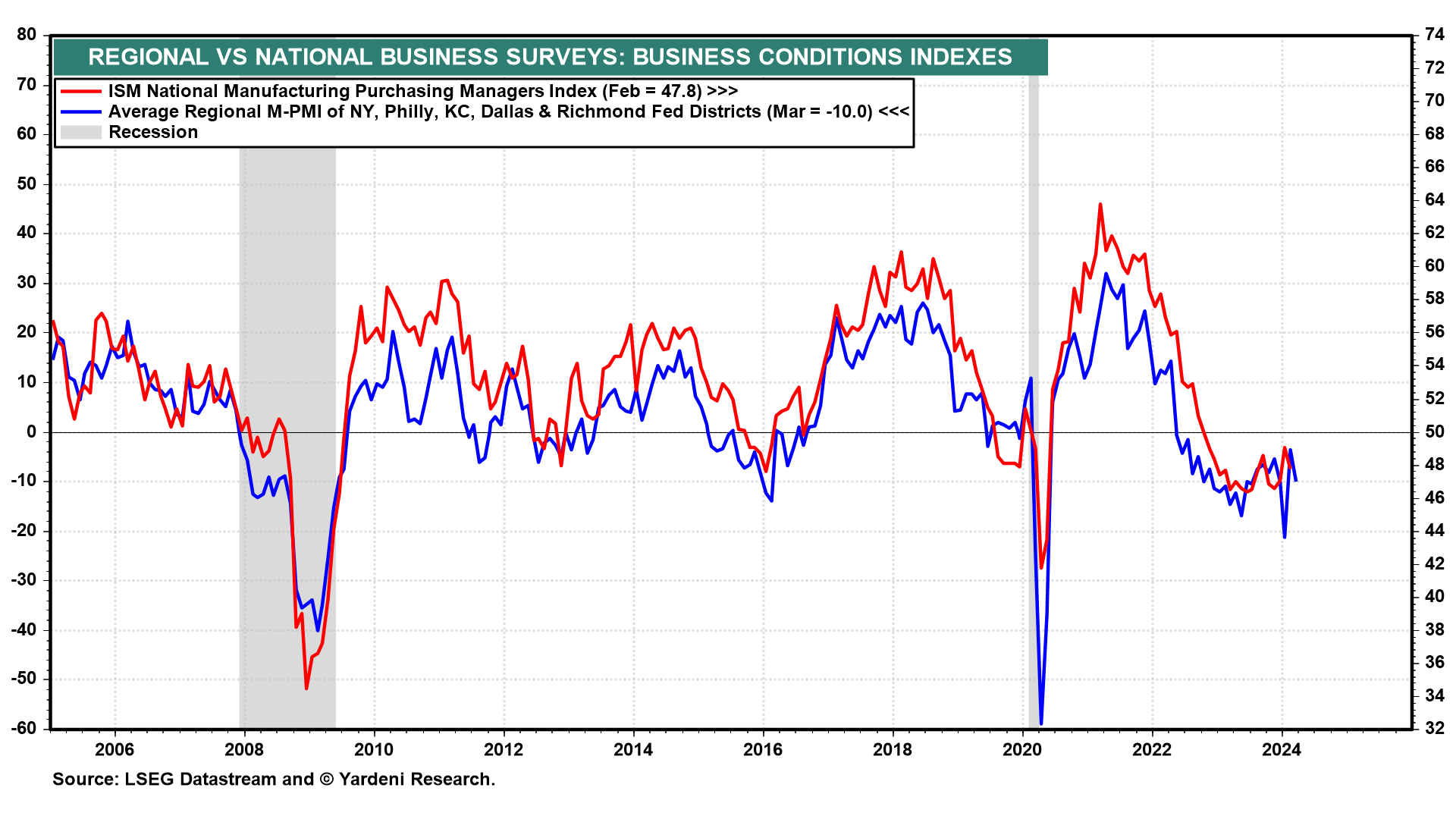

For starters, we'll see if the ISM's March M-PMI (Mon) confirms the weakness in the regional business surveys conducted by five of the 12 Federal Reserve district banks during the month. The average of the five suggests that the national index remained below 50.0 for the 17th consecutive month (chart). The average of the regional business surveys has been negative for 23 consecutive months. Yet the economy has continued to grow and avoided a recession. That confirms the resilience of the economy in the face of the growth recession in manufacturing. Indeed, the March national NM-PMI (Wed) should remain solidly above 50.0; it was 52.6 in February.

