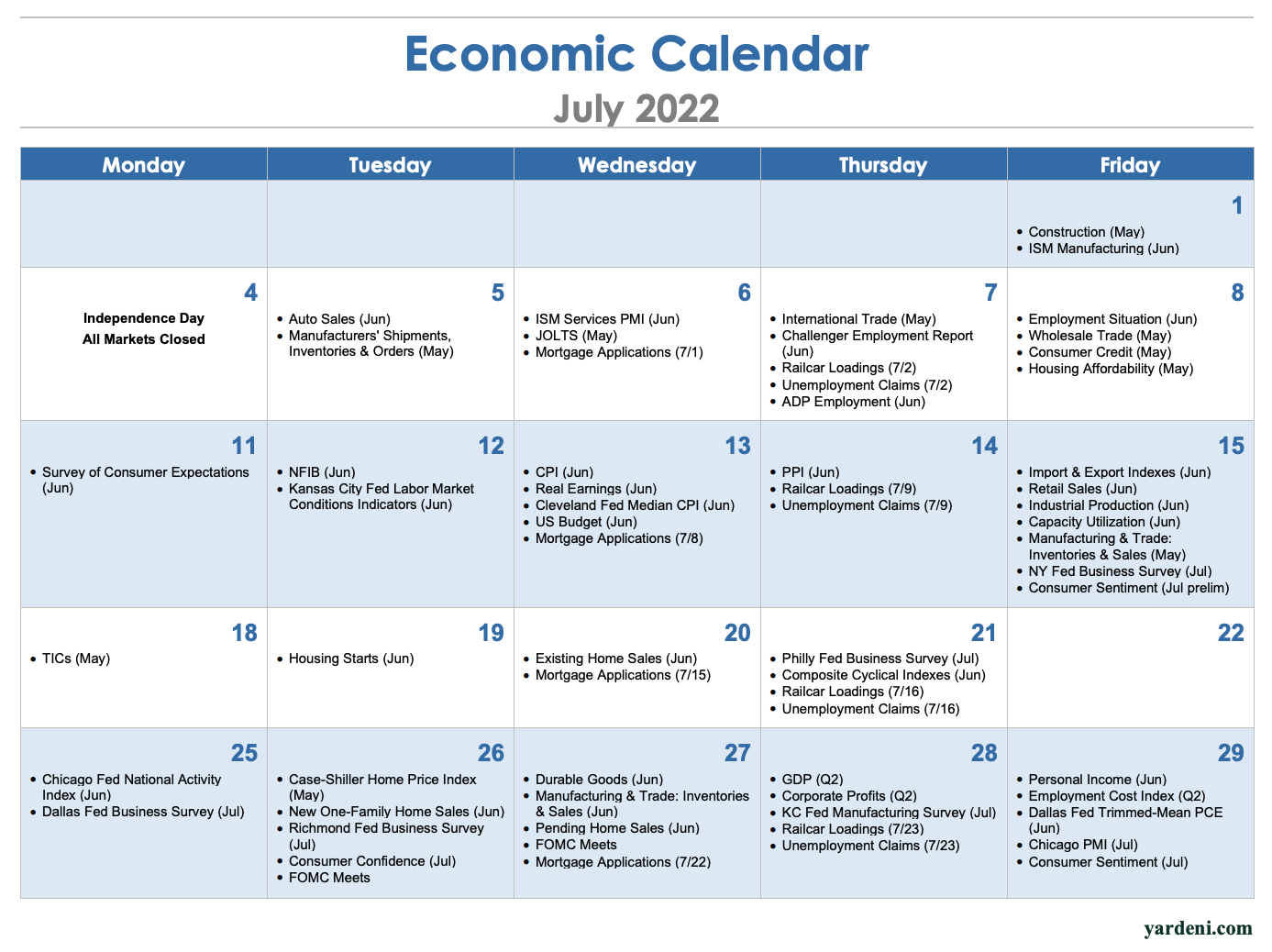

Inflation will be in focus on Wednesday, when June's CPI is released. Bloomberg is showing consensus estimates of up 1.1% (8.8% y/y) for the headline and 0.6% (5.8% y/y) for the core inflation rates. Such readings wouldn't clearly signal that inflation has peaked.

There will be plenty of other inflation indicators this coming week: NY Fed's June survey of inflationary expectations (Monday), June's NFIB small business survey showing prices-paid and prices-received indexes (Tuesday), June's PPI (Thursday), and June's export & import price indexes (Friday). They also aren't likely to add up to a clear signal that inflation has peaked.

Friday will be chock full of business indicators that on balance are likely to confirm that the economy is experiencing a mid-cycle soft patch, which could turn into a mild recession.

(1) June's retail sales, on an inflation-adjusted basis, should confirm that consumers are spending less on goods. The question is whether they are spending more on services, or retrenching across the board.

(2) July's preliminary consumer sentiment index, should show some improvement from last month's record low in reaction to the recent drop in gasoline prices.

(3) Industrial production is one of the four components of the Index of Coincident Economic Indicators. June's number could be weak given that the index of aggregate weekly hours worked in manufacturing has been edging down over the past few months.