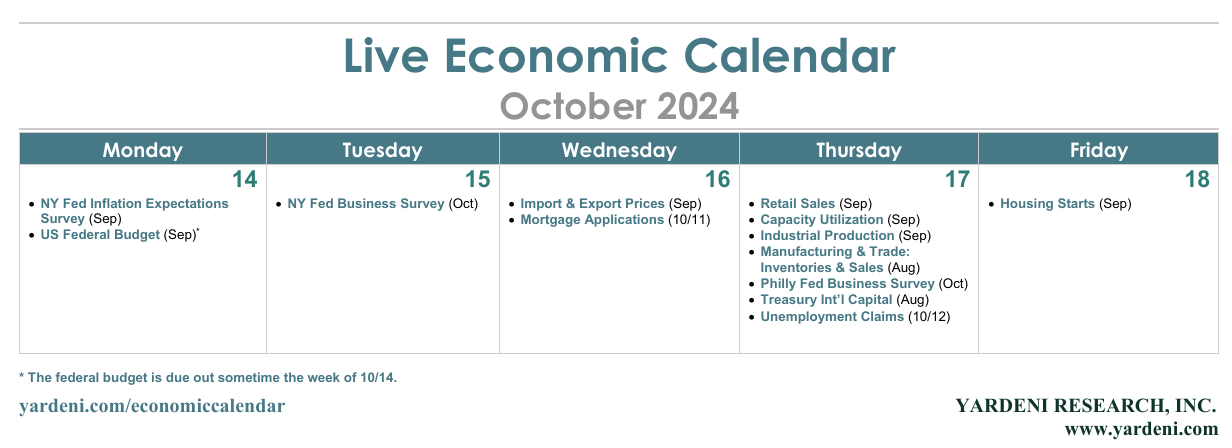

The economic week ahead will likely confirm that consumer spending continues to shine, while manufacturing production remains lackluster. Meanwhile, as earnings season kicks off with the S&P 500 at a record high and valuations relatively stretched, the onus will be on company managements to deliver better-than-expected earnings, which should be relatively easy since expectations are low.