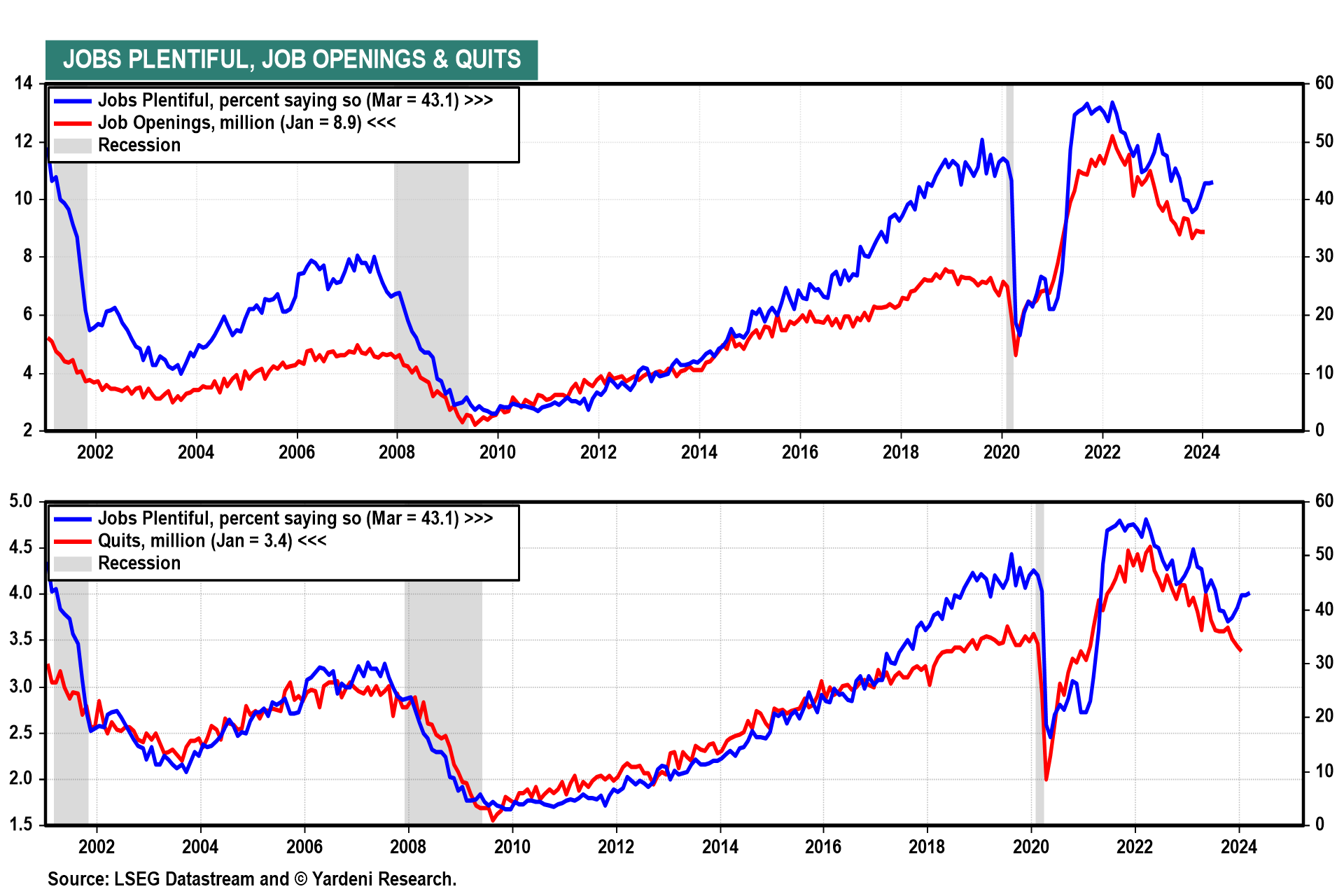

February's job openings, quits, and hires (Tue) should show some easing in labor market conditions as quits continue to fall, thus reducing job openings and hires. But the Consumer Confidence Index survey suggests that job openings remained relatively high through March (chart).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a