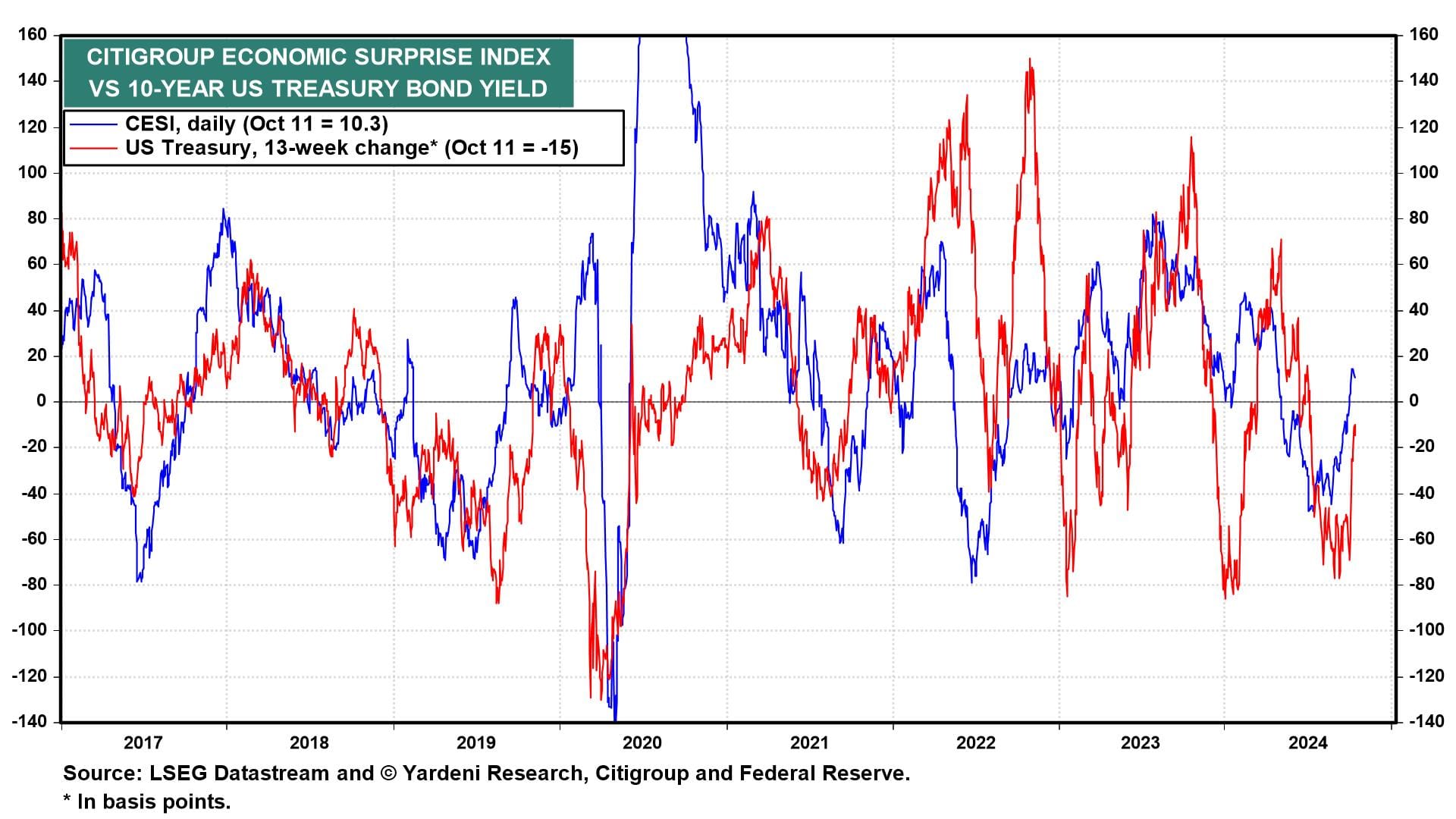

As earnings surprises turned increasingly negative during the summer, so too did industry analysts regarding Q3 company earnings. By the end of August, the Citigroup Economic Surprise Index (CESI) sank to one of its most negative readings in several years. Just as Q3 ended, it turned positive, boosting bond yields and stock prices too (chart).

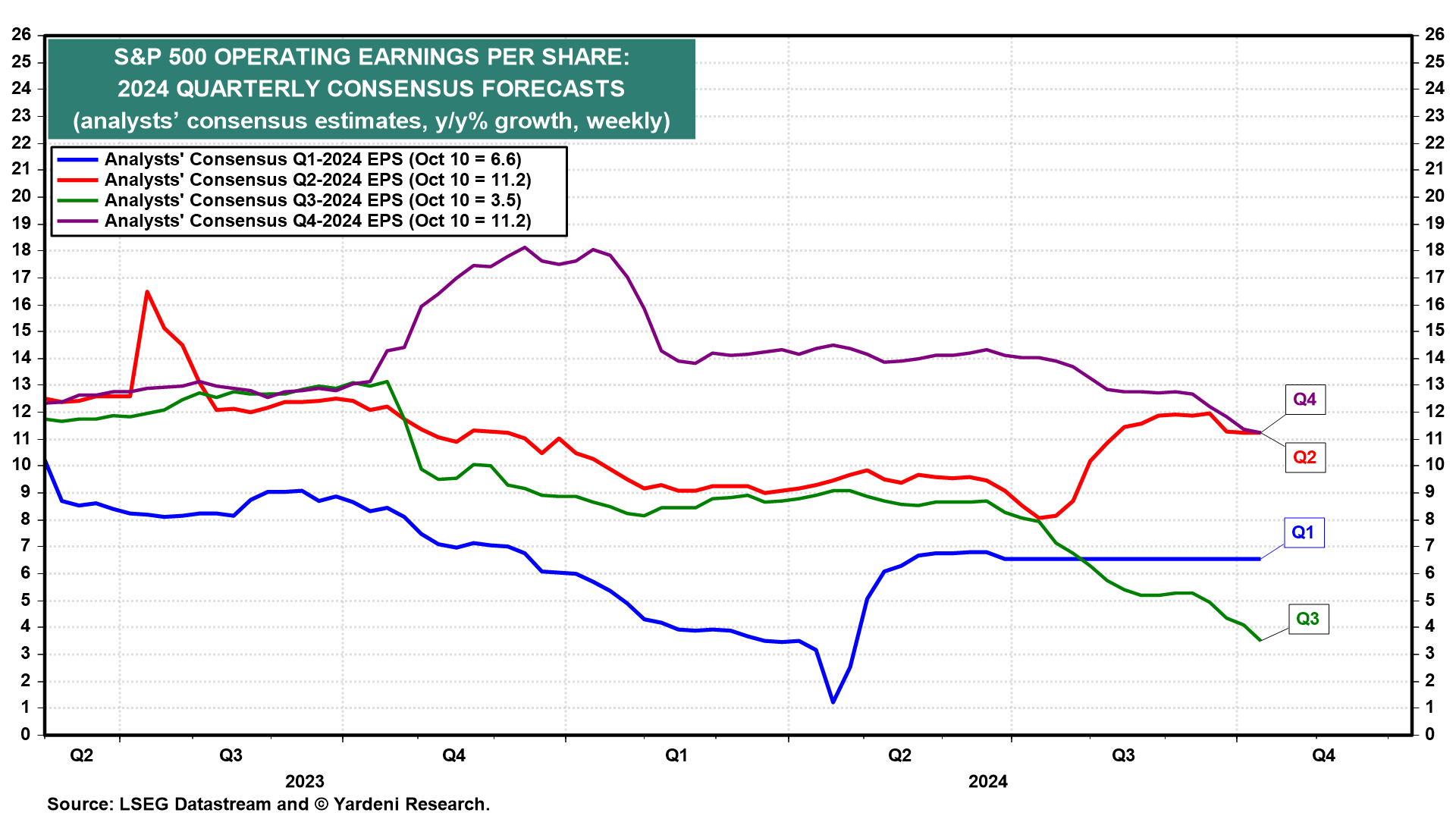

But the analysts haven't revised their Q3 earnings expectations for the S&P 500 any higher after lowering them significantly over the past few months. Their current 3.5% y/y growth estimate for Q3 should provide a very low bar for companies to clear (chart). We think earnings growth will be at least twice as fast. So we are expecting a significant "earnings hook," comparable to the upside surprises during Q1 and Q2.

Here's what else we're watching this week:

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a